I said this was a little more plausible than Michael Moore's contentions that Bush is a terrorist and he knew and blah blah blah.

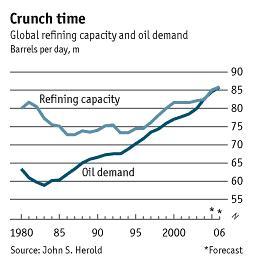

Well, make it a lot more plausible. For while in the past high oil prices were brought on by supply shocks induced by OPEC, this current spat is brought on by demand from China and the US. And with the world's two largest economies growing at full steam, it should be no surprise that when you don't build new refineries to keep up with demand, prices will go up.

To paraphrase the South Park kids "They killed the economy!" "YOU BASTARDS!"

I heard one of the morning-show radio jocks around here--- spouting off about how the US consumer demand for all sorts of cheap chinese imports, fueling the chinese econonmy (and hence the Chinese demand for oil)...

ReplyDeleteI'm not sure what point he was trying to make-- he was waffling back and forth between "buy american!" and "it's all our fault that China is sucking up all the oil and raising the price we have to pay at the pump."

The guy's an idiot. The majority of Chinese growth is domestic. Certainly they appreciate our purchasing of their wares, but their economy would still grow by 6-8% without the US, still demanding more oil.

ReplyDeleteThe idiot should also thank the Chinese for offsetting the price of oil by making all the other goods cheaper.

This is why I hate ignorance. This moron is broadcasting to thousands playing off their emotions, brainwashing them beyond taking any rational action that would actually help our situation.

One way that I'd disagree with you... you blame environmentalists for the lack of refineries. I was listening to some economists discuss the issue tonight, and they talked of how a memo leaked from Mobil about how they tried to shut down an independent refiner in California, and similar cases. The point being that it's the oil companies themselves that want to avoid building refineries; higher gas prices mean more profits for them.

ReplyDeleteThe Bush energy plan gives them tax incentives for building refineries, but that incentive is less appealing than the incentive of higher profits.

I won't deny there's an incentive there, but the percent of the "BIg Oil" profits that are derived from crude instead of distribution/retail is something that I'd have to look into. was meaning to do it, but I got this god foresaken job.

ReplyDeleteCURSES! Why do I have to have gainful employment with benefits and decent income!

JTapp said: "...higher gas prices mean more profits for [big oil companies].

ReplyDeleteThe Bush energy plan gives them tax incentives for building refineries, but that incentive is less appealing"

This is only true if costs remain unchanged. As we have seen, the cost of crude has increased dramatically over the last few years. The high prices now are a reflection of the high cost of production/procurement.

What is sure to lead to higher profits is lower per-unit-cost of production, which can certainly be achieved with deregulation.

Case-in-Point--- Wal-Mart has very low prices, and is profitable.

I saw a documentary on luxury cars a few years back, that reported the following: Saleen (maker of performanace automobiles & aftermarket parts), has NEVER turned an operating profit on the sale of its automobiles...

Despite the "high prices," how is this possible?

JTapp, your logic is unsound.

We could just look up the annual reports of BP and Exxon and that would answer our questions right there.

ReplyDeleteWell, it would answer us righter leaning folk's questions.

The left would just write it off as worthless lies because we all know that all corporations lie and their financial statemetns are worthless Enron tripe.

But for us adults it would answer the question.

Doinkarius:

ReplyDeleteBut if demand for oil/petrol has grown faster than the costs of procurement/production have grown(and I would venture that it has), much of the rise in price would mean higher profits, would it not?

I'm not sure I see where you're headed with this.

ReplyDeleteIf oil companies don't want to build new refining capacity, it is because their marginal costs exceed their marginal incomes.

If you can make more product w/better technology, faster, and at a lower cost, you can do one of two things: Keep your prices the same, and net a nice profit whose ROI would be much greater than that of your competitors. Or, you can lower your prices slightly below your competitors. You will be profitable this way, because the quantity of product demanded increases as price of product decreases. You will be able to sell 100% of your production, and have no inventory carrying costs.

If it were marginally profitable to increase capacity, it would be done. Only an idiot would prefer to earn 5% on 1million dollars than 4% on 2million dollars.

Only a fool would suggest that the carpenter creates more wealth with a blunt hatchet, due to the fact that the demand for his labor is increased due to its inefficiency.

but an answer to your question--- yes, the price of any commodity is simultaneously dependent on the supply of the product and the demand for it.

ReplyDeleteIf you increase production, and demand remains the same, the price falls.

If you increase production, and demand increases, prices remain more or less neutral.

If you production remains the same, and demand rises, prices will rise.

If production remains the same, and demand falls, the prices will fall.

If production decreases, and demand incresaes, prices will rise exponentially.

If production decreases, and demand decreases, prices will remain more or less neutral.

I guess my other question would be this: don't these oil companies have a sort of monopoly on refineries? The complaint I heard was that Mobil was wanting to shut down an independent party from building a refinery in California. More refineries mean greater supply of gasoline which mean lower prices which mean less profit for Mobil (as the independent refinery cuts into their market share).

ReplyDeleteAm I wrong in this logic? Seems that they can supply low by limiting capacity, and therefore acheive higher profits.

if it's true that any company can restrict entry to the market, then yes, i suppose that's right. Barriers to entry, of this sort, are just as evil to a free-marketeer as tariffs, quotas, and taxes, however.

ReplyDeleteBut you make this point as though Exxon mobil wouldn't also benefit from a lower price and a greater demand (at the lower price.) The lower price of all their inputs (think of how much everything they do is dependent on the price of gass-- production,transporation,plastics, etc...) They would benefit from decreased cost of production. They also ought to be able to increase their unit-sales and there is then an opportunity for greater profit (in terms of dollars & cents) than in the current system.

My guess is that this might not be possible. We have so many varied restrictions and regulations on gas in this country, that it is now the case that gasoline refined in California may be fit for sale in Michigan (at a price too high for MI standards) but Gas refined in Indiana or Michigan may not be permitted in California, and so on.