Alas, it seems Blair and Bush wish to accomplish what Reagan did;

Cut taxes to make those who work and contribute happy, while boosting social spending to glean leftists and lazies from the left.

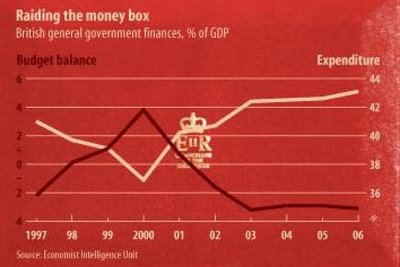

Of course, the gamble they take is that the tax cuts will pay for the increased spending by having the economy grow fiercely, thereby increasing the tax base, and thus increasing nominal tax revenues.

This does work, but the problem is the government spends even more money that what the tax cuts brought in in added government revenue, resulting in deficits, accumulating into debt.

But to the savvy politician, debt is no concern, because you can always rely on a young and ignorant generation to spread their butt cheeks, blissfully unaware of the future financial raping they're about to get in the future.

Hopefully, you will have retired from politics or passed away by that time, effectively pulling off the perfect crime.

Your "this does work" argument is one I think most economists would dispute. Sure, there's a Laffer curve. Sure, you can in theory increase revenues by cutting taxes. But damn near everybody agrees we're well below that point on the Laffer curve.

ReplyDeleteThe Reagan analogy blows. When he started in office the recession was incredible; with the economy coming out of that he could do just about anything and tax revenues would increase. Furthermore at the same time as he cut rates he got rid or a raft of deductions. The shibboleth that Reagan's cutting taxes made tax receipts go up is a more than a little uneconomic.

Debt isn't the problem per se, btw --- I mean right now Asian central banks seem willing basically to give money away at unrealistically low interest rates so you could argue it would be irresponsible _not_ to run a debt; the problem is that sooner or later (one assumes) someone somewhere is going to wise up.