Tis August, or late July, I'm writing near the twilight hour. Regardless, it is summer. And if your summer is like mine, it's about 93 degrees, humid and you have been sleeping in the basement because your day is so busy, you haven't gotten around to getting an air conditioner yet...like you promised yourself you would...last year when it was just as hot.

Regardless, I had a little time today and I walked into the Mall of America to meet with a friend for lunch and whilst basking in the air conditioning it occurred to me, "hey, I could get my Christmas shopping done now."

And why not?

Now is the PERFECT time to do your Christmas shopping! Get it out of the way now, before that dreaded weekend after Thanksgiving approaches and it's too late to buy anything at a reasonable price.

Boost your purchasing power and avoid waiting in lines by buying your Christmas gifts in August.

And when Labor Day approaches you can brag, "got my Christmas shopping done this summer" and be the envy of your neighbors.

Therefore today, August 1st (I think), I declare Christmas Shopping Day!

Go forth and be economic in your shopping.

Tuesday, July 31, 2007

Monday, July 30, 2007

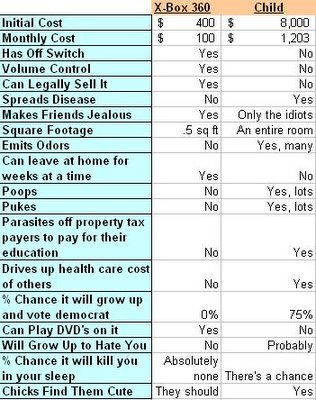

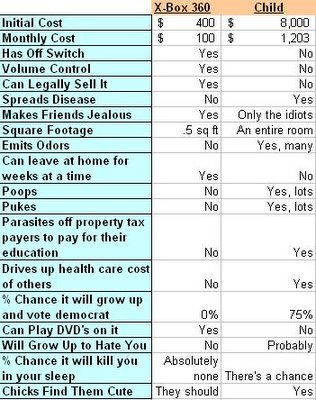

Child vs. X-Box 360 - The Best of Cpt. Capitalism

I'm off to play Indiana Jones again, a fossil site has been discovered in northern Iowa, and I must visit it before my French paleontologist rival beats me to it. Then there's that whole hot chick that I have to save deal, and I've seem to have misplaced my bullwhip. And there's probably Nazi's crawling around there too. Anyway, here's a repost of one of the BEST of Captain Capitalism.

As an avid fan of maximizing one's utility and one who appreciates the wise expenditure of resources, I very much like consumer reports, where various organizations rate and rank different products or services so that you may be a more informed consumer and thus spend your money in a manner that would yield the maximum amount of utility.

And given it is the Christmas season, we here at Captain Capitalism Consumer Reports, Inc. want to give something back to society as a gesture of good will during this charitable time. Something that will help you make a wise decision and maximize your standards of living. Something that will spread mirth and cheer in your household. Something that is sure to help you out in your financial health and endeavors.

A comparison between what seems to be the two hottest items this Christmas season for late 20 to early 30 somethings;

X-Box and a child.

We here at Captain Capitalism Consumer Reports Inc. sincerely hope and wish you and yours the best in this utility maximizing season!

As an avid fan of maximizing one's utility and one who appreciates the wise expenditure of resources, I very much like consumer reports, where various organizations rate and rank different products or services so that you may be a more informed consumer and thus spend your money in a manner that would yield the maximum amount of utility.

And given it is the Christmas season, we here at Captain Capitalism Consumer Reports, Inc. want to give something back to society as a gesture of good will during this charitable time. Something that will help you make a wise decision and maximize your standards of living. Something that will spread mirth and cheer in your household. Something that is sure to help you out in your financial health and endeavors.

A comparison between what seems to be the two hottest items this Christmas season for late 20 to early 30 somethings;

X-Box and a child.

We here at Captain Capitalism Consumer Reports Inc. sincerely hope and wish you and yours the best in this utility maximizing season!

Anti-Commie Propoganda Circa 1950 FROM ACADEMIA!

You will watch this, it's amazing. Especially at the 8 minute 31 second mark.

Sunday, July 29, 2007

Afghanistan: The Opium Monopoly

Friday, July 27, 2007

Home Builders, the New OPEC

I remember getting reprimanded for using the word "glut" in one of my reports one time.

A middled aged, banker who made money lending money to his nearly bankrupt cronies condemned my report when I said there was a "glut" of housing on the market. "Glut is an insulting word, it suggests gluttony." Which I thought to myself, "Well, that's exactly what's been going on, hasn't it????"

Regardless, I changed the word to "oversupply" but that still doesn't change the fact that the best word in the entire English language to describe the situation was indeed "glut." There was a 12 month supply of housing for the particular area we were looking at and it was the four letter word known as "glut."

And though I have no direct experience in home building, with such over supply and low housing prices it seemed to me that home builders would quit producing homes altogether. That new housing starts would drop to zero, allowing the market to catch up and eat through this excess inventory. Alas, this has not seemed to happen;

For while housing starts have plummeted, they're still producing them at a near historic average. And what I don't get is how home builders can't look at this and realize that are now facing a commodity market. And that if they continue to produce more homes for an already gluttonous market, it will depress their prices further. Therefore home builders as a whole are not much different than OPEC in the late 90's where the price of a gallon of gas was 85 cents. The price of their good is at a historic low and if they were smart, they'd cut off the supply.

Seriously, the best thing for home builders would be to take a year long vacation. You can work 60 hours a week, but the market price for your end product will be so low, that if you just wait a year or two, you could work 40 hours and make the same amount of money in just two years. Why work? Do America and all of the home owners a big huge favor and go on vacation.

Of course, I'm assuming home builders have a basic grasp of economics. And given the ruinous oversupply (read "glut") of homes they produced with not one of them, NOT ONE, conducting an absorption study, I am foolish to think they'd drive housing starts to my recommended red line.

A middled aged, banker who made money lending money to his nearly bankrupt cronies condemned my report when I said there was a "glut" of housing on the market. "Glut is an insulting word, it suggests gluttony." Which I thought to myself, "Well, that's exactly what's been going on, hasn't it????"

Regardless, I changed the word to "oversupply" but that still doesn't change the fact that the best word in the entire English language to describe the situation was indeed "glut." There was a 12 month supply of housing for the particular area we were looking at and it was the four letter word known as "glut."

And though I have no direct experience in home building, with such over supply and low housing prices it seemed to me that home builders would quit producing homes altogether. That new housing starts would drop to zero, allowing the market to catch up and eat through this excess inventory. Alas, this has not seemed to happen;

For while housing starts have plummeted, they're still producing them at a near historic average. And what I don't get is how home builders can't look at this and realize that are now facing a commodity market. And that if they continue to produce more homes for an already gluttonous market, it will depress their prices further. Therefore home builders as a whole are not much different than OPEC in the late 90's where the price of a gallon of gas was 85 cents. The price of their good is at a historic low and if they were smart, they'd cut off the supply.

Seriously, the best thing for home builders would be to take a year long vacation. You can work 60 hours a week, but the market price for your end product will be so low, that if you just wait a year or two, you could work 40 hours and make the same amount of money in just two years. Why work? Do America and all of the home owners a big huge favor and go on vacation.

Of course, I'm assuming home builders have a basic grasp of economics. And given the ruinous oversupply (read "glut") of homes they produced with not one of them, NOT ONE, conducting an absorption study, I am foolish to think they'd drive housing starts to my recommended red line.

Thursday, July 26, 2007

No Reason to Panic Despite the Down Jones Dropping 310 Points

So the Dow Jones dropped by 310. So what?

Unlike the idiots who I graduated with from college during Dotcom Mania, that drove stock prices to insane levels the average US stock is accurately valued, based on historic measures, namely the P/E ratio.

The S&P 500's P/E ratio is at about 16 right now, just one point higher than its historic average of 15 since 1928. This is in contrast with a P/E ratio of 61 at the height of Dotcom Mania.

I know that the recent bull market may have some cautious minds scared, but unlike our last bubble the earnings are actually there, legitimazing the Dow's current level.

Additionally, corporate profits are at an all time high relative to the economy.

Corporations, unlike their government and citizen counterparts, are actually very efficient with their money, squeezing ever more profit out of their sales and assets. You may be a beer drinking slob, watching American Idol and the local sports franchise but the corporation you work for is actually a bit more hard working than that.

So do yourself a favor and relax. The only way stocks are overvalued is if there's a recession on the way...oops.

Unlike the idiots who I graduated with from college during Dotcom Mania, that drove stock prices to insane levels the average US stock is accurately valued, based on historic measures, namely the P/E ratio.

The S&P 500's P/E ratio is at about 16 right now, just one point higher than its historic average of 15 since 1928. This is in contrast with a P/E ratio of 61 at the height of Dotcom Mania.

I know that the recent bull market may have some cautious minds scared, but unlike our last bubble the earnings are actually there, legitimazing the Dow's current level.

Additionally, corporate profits are at an all time high relative to the economy.

Corporations, unlike their government and citizen counterparts, are actually very efficient with their money, squeezing ever more profit out of their sales and assets. You may be a beer drinking slob, watching American Idol and the local sports franchise but the corporation you work for is actually a bit more hard working than that.

So do yourself a favor and relax. The only way stocks are overvalued is if there's a recession on the way...oops.

Shouldn't the Baby Boomers Be Paying Down Their Debts?

I was under the presumption that as you approach retirement, you not only store up enough cashiola to float you through to your death, but that you also pay down your debts. Alas, this does not seem to be happening;

And it concerns me a little bit because I see people older than me not only cashing out all the equity in their homes, but more and more people using the reverse amortization mortgage as a means to bleed out all the equity in their homes as they retire. Effectively leaving their children with a fully leveraged house. My question is what will happen to the value of these inherited properties when Gen X sells them, because we already have our own homes and don't need them? The flood of properties will lower the price below the amount owed on it and we'll have ourselves a nice little debt problem.

Alas it seems a generation is unknowingly committing the perfect crime, racking up debt, only to die before they pay for it...then again, I don't know how this materially differs from social security.

And it concerns me a little bit because I see people older than me not only cashing out all the equity in their homes, but more and more people using the reverse amortization mortgage as a means to bleed out all the equity in their homes as they retire. Effectively leaving their children with a fully leveraged house. My question is what will happen to the value of these inherited properties when Gen X sells them, because we already have our own homes and don't need them? The flood of properties will lower the price below the amount owed on it and we'll have ourselves a nice little debt problem.

Alas it seems a generation is unknowingly committing the perfect crime, racking up debt, only to die before they pay for it...then again, I don't know how this materially differs from social security.

Wednesday, July 25, 2007

Tuesday, July 24, 2007

Making It Difficult to Be Against a Progressive Tax System

I am as ardent a supporter of capitalism as there will ever be.

I largely view the majority of people's circumstances in the developed and free world as a product of their work ethic and drive. I largely view the developed world as meritocracies where you get what you deserve. I was dirt poor and I couldn't care less about your problems because I've been there and chances are you haven't.

But then this happens.

And it becomes insanely difficult to defend my position to be against the redistribution of wealth.

At what point does your moral compass kick in and say,

"You know, for $210,000 I could do a LOT of good in the world. I could put some poor kids through college. I could get some tutors for some kids that have trouble at school. I could pay for single parents to get some training or college or have their children get day care while they get some schooling." Or something of noble worth you could do with $210,000.

But $210,000 FOR DRINKS?????

Come on!!!!! WTF???? Wouldn't you feel a bit better about yourself if you donated it to a charity? Or heck, just threw it out into a street and made a bunch of normal schleps happy? Hell, I'd pay somebody's mortgage off just for kicks. But no, you're going to spend it on booze. And on booze, that frankly, probably tastes no better than a cold Sam Adams.

Forgive me while I feel a little socialist for a while.

I largely view the majority of people's circumstances in the developed and free world as a product of their work ethic and drive. I largely view the developed world as meritocracies where you get what you deserve. I was dirt poor and I couldn't care less about your problems because I've been there and chances are you haven't.

But then this happens.

And it becomes insanely difficult to defend my position to be against the redistribution of wealth.

At what point does your moral compass kick in and say,

"You know, for $210,000 I could do a LOT of good in the world. I could put some poor kids through college. I could get some tutors for some kids that have trouble at school. I could pay for single parents to get some training or college or have their children get day care while they get some schooling." Or something of noble worth you could do with $210,000.

But $210,000 FOR DRINKS?????

Come on!!!!! WTF???? Wouldn't you feel a bit better about yourself if you donated it to a charity? Or heck, just threw it out into a street and made a bunch of normal schleps happy? Hell, I'd pay somebody's mortgage off just for kicks. But no, you're going to spend it on booze. And on booze, that frankly, probably tastes no better than a cold Sam Adams.

Forgive me while I feel a little socialist for a while.

If You're Happy and You Know It Clap Your Hands

The Economist came out with another interesting chart, showing once again money does correlate with happiness.

Of the many observations I could make, I will only make two;

1. The UAE, the most capitalist (and least radical) Arab country is pretty darn happy.

2. What the hell are the Finlanders so happy about?

(though I can see a joke "Why is Finland so happy? "Because they're not Norway")

Of the many observations I could make, I will only make two;

1. The UAE, the most capitalist (and least radical) Arab country is pretty darn happy.

2. What the hell are the Finlanders so happy about?

(though I can see a joke "Why is Finland so happy? "Because they're not Norway")

Monday, July 23, 2007

Sunday, July 22, 2007

Economics Made Very Simple

Economics, when it really boils down to it, comes down to one simple, cardinal rule;

If you don't work, you don't eat.

If there was just one person on the planet and that person didn't work to find food and find shelter he/she would die.

And even though there is more than one person on the planet, if everybody took the attitude, "I don't have to work" then as a whole since we don't work, we don't eat, we'd all die.

Therefore self-supportation or self-reliance is the single most honorable moral a human can have out of respect for his fellow man and society.

I will work, therefore I shall eat and therefore not rely upon you to take care of me.

However, the left finds refuge in the fact that if there's enough people on the planet and if they work hard enough, then there is a surplus of food and shelter and that some people don't have to work in order to eat. And the left (and I mean this in the sincerest sense) only has the power it does because it convinces people that "no, you really don't have to work in order to eat" and promises those weak-minded fools such a scenario.

Playing off of victimhood, conspiracy theories and any other half-baked reason they can find, the left convinces people they were deprived of food, deprived the opportunity to work, and therefore are entitled to eat at others' expense. And human nature is all too accommodating to this type of thinking because provides them with a benefit with no cost.

But that still doesn't change the cardinal rule that if you don't work, you don't eat.

So, even though common sense, just basic kindergartener common sense would prove this simple rule to be true, because such a large percentage of the population's livelihood is based on the opposite of this rule I find no greater joy in providing empirical evidence to prove them wrong.

For it seems that the freer a society is, the more one is allowed to pursue not just wealth, but allowed to keep the majority of their wealth, the more successful that society is, and not just for the individual, but for society as a whole.

And it is this that gets to the heart of the matter. If you are genuinely concerned about the poor, if you are genuinely concerned about advancing society and increasing the standards of living for ALL people, you would be the most ardent supporter of capitalism, low taxes, freedom and individualism. Alas, because of the left's vehement opposition to economic freedom, I am only left to conclude that the left uses "the advancement of the poor" as a farcical and cowardly cover argument to rationalize the transfer of wealth to themselves.

Craft and construe the argument however you want, it still doesn't change the fact that if you don't work, you don't eat.

If you don't work, you don't eat.

If there was just one person on the planet and that person didn't work to find food and find shelter he/she would die.

And even though there is more than one person on the planet, if everybody took the attitude, "I don't have to work" then as a whole since we don't work, we don't eat, we'd all die.

Therefore self-supportation or self-reliance is the single most honorable moral a human can have out of respect for his fellow man and society.

I will work, therefore I shall eat and therefore not rely upon you to take care of me.

However, the left finds refuge in the fact that if there's enough people on the planet and if they work hard enough, then there is a surplus of food and shelter and that some people don't have to work in order to eat. And the left (and I mean this in the sincerest sense) only has the power it does because it convinces people that "no, you really don't have to work in order to eat" and promises those weak-minded fools such a scenario.

Playing off of victimhood, conspiracy theories and any other half-baked reason they can find, the left convinces people they were deprived of food, deprived the opportunity to work, and therefore are entitled to eat at others' expense. And human nature is all too accommodating to this type of thinking because provides them with a benefit with no cost.

But that still doesn't change the cardinal rule that if you don't work, you don't eat.

So, even though common sense, just basic kindergartener common sense would prove this simple rule to be true, because such a large percentage of the population's livelihood is based on the opposite of this rule I find no greater joy in providing empirical evidence to prove them wrong.

For it seems that the freer a society is, the more one is allowed to pursue not just wealth, but allowed to keep the majority of their wealth, the more successful that society is, and not just for the individual, but for society as a whole.

And it is this that gets to the heart of the matter. If you are genuinely concerned about the poor, if you are genuinely concerned about advancing society and increasing the standards of living for ALL people, you would be the most ardent supporter of capitalism, low taxes, freedom and individualism. Alas, because of the left's vehement opposition to economic freedom, I am only left to conclude that the left uses "the advancement of the poor" as a farcical and cowardly cover argument to rationalize the transfer of wealth to themselves.

Craft and construe the argument however you want, it still doesn't change the fact that if you don't work, you don't eat.

Hugo the Hypocrite

Saturday, July 21, 2007

The Idiocy of Argentinian Economics

Christina Kirchner, the wife of Argentina's current president Nestor Kirchner, is running for president.

And to make a long story short, Argentina is much akin to Ecuador, Bolivia and Venezuela in that (very long economic story made short) the people blamed the IMF, America and the West for their problems, elected idiots or outright dictators into office who are now about to destroy not just their economies, but their democracies.

But this takes the cake. To show you how utterly stupid and naive Kirchner (wife or husband) really is. She asks, rhetorically, the audience how Argentina lowered its debts. Claiming the lowering of the debt was due to some economic genius on the part of her husband. Look closely at the red highlights in the article.

"HOW DID WE CUT OUR DEBT?????!!!!"

Are you joking?

Yeah, what Argentinian economic genius. Lower your debts, by just refusing to pay for them.

Wow, seriously, she must have gone to the U of Chicago.

I think I'm just going to do the same with my mortgage and then brag about it. I can see it now, chatting up some girl at the bar;

"Hey baby, I just got rid of my mortgage."

"Really, how? Through hard work? Creative investments? You won the lottery?"

"No baby, I pulled an Argentinian. I just refused to pay it. I'm an economic deadbeat. And I blame America and the IMF."

"Wow, you're so dreamy!"

What gets me is she's the most popular candidate and likely to become the president of Argentina. Are the Argentinian people really that stupid to elect somebody like her when within 2 minutes of a speech she clearly displays her ignorance of basic economics???

Yeah, right, enjoy those 4 years of economic growth in Argentina. It will be coming to an end.

And to make a long story short, Argentina is much akin to Ecuador, Bolivia and Venezuela in that (very long economic story made short) the people blamed the IMF, America and the West for their problems, elected idiots or outright dictators into office who are now about to destroy not just their economies, but their democracies.

But this takes the cake. To show you how utterly stupid and naive Kirchner (wife or husband) really is. She asks, rhetorically, the audience how Argentina lowered its debts. Claiming the lowering of the debt was due to some economic genius on the part of her husband. Look closely at the red highlights in the article.

"HOW DID WE CUT OUR DEBT?????!!!!"

Are you joking?

Yeah, what Argentinian economic genius. Lower your debts, by just refusing to pay for them.

Wow, seriously, she must have gone to the U of Chicago.

I think I'm just going to do the same with my mortgage and then brag about it. I can see it now, chatting up some girl at the bar;

"Hey baby, I just got rid of my mortgage."

"Really, how? Through hard work? Creative investments? You won the lottery?"

"No baby, I pulled an Argentinian. I just refused to pay it. I'm an economic deadbeat. And I blame America and the IMF."

"Wow, you're so dreamy!"

What gets me is she's the most popular candidate and likely to become the president of Argentina. Are the Argentinian people really that stupid to elect somebody like her when within 2 minutes of a speech she clearly displays her ignorance of basic economics???

Yeah, right, enjoy those 4 years of economic growth in Argentina. It will be coming to an end.

Snidley Whiplash Doesn't Adjust for GDP

Ryan had a better title so I went with it.

Originally it was titled "Military Spending" because I get a kick out of how the left complains we always, ALWAYS spend too much on the military (which a quick perusal of the federal budget would tell you otherwise). Regardless, to convey context as to just how much we spend on the military and for all the troubles we have with terrorism in the middle east, you all should just shut the hell up and enjoy your plasma screen TV's because it really isn't that bad. We spend nothing, I mean nothing on the war on terror. The Japanese killed 3,000 of our men and women and we responded with a budget that allocated 40% of our GDP to the military.

Muslim nutjobs killed 3,000 Americans and we ever so slightly bump up our military spending from 3% to 4% GDP, to the howls and protests of anti-war leftists. Sheesh!

So new lesson people. It's always got to be as a percent of GDP.

Don't care what you're measuring, you have to account for not only the increase in the country's population as well as the increase in its economy. Otherwise inflation and population growth distort your figures.

Just the other day I was on a date and she asked me "what do you do for fun?" And I said, "I like playing video games but only after converting them to a percentage of GDP."

When I get to the pearly gates, St. Peter will ask, "What did you do with your time on Earth? Donate to charity? Work with children?" and I'll say, "I converted things into a percentage of GDP."

My Mom will call me up and still to this day ask if I brushed my teeth. But she'd be wiser in asking if I brushed my teeth adjusting for GDP.

So remember, Americans, Patriots and all around cool guys and redheaded libertarian gals adjust for GDP. Commies, liberals and Snidley Whiplash don't.

Originally it was titled "Military Spending" because I get a kick out of how the left complains we always, ALWAYS spend too much on the military (which a quick perusal of the federal budget would tell you otherwise). Regardless, to convey context as to just how much we spend on the military and for all the troubles we have with terrorism in the middle east, you all should just shut the hell up and enjoy your plasma screen TV's because it really isn't that bad. We spend nothing, I mean nothing on the war on terror. The Japanese killed 3,000 of our men and women and we responded with a budget that allocated 40% of our GDP to the military.

Muslim nutjobs killed 3,000 Americans and we ever so slightly bump up our military spending from 3% to 4% GDP, to the howls and protests of anti-war leftists. Sheesh!

So new lesson people. It's always got to be as a percent of GDP.

Don't care what you're measuring, you have to account for not only the increase in the country's population as well as the increase in its economy. Otherwise inflation and population growth distort your figures.

Just the other day I was on a date and she asked me "what do you do for fun?" And I said, "I like playing video games but only after converting them to a percentage of GDP."

When I get to the pearly gates, St. Peter will ask, "What did you do with your time on Earth? Donate to charity? Work with children?" and I'll say, "I converted things into a percentage of GDP."

My Mom will call me up and still to this day ask if I brushed my teeth. But she'd be wiser in asking if I brushed my teeth adjusting for GDP.

So remember, Americans, Patriots and all around cool guys and redheaded libertarian gals adjust for GDP. Commies, liberals and Snidley Whiplash don't.

Friday, July 20, 2007

Delinquency and Default

Thursday, July 19, 2007

Tuesday, July 17, 2007

The Housing Market Index

Well seems it dropped to a historic low.

This would be expected seeing it was at a historic and unsustainable high.

But what I find interesting about this is that it is the "builders" perception of the housing market. Builders thought that the future of housing was going to be GREAT in late 2005 while the rest of us educated schleps knew otherwise. Which means we should really view this as a good thing.

I don't mean to become the cheerleader for the housing market. I truthfully enjoy watching it tank, destroying those that laughed and mocked me and my economic brethren who warned of a housing crash. But in my experiences in banking and the housing market I realized one key thing;

Builders aren't economists.

I never once, NOT ONCE saw a builder bother to sit down and do economic research. I've never seen a builder do an absorption study. All I ever saw builders do is say, "Hey, I sold 4 houses last year. I'm going to build 20 this year!!!!" And that was the extent of their economic and market research.

And given their track record of miserably failing to predict the market, if they view things as being so bad, then I have a hard time thinking there isn't something good ahead.

But don't get excited. I'm not forecasting a quick recovery here. I'm just pointing to the beginning signs of a recovery, the most recent of which are the home builders' claiming doom and gloom.

This would be expected seeing it was at a historic and unsustainable high.

But what I find interesting about this is that it is the "builders" perception of the housing market. Builders thought that the future of housing was going to be GREAT in late 2005 while the rest of us educated schleps knew otherwise. Which means we should really view this as a good thing.

I don't mean to become the cheerleader for the housing market. I truthfully enjoy watching it tank, destroying those that laughed and mocked me and my economic brethren who warned of a housing crash. But in my experiences in banking and the housing market I realized one key thing;

Builders aren't economists.

I never once, NOT ONCE saw a builder bother to sit down and do economic research. I've never seen a builder do an absorption study. All I ever saw builders do is say, "Hey, I sold 4 houses last year. I'm going to build 20 this year!!!!" And that was the extent of their economic and market research.

And given their track record of miserably failing to predict the market, if they view things as being so bad, then I have a hard time thinking there isn't something good ahead.

But don't get excited. I'm not forecasting a quick recovery here. I'm just pointing to the beginning signs of a recovery, the most recent of which are the home builders' claiming doom and gloom.

Monday, July 16, 2007

This Horrible Country Known as America

Saturday, July 14, 2007

I Have Chart Envy

A microcosm of the unionized American labor force in general, Dr. Mark Perry makes an EXCELLENT point with and EXCELLENT CHART!!!

Read the whole post here (which you will, you will conform!)

Many thanks to Dr. Bob!

Read the whole post here (which you will, you will conform!)

Many thanks to Dr. Bob!

Those Sub Prime Blues

Thursday, July 12, 2007

The Economics of Girls' Showers

I ran.

Therefore I stank.

But before I could return to the Captain's Cave I got a call from a female friend of mine who invited me over for dinner.

And seeing I'm an economist and I outsource all my cooking, there is nothing better than homemade food prepared by anybody else but me, and so I gladly accepted her invitation.

However, as I mentioned before, I stank.

So upon arriving at her place I asked her if I could take a shower and fortunately, I had brought an extra change of clothes along with some deodorant.

Now, as a guy there are only two things I want when I take a shower. Two SIMPLE, BASIC GOD-GIVEN THINGS!

1. Soap.

and

2. Shampoo.

However, it seems a Herculean, Indiana Jones-esque crusade to find these two items for I was not in my humble shower, but that of a girl's.

Go into any guys' shower stall and you will find only two things. JUST TWO SIMPLE THINGS!

Soap and shampoo.

In mine there is the knock off brand of Head and Shoulders (which I save a tidy $2 per bottle on over the brand name) and a half melted bar of Irish Spring.

That's it! That's all I need. That's all ANYBODY needs. Maybe a wash cloth. I'll even go so far as to permit a loova. But as for hygienic products all any human, the richest of the rich, and the poorest of the poor, all they need is

Soap and shampoo.

But go into a girl's shower and there are a billion body care lotion thingies that are anything BUT

Soap and shampoo.

You then spend the next three hours, racing the water heater before it runs out of hot water to find those two rare and coveted items;

SOAP AND SHAMPOO.

But oohhh, no! You can't find the soap or shampoo.

No, your thwarted by knock offs. Posers. Things that aren't quite

SOAP AND SHAMPOO.

So I started cataloging all the different things in this girl's shower stall that were NOT

SOAP AND SHAMPOO.

Item 1 - Moisturizing Face Wash (will not the water moisturize your face????)

Item 2 - Body Lotion (I don't want any!)

Item 3 - Body Wash (WHAT WAS THE LOTION FOR THEN???)

Item 4 - Dumb Blond Infusion (Is it wise to infuse things with running water?)

Item 5 - Lavender Bead Infused Body Wash (Why do I want beads? And what was wrong with the regular body wash???)

Item 6 - Cocoa Butter Skin Moisturizer (see item 1!)

Item 7 - "Enfuz" Treatment for Dry to Normal Hair (why are they always trying to infuse things in the shower?!?!!?)

Item 8 - Citrus Skin Treatment (What was wrong with the cocoa butter???)

Now I could go on for there were literally, LITERALLY a dozen more products. And that was the stuff just in the shower stall! You go to the bathroom counter and there is countless other products that I could never use.

I inevitably did find the shampoo (Strawberry Enhanced Shampoo no less) but could never find the soap! But my question to all of you ladies out there, especially those studying economics, COULD YOU PLEASE TELL ME WTF IS GOING ON WITH ALL THIS LOTIONY STUFF IN YOUR SHOWERS??? WHAT IS THE ECONOMIC RATIONALE FOR HAVING ALL THIS STUFF?????

I patiently await your answer! You could probably win the Nobel prize in economics if you could explain this phenomenon!

Therefore I stank.

But before I could return to the Captain's Cave I got a call from a female friend of mine who invited me over for dinner.

And seeing I'm an economist and I outsource all my cooking, there is nothing better than homemade food prepared by anybody else but me, and so I gladly accepted her invitation.

However, as I mentioned before, I stank.

So upon arriving at her place I asked her if I could take a shower and fortunately, I had brought an extra change of clothes along with some deodorant.

Now, as a guy there are only two things I want when I take a shower. Two SIMPLE, BASIC GOD-GIVEN THINGS!

1. Soap.

and

2. Shampoo.

However, it seems a Herculean, Indiana Jones-esque crusade to find these two items for I was not in my humble shower, but that of a girl's.

Go into any guys' shower stall and you will find only two things. JUST TWO SIMPLE THINGS!

Soap and shampoo.

In mine there is the knock off brand of Head and Shoulders (which I save a tidy $2 per bottle on over the brand name) and a half melted bar of Irish Spring.

That's it! That's all I need. That's all ANYBODY needs. Maybe a wash cloth. I'll even go so far as to permit a loova. But as for hygienic products all any human, the richest of the rich, and the poorest of the poor, all they need is

Soap and shampoo.

But go into a girl's shower and there are a billion body care lotion thingies that are anything BUT

Soap and shampoo.

You then spend the next three hours, racing the water heater before it runs out of hot water to find those two rare and coveted items;

SOAP AND SHAMPOO.

But oohhh, no! You can't find the soap or shampoo.

No, your thwarted by knock offs. Posers. Things that aren't quite

SOAP AND SHAMPOO.

So I started cataloging all the different things in this girl's shower stall that were NOT

SOAP AND SHAMPOO.

Item 1 - Moisturizing Face Wash (will not the water moisturize your face????)

Item 2 - Body Lotion (I don't want any!)

Item 3 - Body Wash (WHAT WAS THE LOTION FOR THEN???)

Item 4 - Dumb Blond Infusion (Is it wise to infuse things with running water?)

Item 5 - Lavender Bead Infused Body Wash (Why do I want beads? And what was wrong with the regular body wash???)

Item 6 - Cocoa Butter Skin Moisturizer (see item 1!)

Item 7 - "Enfuz" Treatment for Dry to Normal Hair (why are they always trying to infuse things in the shower?!?!!?)

Item 8 - Citrus Skin Treatment (What was wrong with the cocoa butter???)

Now I could go on for there were literally, LITERALLY a dozen more products. And that was the stuff just in the shower stall! You go to the bathroom counter and there is countless other products that I could never use.

I inevitably did find the shampoo (Strawberry Enhanced Shampoo no less) but could never find the soap! But my question to all of you ladies out there, especially those studying economics, COULD YOU PLEASE TELL ME WTF IS GOING ON WITH ALL THIS LOTIONY STUFF IN YOUR SHOWERS??? WHAT IS THE ECONOMIC RATIONALE FOR HAVING ALL THIS STUFF?????

I patiently await your answer! You could probably win the Nobel prize in economics if you could explain this phenomenon!

Tuesday, July 10, 2007

Based on GDP per Kilometer, Property May Not Be as Overvalued as You Think

Property, it is assumed, always goes up in the long run. This is based on the assumption that there is a limited amount of land, yet the population will continue to grow, therefore housing prices will forever trend upward.

However, if that was the case then countries like Ethiopia, Somalia, Sudan, etc., that have significant populations would have high property values. Alas they don't since they are constantly plagued by war, famine, plague, etc. However, they are also plagued by another disease; the lack of economic growth.

While I'm sure at some level population does correlate with higher property prices, a better determinant of property prices is the amount of wealth created from that land. The more wealth that can be produced per square mile of a particular piece of land the higher its underlying rents would be and therefore its value. Thus I crafted a new ratio;

GDP per Square Kilometer (I had to use kilometer because the CIA World Fact Book has the countries' area in kilometers)

Real GDP per sq. km. in the US has gone from just under $200,000 almost $1.3 million today. As technologies have advanced, managerial efficiencies invented and employed, we here in the US are able to squeeze out almost 7 times the amount of wealth from our land per square kilometer than we were just 50 years ago (quite identical to farming yields on a per acre basis).

It is this increase in wealth that we can extract from each square mile of our land that has truly increased our property values. However, combine the two, high levels of the production of wealth with high populations, and you get property that is most highly valued; cities.

It is no coincidence that New York, London, Hong Kong, Singapore, Tokyo etc. etc. have the highest property values in the world because not only do they have some of the largest populations, but they are also centers of commerce where disproportionate amounts of wealth are created.

However, GDP per square kilometer also provides us with a tool by which to gauge property values. In theory as more and more wealth is squeezed from a particular piece of land, the value of that land should increase proportionately. Therefore the ratio between GDP per square kilometer and the value of that land should remain constant. Introduce a new measure;

Median Housing Prices divided by GDP per Sq. Kilometer.

In theory the average price of a home in the US should increase in sync with GDP per Sq. KM resulting in a constant ratio. However, that has not been the case;

Average (mean) housing prices were originally 28% of the wealth produced on a per square kilometer basis in the US. This has trended downward to 19% in 2001, only to recover to 21% in 2006.

In other words, the value of our land is not keeping up with the wealth that is produced by it. And although property prices did seem to recover in the latest housing bubble, they look set to trend back down towards the 19% mark (coincidentally implying a 10% over-valuation in the housing market).

Therefore there must be a macro-economic variable driving this ratio down. Without additional research and left to guess, I surmise it is the transition from manufacturing to services that is disconnecting the market value of the land from the wealth that is produced from it. Services require less land than manufacturing. Goldman Sachs has produced ever increasing wealth from it's meager .9 square kilometers of land it owns in New York by offering ever more profitable services, while GM has barely produced squat with its arguably scores of square kilometers of land that its factories and facilities sit on.

Alas I'd be curious to see if my theory would hold for China which is experiencing a manufacturing boom.

However, if that was the case then countries like Ethiopia, Somalia, Sudan, etc., that have significant populations would have high property values. Alas they don't since they are constantly plagued by war, famine, plague, etc. However, they are also plagued by another disease; the lack of economic growth.

While I'm sure at some level population does correlate with higher property prices, a better determinant of property prices is the amount of wealth created from that land. The more wealth that can be produced per square mile of a particular piece of land the higher its underlying rents would be and therefore its value. Thus I crafted a new ratio;

GDP per Square Kilometer (I had to use kilometer because the CIA World Fact Book has the countries' area in kilometers)

Real GDP per sq. km. in the US has gone from just under $200,000 almost $1.3 million today. As technologies have advanced, managerial efficiencies invented and employed, we here in the US are able to squeeze out almost 7 times the amount of wealth from our land per square kilometer than we were just 50 years ago (quite identical to farming yields on a per acre basis).

It is this increase in wealth that we can extract from each square mile of our land that has truly increased our property values. However, combine the two, high levels of the production of wealth with high populations, and you get property that is most highly valued; cities.

It is no coincidence that New York, London, Hong Kong, Singapore, Tokyo etc. etc. have the highest property values in the world because not only do they have some of the largest populations, but they are also centers of commerce where disproportionate amounts of wealth are created.

However, GDP per square kilometer also provides us with a tool by which to gauge property values. In theory as more and more wealth is squeezed from a particular piece of land, the value of that land should increase proportionately. Therefore the ratio between GDP per square kilometer and the value of that land should remain constant. Introduce a new measure;

Median Housing Prices divided by GDP per Sq. Kilometer.

In theory the average price of a home in the US should increase in sync with GDP per Sq. KM resulting in a constant ratio. However, that has not been the case;

Average (mean) housing prices were originally 28% of the wealth produced on a per square kilometer basis in the US. This has trended downward to 19% in 2001, only to recover to 21% in 2006.

In other words, the value of our land is not keeping up with the wealth that is produced by it. And although property prices did seem to recover in the latest housing bubble, they look set to trend back down towards the 19% mark (coincidentally implying a 10% over-valuation in the housing market).

Therefore there must be a macro-economic variable driving this ratio down. Without additional research and left to guess, I surmise it is the transition from manufacturing to services that is disconnecting the market value of the land from the wealth that is produced from it. Services require less land than manufacturing. Goldman Sachs has produced ever increasing wealth from it's meager .9 square kilometers of land it owns in New York by offering ever more profitable services, while GM has barely produced squat with its arguably scores of square kilometers of land that its factories and facilities sit on.

Alas I'd be curious to see if my theory would hold for China which is experiencing a manufacturing boom.

Sunday, July 08, 2007

Thursday, July 05, 2007

You Go to the Penalty Box. You Feel Shame

"Long term unemployment" is defined as when you've been unemployed for a year or longer. And while people may cite different variables for it, I surmise that if the most advanced student of econometrics at the U of Chicago were to do a thorough analysis of it, it would boil down to two things;

1. How generous/stingy a country's unemployment benefits are.

2. How lazy/hard working its people and culture are.

And so The Economist has come out with the most recent long term unemployment figures.

Sadly it does not include South Korea and Mexico where the shame of being unemployed is enough to make people lie about it and the unemployment benefits are nil (and it showed on the last chart where less than 2% of both countries' unemployed were long term).

Now I understand the occasional person that has a spat of bad luck. I can even understand entire swathes of laborers unemployed for a year or more if their industry is rendered obsolete or is going through a dramatic change, but to be in Germany or Italy where over half your unemployed people have been so for a year or more is disgraceful.

Alas, maybe the European Union doesn't need labor reforms to get the economy going as much as going into the penalty box and feeling a little noble South Korean shame.

1. How generous/stingy a country's unemployment benefits are.

2. How lazy/hard working its people and culture are.

And so The Economist has come out with the most recent long term unemployment figures.

Sadly it does not include South Korea and Mexico where the shame of being unemployed is enough to make people lie about it and the unemployment benefits are nil (and it showed on the last chart where less than 2% of both countries' unemployed were long term).

Now I understand the occasional person that has a spat of bad luck. I can even understand entire swathes of laborers unemployed for a year or more if their industry is rendered obsolete or is going through a dramatic change, but to be in Germany or Italy where over half your unemployed people have been so for a year or more is disgraceful.

Alas, maybe the European Union doesn't need labor reforms to get the economy going as much as going into the penalty box and feeling a little noble South Korean shame.

Wednesday, July 04, 2007

Tuesday, July 03, 2007

Don't Forget, the French Gave Us the Statue of Liberty

Much as I ridicule the French (deservedly so), there is the occasional one or two Frenchmen that fought in the resistance, joined the French Foreign Legion or displayed some semblance of independent thought and manliness that would make you say, "you know, I would trust to have this Frenchman in my platoon if I were in Vietnam. Dien Bien Phu and all that aside, I'd still trust them."

And this guy is one such person.

Only problem is I don't speak French. But on the birth of my nation, that would not exist without the support of the French (an accursed historical fact I wish could be purged from the history books), I think we owe it to our French brothers who didn't capitulate to Vichy and were of the caliber that fought for America's freedom (or at least hated the Brits enough to do so) a little hat tip on this 4th of July.

Not that this means there will be end to the French jokes and mockery, just so you know! They shall forever be cheese-eating-surrender-monkeys.

And this guy is one such person.

Only problem is I don't speak French. But on the birth of my nation, that would not exist without the support of the French (an accursed historical fact I wish could be purged from the history books), I think we owe it to our French brothers who didn't capitulate to Vichy and were of the caliber that fought for America's freedom (or at least hated the Brits enough to do so) a little hat tip on this 4th of July.

Not that this means there will be end to the French jokes and mockery, just so you know! They shall forever be cheese-eating-surrender-monkeys.

You Think We Have a Housing Bubble? Check Out the Brits!

The Real Slim Shady

Please stand up

So my question is do Mexicans hate this guy like most Americans hate rich people here or do they hold him up as a national champion and something to emulate?

So my question is do Mexicans hate this guy like most Americans hate rich people here or do they hold him up as a national champion and something to emulate?

Monday, July 02, 2007

China's Stock Markets May Not Be Overvalued

As you know when I make outlandish stock recommendations they tend to be disproportionately in China. And the reason is simple;

China produces wealth.

Come up with as many reasons and rhymes as you want for what a stock should go up, but it ultimately boils down to wealth (in the form of profit) that will drive prices up. Not how to make new B2B platforms work. Or how a search engine is going to revolutionize mapping with effectively what is only a toy. Or that you can flip it and sell it for more later.

The production of wealth ultimately drives up asset prices.

Now an investment banking colleague of mine and I were discussing it and he suggested that China was in the middle of a bubble. That millions of Chinese were borrowing to invest in the stock market and that stock market had increased in price at an unsustainable level. But allow me to share one dandy chart suggesting China may not be as overvalued as you think;

China's market capitalization as a percent of GDP is a mere 25% while Britain and the US are over 150%. It's a testament to just how much wealth is being produced in China. Additionally this does not consider the fact that China is certain to grow at rates triple that of Western economies which makes it seem even more undervalued. Add to this the fact their middle class is growing and these people will want to invest in the stock market as well, this new infusion of money will also provide upward support on prices.

So go ahead and invest in American companies, there are some good ones out there. Go ahead and invest in Apple because of the i-Phone. Just look on the back of the i-Phone and see where it was made.

China produces wealth.

Come up with as many reasons and rhymes as you want for what a stock should go up, but it ultimately boils down to wealth (in the form of profit) that will drive prices up. Not how to make new B2B platforms work. Or how a search engine is going to revolutionize mapping with effectively what is only a toy. Or that you can flip it and sell it for more later.

The production of wealth ultimately drives up asset prices.

Now an investment banking colleague of mine and I were discussing it and he suggested that China was in the middle of a bubble. That millions of Chinese were borrowing to invest in the stock market and that stock market had increased in price at an unsustainable level. But allow me to share one dandy chart suggesting China may not be as overvalued as you think;

China's market capitalization as a percent of GDP is a mere 25% while Britain and the US are over 150%. It's a testament to just how much wealth is being produced in China. Additionally this does not consider the fact that China is certain to grow at rates triple that of Western economies which makes it seem even more undervalued. Add to this the fact their middle class is growing and these people will want to invest in the stock market as well, this new infusion of money will also provide upward support on prices.

So go ahead and invest in American companies, there are some good ones out there. Go ahead and invest in Apple because of the i-Phone. Just look on the back of the i-Phone and see where it was made.

Women, Children and Education

The Economist (which all aspiring and junior deputy economists should be reading) came out with an amazing article on the effects of education on divorce, women and children.

Allow me to share just two charts from the article. The first one showing divorce rates versus education.

The most obvious relationship here is that the more a woman is educated the less likely she is to be divorced (also the younger the woman, the less likely as well).

The second chart shows that the more education women have the less likely their children are going to be raised by a single parent.

Now the article is amazing and important in that it shows the importance of education. Not just for earnings sake, but for healthy relationships' sakes and the sake of the children. it also shows smart women know that we men are cool dudes and not worth getting divorced from for we provide a heaven that is known as eternal bliss.

Alas, I would like to see the same figures for men.

Allow me to share just two charts from the article. The first one showing divorce rates versus education.

The most obvious relationship here is that the more a woman is educated the less likely she is to be divorced (also the younger the woman, the less likely as well).

The second chart shows that the more education women have the less likely their children are going to be raised by a single parent.

Now the article is amazing and important in that it shows the importance of education. Not just for earnings sake, but for healthy relationships' sakes and the sake of the children. it also shows smart women know that we men are cool dudes and not worth getting divorced from for we provide a heaven that is known as eternal bliss.

Alas, I would like to see the same figures for men.