Not a lot to do in Fergus Falls, but managed to get what errands I could get done while there.

Got a hair cut.

Walked the 5 miles into town from the interstate to get access to the internet.

Had a decent meal at a local 1940's type diner.

Read through two issues of The Economist.

But when all was said and done, I still had to kill about 6 hours of time waiting, which for my personality is the equivalent of hell.

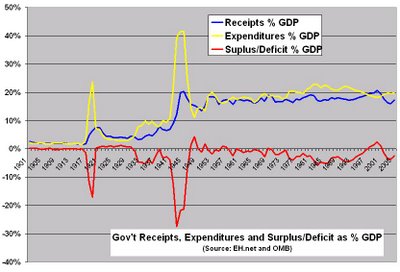

So while suffering the flames of hell waiting for a buddy of mine to pick me up, my brain in desperate bid to stay sane came up with the idea of going back further in the US federal government's history to calculate the overall taxation rate, expenditure rate and surplus/deficit as a percent of GDP.

Up to this point I had received the data available at the OMB. But I recall eh.net having GDP figures going back to 1790. That would make a spiffy chart indeed seeing how federal spending/revenues compared from today to the founding of the country.

Unfortunately, the OMB only has data going from 1789-1900 CUMULATIVELY. In other words, it isn't year by year, they just added up the budgets and the GDP's of the first 111 years of the country and listed in on one line item.

Obviously the economist who thought up that brilliant idea is getting no girly action because he is an idiot.

That being said, at least there was data from 1901 on, which still made for a better chart which only goes back to 1930 and would include WWI.

Several observations I made of the chart.

First, you really get a feel for what a real war costs with the spikes in WWI and WWII. Tragic as the deaths and so forth may be in the current war, but the American people are not suffering or sacraficing squat in this current war. It reminds me of a story I recall where the upper classes of society from the Union decided to take their carriages near the battle frield to "watch the war." Sure enough the Confederacy delivered a defeating blow and the upper classes were shocked as to not only the horrors of war, but were throwing up as mutilated Union soldiers were thrown on their carriages to be evacuated from the battlefield.

Second, after each war, a new and HIGHER level of taxation was established. Previous to WWI the federal government taxed Americans at a rate of about 2.6%(like the shirt says, "Imagine a world with no liberals.") That in itself is worth pondering. Then after WWI, the over tax rate went to something around 5%. FDR, the modern day socialists's All American Hero, kept taxes at that rate, until WWII came about. Today, democrats would cruxify FDR for being such an obvious shill for the rich. Regardless, after WWII the tax rate quadrulped up to just below 20% GDP where it has stayed. If this is the effects of war, I might just become a pacifist.

Third, contrasted to previous generations, you see the reiteration of the Baby Boomer generation voting in congressmen to spend beyond their means and mortgage the future. Right about when Jim Morrison was OD-ing on heroin was about the time balanced budgets would take a 30 year sabbatical from America and we'd run deficits to finance programs that would ultimately do nothing other than transfer wealth and destroy families.

As far as I can tell this chart just shows how a higher and higher percentage of the people are chosing the dead-end road of voting in people who promise to take money from Paul and give it to Peter. The day will come we'll expect the government to provide so much for us, we'll have no incentive to work, and thus we'll have no wealth. However, we will have one thing; a Bolshevikian revolution.

The only solace I can take in it is that the people will bring it upon themselves and get what they deserve for their ignorance of history and economics.

Dude, extraordinary post but don't mess with the Lizard King. He was a great capitalist, by music industry standards! Check out the track "Money" (I'd love to see Pearl Jam or Bono cover that!) and his poetry/put to music (Stoned Immaculate, hello!). :-)

ReplyDeleteI believe you're referring to the First Battle of Bull Run, Captain, where various Congressmen and prominent Washingtonians went to watch the "fun", and caused a pileup when the military picnic turned somewhat ugly.

ReplyDeleteAlso, bear in mind that the War of the Rebellion was when the income tax was first introduced (and later declared unconstitutional in 1872-oh, for THAT SCOTUS!), and the federal budget ballooned during that period, but was paid down during subsequent years (yes, I have the data) owing to that whole "balance the budget" idea (those wacky limited government types!).

"If this is the effects of war, I might just become a pacifist."

ReplyDeleteThat's pretty much what convinced me of the wisdom of pacifism. Every time a new war comes along, it gives government the excuse to raise taxes, encroach on social freedoms and market itself as the savior of its people.

Did you ever read State of Fear, by Micheal Criton? It's pretty mediocre as a novel, but it raises the point that a government always has to have something with which to scare its people into submission. Global warming does the job nicely, but if you're a politician trying to convince people to vote you more power, you just can't beat a good ol' fashioned war.

Worth noting that the U.S. (and the world) was on a gold standard until WWI, and briefly afterwards, except for when they went off it to finance the Civil War. This limited the ability of the government to run huge deficits.

ReplyDeleteAlso, (as an aside) increased tax receipts in a given year doesn't mean there was a a higher tax rate.

But, if you look closely at 1932, you can see the affects of Hoover's idiotic tax hike. Receipts go up and then sharply down as the economy responds with a nasty downturn.

From Wikipedia: (Hoover) raised taxes on the highest incomes from 25% to 63%. Corporate taxes were raised almost 15% and the estate tax was doubled.

Just thought it was worth pointing out the landmarks along the graph.