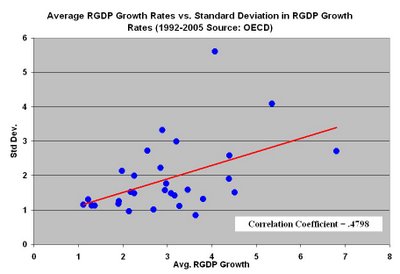

So what I did was run a correlation between the OECD member countries' average economic growth and the standard deviation in that growth to see if more volatile economic growth coincided with high average economic growth;

And what do you know, I'm right once again.

And what do you know, I'm right once again.It seems that if the government steps aside, lets people make decisions (good or bad) for themselves, the people will inevitably make the right choices. It also suggests that if markets are allowed to be volatile, yes, there may be a rollercoaster, but those markets are allowed to adjust quicker. That capital and resources are allocated more efficiently, and thus losses caused by mistakes are cut short and profitable ventures and industries are allowed to be chased and exploited with the utmost of efficiency...meanwhile the French still pay 50 Euro's for a bottle of milk.

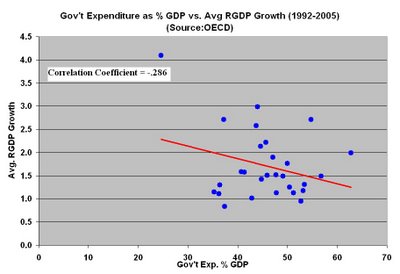

Of course, thus far all I've proved is that economies that are more volatile have on average higher economic growth rates. This says nothing about how much the government intervenes in those countries. Thusly I ran another correlation, this time with government expenditures as a percent of GDP versus the volatility of that country's economic growth.

Again confirming what I have suspected.

Again confirming what I have suspected.Alas it seems that if you want to get the big economic thrills you have to stomach the big roller coaster rides. Too bad our European counterparts are stuck on the little kiddie rides.

How are you right? Isn't 0.4 and 0.2 too low? Your hypothesis can account for less than 50% of the variance of the phenomenon... Where am I going wrong?

ReplyDeleteFrankly, Captain, this is as good an argument for reading one of those books I keep bringing to your attention as you're going to find, as the author points to periods in our country's history with virtually NO regulation or government intervention, and to resulting roller-coaster ride was extreme, to say the least, but also resulted in massive economic growth.

ReplyDeleteI think this would help bolster your case as well, and you wouldn't have to rely on these newfangled Babbage engines so much.

This comment has been removed by a blog administrator.

ReplyDeleteIf anybody out there has a correlation with a statistically significant p-value or r-factor let me know.

ReplyDeleteIn the meantime, all my research in academia showed me that NOTHING can be concluded from all the studies done out there because it wasn't statistically significant.

You inevitably have to make decisions, and if it were up to these number monkeys that have essentially turned every economics department in the world into nothing more than an extension of the mathemtics department, nobody would make any decisions because their freaking p-values were too high.

You are now faced with a correlation that shows the more volatile the economic growth is, the higher its average growth it.

My god, you people out there wonder why "real" economists don't get dates or don't land any private sector contracts? It's because you lose sight of the larger goal. That the science is there to make decisions.

If you don't like the data, fine, then go ahead and find data would would counter it. I'd welcome it. Just don't sit there and piss and moan about the god damned statistical significance. It only shows you have to resort to critiquing techincalities to counter the argument I pose.

And no, Gabriel, .4 and .2 are not too low. You are lucky to find somethign around .3 in the social sciences. Modern day HR techniques to find qualified candidates for jobs are based on cc's of .15 or so.

The fact that I read this and was thinking the same thing other commenters were shows me that I'm learning something in my econometrics class. Significance does matter.

ReplyDeleteOK, then calculate the p-values for this data set. Correlation coefficient of .48 with 32 data points.

ReplyDeleteActually, CC, everything you said abot economics in your post above is just wrong. Don't take my word for it --- read John Kay's column on economics in the May 2 Financial Times.

ReplyDeleteEconomics is _not_ about "the larger goal" and in fact your egneral abuse of it stems from that misapprehension: you try to use your graphs to justify a policy idea and consequently misuse them more often than not. Economics is about solid data analysis of the choices people make: it's the "number monkeys" who have it right. You provide impartial analyses of data and policymakers use 'em.

Now, your data here suck. That's the point we're making with the R-factors. They suggest something a policymaker might use but at the same time suggest, eh, fuck it, probably there's something better he/she can do, and he/she isn't really likely to get a lot of bang out of your thesis. But you did the economics backward: you started with an idea and went looking for something to justify it, and if there was a better measure you might have made but it would be more complex in the interpretation or might qualify your thesis, fuck it.

This is the same thing you did in the post below. Look, I actually think the US has a higher standard of living in general than France --- but there are different measures of "standard of living". "GDP per person" isn't usually one of them, is it? In fact, if you titled that graph, "Normalized GDP per person," almost _nobody_ would use _that_ data to support the statement, "the US has a higher standard of living than France." But instead you played fast and loose with it, which is crap. Jesus, do you actually _read_ the _Economist_, or just the cartoons?

Again Sanjay, show me the data that would counter this. Don't ask for pie in the sky economics where you have 300 data points (there's only 32 OECD countries, that's what we're stuck with, sorry). I'm all for seeing countering data, because my ultimate goal here is the truth. But you haven't proven me wrong, all you've done is bitch and whine about the statistical significance on something that will never have enough data points to achieve that.

ReplyDeleteAnd I'd love to see what you'd use ASIDE from the avg. economic growth rate versus the standard deviation in the growth rate that would correlate volatility versus average economic growth.

That's easy. Like I said, if you force the economic growth to trend upwards --- say, use a Poisson for economic growth each year -- I suspect random data will do the same.

ReplyDeleteYou again betray a lack of understanding of economics. If your r-value sucks it's not, OK, come up with data to prove the opposite. It's, you haven't even proved the thesis yet. Not significantly --- which means, not at all.

Since there are obvious cases where volatility is going to correlate with poor growth (think, say, interwar periods), I can easily cherry pick data (call this, "the Captain Capitalism method") to prove a hypotesis I don't particularly believe.

Your problem is simply: for any graph to be any damn good you have to prove you didn't cherry pick data --- that's what the statistical measures are for. And you aren't up to that challenge.

As for the laughable, " .4 and .2 are not too low. You are lucky to find somethign around .3 in the social sciences" -- again, so what you're saying is, you aren't actually, y'know, reading any social science journals. Real r values show up in them all the time and when they suck like yours do, the authors have to defend the crap out of them in the paper to pass peer review. Again: you're not up to that challenge.

In fact, silly me. That's exactly what you do.

ReplyDeleteMake up data. Fifty countries, say, over fifty years. And have the GDP growth per year in each one be a Poisson, with a different average in each country: so you have high-growth and low-growth countries. I'll send you the R code if you can't do it yourself, which I imagine you can't.

Now plot the variance in growth versus the average growth. Do this, oh, three or four times.

Surprised?

Can we agree you have no idea what you're talking about, now?

It occurs to me that you might be too economically naive to grasp that.

ReplyDeleteWhat you're going to find is that random data will show a tighter trend than you have in your data. Which means in the real world, you get less effect on growth with variance than you'd expect (there's a hole in this but _you_ won't figure it out).

Which means, you've proved the opposite of your hypothesis.

Nice trick.

Oh -- and when you _make_ that graph, I'd like to submit it for my entry in the "best graphs" competition.

ReplyDeleteI'm _laughing_ at you. _At_ you, not _with_ you.

Sanjay, take a chill pill, dude.

ReplyDeleteThis is not JStor. If CC wants to try out some data, suggest some conclusions and start a discussion, then that's a great effort on his part. Of course, we can disagree about what's relevant, here and in general, but that shouldn't be a personal problem.

But this is my whole point, Sanjay is an academian all caught up in the statistics, when I'm trying to say, you won't have 50 years of data for 50 countries to acheive the results and confidence intervals you'd like.

ReplyDeleteYou have to deal with what you got. But his 40 posts or so more or less make my point.

Heh, heh. OK, simulate it with exactly what you've got. 32 countries, 10 years.

ReplyDeleteWhat you'll get: the random simulation _still_ shows _more_ correlation between growth and volatility than your real data.

So: the real data support the opposite of your hypothesis: growth shows less dependece on volatility than you'd expect. You're making the case for government intervention! Fuckin' commie.

NB there is a huge flaw here. Again: _you_ can't find it.

http://www.howardwfrench.com/archives/2006/05/04/why_china_wont_slow_down/

ReplyDeleteDoes this article fit equation?

Economic significance is not the same thing to statistical significance.

ReplyDeleteBut don't take my word for it

Shorter 1Cor:

ReplyDeleteData don't matter. The blog is about saying things we can all stupidly agree with.

Look, the charts are about _data_. And more often than not (there's a nice histogram for someone to make), Aaron's plots are at right angles to his conclusions (and in this case they directly oppose them). "Some slob in academia, funded with tax paying dollars"? Dude, I haven't even done the simulation: it's just obvious to anyone with the faintest clue about statistics what it'll give. Takes me microseconds. I spent a lot less time figuring it out than Aaron did making the plot.

Meh, you're sort of misinterpreting. Statistical significance matters. The problem is it's not always clear how one shoudl use it. In this case (for example) Aaron's p-vals are no good because his null hypothesis is crap: that's what the random simulation will buy you, is a baseline for what you'd expect if the hypothesis is wrong. That kind of mistake is what they're getting at in that paper too.

ReplyDeleteBut Sanjay, despite your temperment, you are missing the point we're all trying to give you. You're right, I don't have a degree in statistics, I only have a MINOR in economics, but the REAL WORLD doesn't sit around and wait for the perfect scenario with ample data points to get under a 5% statistical significance threshold like academia.

ReplyDeleteWe're talking billions of dollars that must be moved NOW to take advantage of market conditions. If I get a client asking me what is happening in X-market in regards to y-variables, I don't have the time to be piddling around, looking for an adequately low p-value. This is the true distinction between academia and the private sector. You guys want lab-controlled conditions. We're dealing with the real world, the here and the now.

Hell, if you want to lambast somebody, lambast floor traders. How dare those bastards trade trillions worth of securities everyday WITH NO REGARD TO R-FACTORS!!!!

It's all nice in academia, and i'm sure fundamentally, you are right on some points, in the meantime, it took you 3 months to compile the data, 1 month to crunch the numbers, to inevitably arrive at the same decision I did. The only difference is that you are 100% sure of your decision and I'm 95%, but the decision had to be made 4 months ago and I'm the only one with money in his pocket (not taxpayer money mind you) because I had the balls to make the decision that early on.

And seriously, it is no different when it comes to girls.

You goofy boob. I've actually runa business and made payroll. I am a fer-real capitalist. Who are you? I know something about "real-world" conditions. And if you want to write a blog about your gut feelings and not pretend to show any data, good for you. Go for it. But most of the time you try to show data and it undermines you.

ReplyDeleteAaron (I'm busting you down from CPT to 2LT for this graph. No, screw it, I'm taking away your comission altogether for sins against economics), you're trying to dodge by saying, I'm being finicky about the graphs. Nice try, but no luck.

Here's your problem: why put up graphs at all? You're trying to show something. OK, what does that graph show?

Well, it shows a slope. Forget the R factor for now. Let's assume it's fuckin' great. Now, let's do a control: I proposed a simple sort of intuitive one. In that control, the slope is much much bigger. So your graph shows the opposite of your hypothesis: you get more growth for less volatility than you'd expect. It's not about picking on th R-factor. It's about, what is this data? What does it mean? Traders -- real floor traders --- grapple with that issue too: I see this market response, how do I interpret it? What's my model?

1Cor, actually you're a little wrong. I'll explain the risk hypothesis a bit better in a bit. And I do agree that volatility correlates with growth (although both you and Aaron are getting it wrong on multiple fronts, there's a correlation/causation problem here. But what you want to say is economic risk bolsters economic vitality, and I agree.)

ReplyDeleteBut here's the problem. You put graphs up everywhere. This one shows the opposite of what you believe. I've proven that. So? This data is no good, the others are fine? Wow, that's some convincing shit.

And you have the gall to talk about "LIFE." Well, that's the point. Life is complicated. Sometimes the data don't go your way.

As for government controlling volatility -- most (almost all) economists would say you're wrong (you're confusing volatility at a couple different scales here). They would say that in their dream scenario the government acts to damp the business cycle, running deficits during downturns and surpluses during flush perods (putting stimulus into a weak economy and taking fizz out of a strong one). When people praise Greenspan or Volcker it's for their skill at using monetary policy to do exactly that. The funny thing is, Aaron has praised Greenspan to the skies for it. Now you argue that doing that hurts the economy? Uh......no. You're confusing different kinds of volatility.

1Cor,

ReplyDeleteStill wrong. It's not good "because of human nature." It's good because of basic economics. It's hard for things not to run away. A depressed economy can get worse and worse because less captial is available for investment, for example. A fizzy economy has the resonable problem that people want good return on investment and that can kill some investments off. It's not because people are unreasonable, it's because they are reasonable.

I'm still trying to understand why you think the graph is somehow less meaningful when it goes against your thesis.

Hi ,1Cor, some corrrections:

ReplyDeleteSure, economics involved human nature. I guess my point is, you seem to think that people misjudge things and that's why we need government to reduce volatility, lest we live horribly. Not at all! In this case even when people judge their own interest quite well, there's a reason to minimize volatility. I'm sure the Ayn Rand nutcases would disagree, but, they are vastly outnumbered on this point among economists.

As for my thinking the data is reasonable: eh. Actually I suppose I think it _isn't_: I do believe that growth correlates with variability for a few reasons, but it's correlation not causation. (and the second plot is just crap: if you removed the one outlier it would say nothing. Libertarians everywhere would carry that plot in their wallets otherwise).

But the thinking here is crazy. Aaron imbues most of his posts with "data." And in most cases he misinterprets or overinterprets it. Now, when this post went up I'm sure a bunch of you were sagely shaking your heads: yep, sure, Cap'n I agree. But as I've shown -- and can do for a lot of other posts --- it's crap. But y'all can't deny that so instead you tell me I'm some crappy academic worrying about R factors.

Is that how you handle all your economic information? Doesn't give me a lot of confidence in what you conclude. If you just think of data as a "conversation starter," --- that smehow your policy/economics conclusions then float of away free of the data, and it's not worth analyzing and undersanding them: well, that's Aaron's method, I guess it works for some people. But I'm going to be able to make my case better than you, always.

1Cor

ReplyDeleteNice try. Wrong again. I don't think people are always reasonable: in fact you can do psychological tests to show people make bad choices all the time. I just think (still) you are (still) wrong in appealing to people's unreasonableness, as why it's good to damp down economic cycles.

Thanks 1Cor, that's gracious of you. Of couse I agree people have to trust the system -- that's one of many ways (limited) governmental intrusion can be a positive thing in the market: contracts, for example, can be enforced.

ReplyDeleteI'm doing an honours dissertation on a very similar topic. Doing research I found a journal article on this very topic: "Cross-Country Evidence on the Link between Volatility and Growth" by Ramey and Ramey.

ReplyDeleteSorry, Capt Capitalism, but they find "that countries with higher volatility have lower growth. The addition of standard control variables strengthens the negative relationship."

But there is a redeeming finding for you: "The authors also find that government spending-induced volatility is negatively associated with growth even after controlling for both time- and country-fixed effects."

You can read the abstract here:

http://ideas.repec.org/a/aea/aecrev/v85y1995i5p1138-51.html

but you'll need Jstor access for the article.

Well, hell, Anonymous, that's what Aaron found too. He just didn't know it.

ReplyDelete