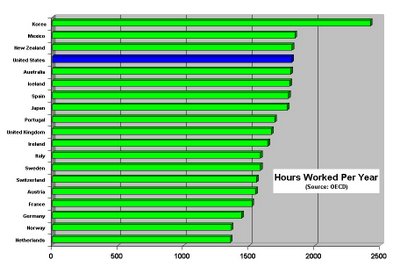

It is creation and innovation that is the true producers of wealth and it is what America has specialized in since its existence which has given us our (soon-to-be-lost I predict) preeminent position in this world. That and we work more than most people didn’t hurt either.

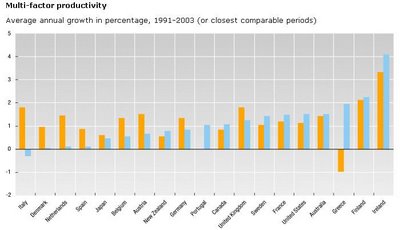

But to prove the importance of working smarter and not harder, allow me to introduce the concept of “multi-factor productivity” or MFP.

GDP growth is chalked up to increases in the use of capital and labor. When you use more labor and more capital, you’ll get more GDP.

However, when disseminated, changes in labor and capital doesn’t fully explain all the economic growth that occurs. The residual is chalked up to “MFP.”

MFP is basically any efficiencies gained BEYOND using more labor and capital. A smart young operations manager could find a way to reorganize the conveyer belts to produce 10% more widgets without an increased use of labor or capital. A new chemical that costs only $20/ton may replace the need for two chemicals that cost $50/ton. Or a technological invention could completely replace an industry and fundamentally change how it does business; NAPSTER, the assembly line, Windows come to mind. Even The Economist had an article recently showing how e-mail broadband, and PDF files are eliminating the need for bike couriers.

These cumulative increases in efficiency arising from either smarter use of current resources or a completely new innovation/technology is the true engine of economic growth and is why we should be focusing on working smarter…and why we should be pushing engineering and the sciences and funding less sociology, philosophy and hyphenated-studies majors…or at least severely mocking them.

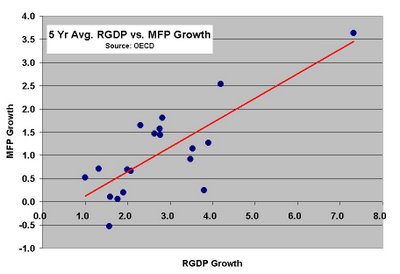

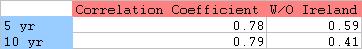

When GDP growth rates are correlated with MFP growth rates, the correlations are impressive thus proving working smarter is an excellent predictor of producing wealth.

(note, I took out Ireland as it was the "outlier," but contest it should stay inbecause of the sophisticated economic argument that the Irish kick ass)

Thus, foreign labor and outsourcing is not a threat to anything but low skilled workers as labor truly is a commodity at the low skilled levels. And while it may be regrettable that some slothful union types are out of a job or are forced to compete, it is the economic reality that if America is to ensure its preeminent position in the world we better get back to doing what we do best; being the inventor of the world.

If we shrink the money supply that could happen.

ReplyDeleteSomehow I find that it only has 40% correlation over the 10 year period (with the removal of Ireland) pondersome. Are there mfp statistics out there over a longer period of time?

ReplyDelete