DISCLAIMER-BY READING THIS YOU WAIVE THE RIGHT TO SUE ME! IF YOU FOLLOW ANY OF THIS ADVICE AND YOU LOSE MONEY OR DON'T MAKE AS MUCH AS YOU WOULD HAVE OTHERWISE, TOUGH! AND EVEN IF YOU WERE TO SUE AND WIN, I'D GUARANTEE YOU'D HAVE MORE PRESSING MATTERS TO WORRY ABOUT!

Everything clear? OK, good, let's move on.

Several times now that I have run into the classical "starving student" while teaching economics at the local community college, where of course, we accept only the finest the public schools have to offer. And it is obvious these starving students received their education at the public schools, because their logic is so solid.

For example, one particularly starving student was so desperate for money, he had to sign up for MinnCare (Minnesota's state sponsored health care system). This means myself and other lucky fellow (and self-supporting) Minnesota taxpayers now provide this student in need with health care if he can manage to pay the $20 a month required of MinnCare. Unfortunately, I don't think he can even afford that because he bought himself a portable DVD player and the entire "Family Guy" series on DVD.

Another classic example would be the poor, tortured soul who stormed into my classroom tirading about the financial aid department's refusal to disperse any further financial aid to her. Don't these people realize that this is the same girl that needs to get hammered every weekend at the bars? And don't they realize that drinks nowadays cost about $5 a pop? I'm scared to speculate if she has a child.

Regardless, I could go on with endless examples of how students' choices to spend their money serves only to utterly destroy the broken record track of the left that 80 gazillion people are without health insurance, but that is not what this article is about. For while I certainly can critique the parasites of society for insisting the taxpayer subsidize their lives whilst they go and booze it up and buy the latest electronic gadgetry, the public school-educated youth are not the only ones guilty of making poor investment decisions.

For example, take the good little Jessica-Simpson-Americans. They work hard. They maximize their contributions to their 401k's. They get a house in the suburbs. Set aside some money in a 529 plan for little Jr. And if they have some extra money they perhaps contribute that to a Roth IRA.

What could possibly be wrong with that?

Nothing from moral standpoint. You certainly aren't having me pay for your health care (much appreciated). You certainly are contributing to GDP and thus society. You're probably doing more for your children than most by setting up a 529 plan. And despite Jessica Simpson making me want to gag, as an advocate of self-reliance I couldn't critique anything about it.

However, from a financial or economic standpoint rarely do I see anybody putting forth the effort to thoroughly and fully analyze what they're throwing their money into. And while it isn't an obvious waste like choosing Jack Daniels over college books, there are some things you should consider before you just blindly invest with the masses into your 401k.

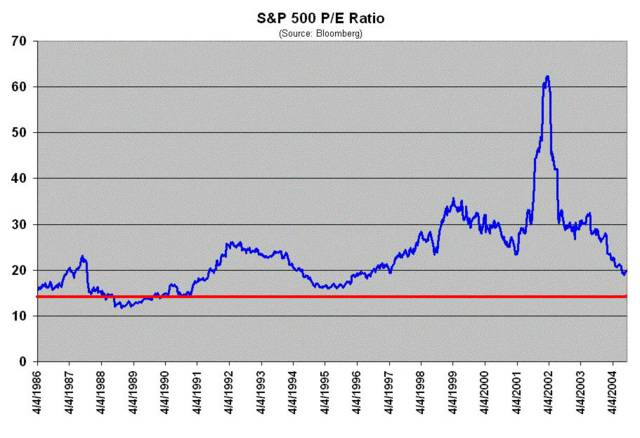

First off is the crazy, outside chance that maybe, just maybe, with the entire Baby Boomer generation throwing all their money into their 401k's that this may have overvalued the stock markets. Beforehand people would just retire off the farm, sell the business, or (here's a foreign concept to the Baby Boomers) work until they died. But it is only recently that we've opted to use the stock market as our main investment for retirement. Using the S&P 500's P/E ratio (for those without a degree in finance, this a measure used to gauge how over/undervalued a stock is), you'll note that US stocks, despite the crash are still overvalued by about 25% from their historical average of 15 as notated by the red line. Furthermore, ever since the Baby Boomers have entered their "prime earning years" say in the late 80's the stock market has always traded above this average, suggesting this overvaluation is persistent and fundamental.

Worst still is what will happen when the Baby Boomers start to retire and withdraw their money from the stock market? Well, you just keep on contributing to that US equity fund of yours and see what happens 2009-ish.

Another item you might want to consider is that precious house of yours. Why, at all the cocktail parties who doesn't brag about how much the value of their house has increased? Certainly a considerably loose monetary policy and abnormally low interest rates hasn't artificially boosted housing prices. Well, very similar to the S&P 500's P/E ratio is the price to rents ratio for housing in the US. Put out by HSBC, this measures the average price of a US house to its plausible rents.

Alas, it seems the housing market is not only too pricey, but bound to correct a little.

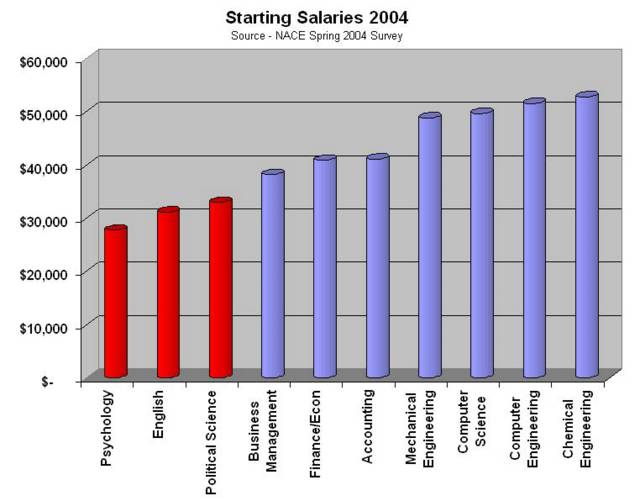

But how about education? Specifically, your child's education. How can a 529 plan possibly go wrong? Well it can go wrong since you have to invest the money just like you would a 401k plan and thus face the same overvaluation risks. Best bet is to go with the prepaid tuition option for the 529's. But then again, and me being forever the cynic, your child will no doubt major in some crap study like "sociology," or "peace studies" or "feelings," effectively wasting all your money anyway.

Perhaps you should just buy yourself a boat.

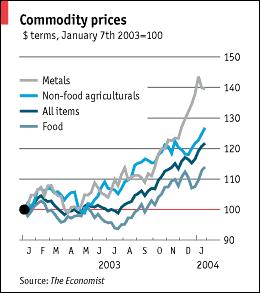

So what's left to invest in if the stock and property markets are overvalued? Sure you could go overseas and invest there, but you'd be facing various exchange rate and political risks. You can invest in bonds...and earn a whopping 5.5%. What about commodities? They've had a bold performance.

Of course, that bold performance is solely due to China's blistering economic growth and voracious demand for raw materials, sure to reverse itself once China's economy slows down to a more rational 8% GDP growth.

But there is another option...an option that nobody considers. Well, perhaps somebody has considered it, but financial advisors aren't too keen to tell you about it, because they won't make money. Matter of fact, neither will you, but it certainly has more benefits than any other investment I've seen in a long time.

Pay off your debts.

Car loans, student loans, credit cards and even your mortgage; pay off your debts.

Now conventional wisdom had it that you should consolidate your debts under a home equity loan. This in turn would allow you to write off all that nasty interest from your taxes. But I am not conventional. And while I do subscribe to consolidating your debts so that its interest is tax deductible, I much prefer to pay off all that debt prematurely and forego the interest deduction.

Now MBA's from Ivy League schools are probably scratching their heads just as they were when Dotcom Mania came crashing down because it says in the Official Ivy League Textbook of Finance that you should always hold that interest deduction in high and holy regards. No matter what you do, you need that interest deduction. Shoot the children, sell the dog, but whatever you do, do not give up that interest deduction.

Here's the problem. Do you want to hold on to that holy and sacred interest deduction, or would you rather just not pay the $300,000 in interest expense over the course of the mortgage in the first place?

Yeah, I thought so.

But there are more benefits to paying off your mortgage and debts early than the cash flow you'd save. Converted into a rate of return, you'd actually be earning a better rate than you would most bonds. Below are the returns you'd realize on a standard 30 mortgage rate at 8%.

(Note - this "rate of return" is somewhat misleading. Sure if you pay off additional principal you save future interest payments, however you won't see an "annualized rate of return" out to 30 years simply because in paying off additional principal, you bring your mortgage to a pre-mature end. If this doesn't make sense, don't worry, I just put this in here as a technicality incase some math/econ/finance geeks were interested).

However, this "rate of return" is actually a misnomer since you aren't really investing in anything as much as you are paying off your debts to save future cash flow. This brings up another benefit to paying off your debt; it's risk free. You are not the one taking a risk, it is the mortgage company that loaned you the money that is taking the risk on you. Thus it is a completely risk free investment to pay off your debts early, even less risky than investing in US Treasuries.

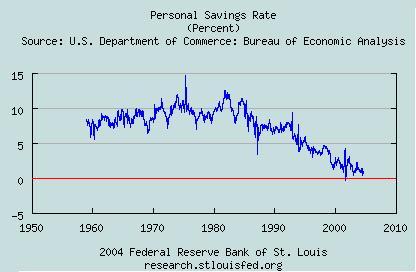

While this is all well and good for you, there are also benefits to society and the economy as well. Realize Americans have saved themselves and the world from arguably two recessions with one thing;

Insatiable spending.

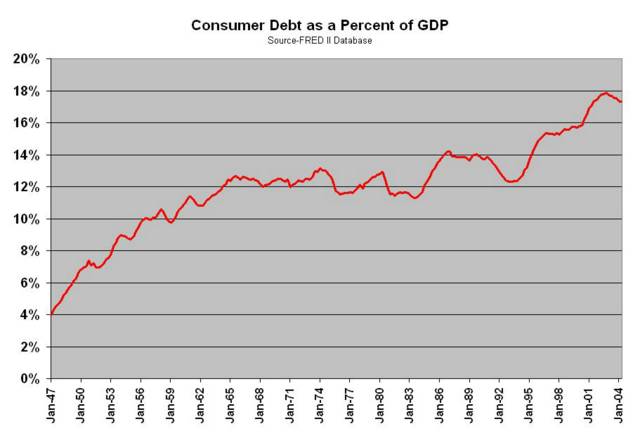

By spending like we're married to a ketchup heiress, and borrowing the money to do so, we not only merely post-pone an inevitable decrease in consumer spending into the future, but we rack up massive amounts of debt in the process. This has resulted in an amassing of $2 trillion in consumer debt, putting it at a historical high of over 17% of the economy's GDP.

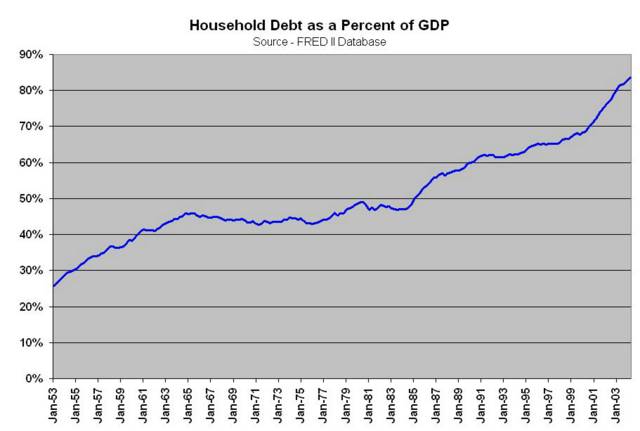

But that is nothing compared with the level of household debt (consumer debt + mortgages and some other liabilities) currently standing at $9+ trillion, roughly 85% of our GDP. Thus, the coincidence of the rise in household debt and the rise in property prices suggests the property "bubble" is driven by debt-always a good thing (for those of you with real lives and the ability to attract members of the opposite sex, this was a joke that only economists would get and find funny. A debt-driven stock or property bubble is a VERY BAD thing, so this was meant as sarcasm).

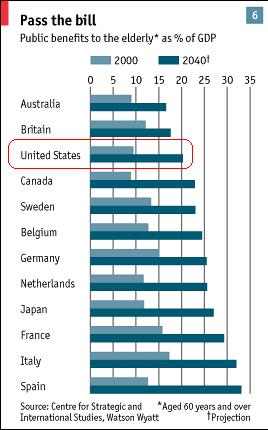

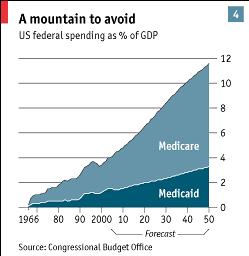

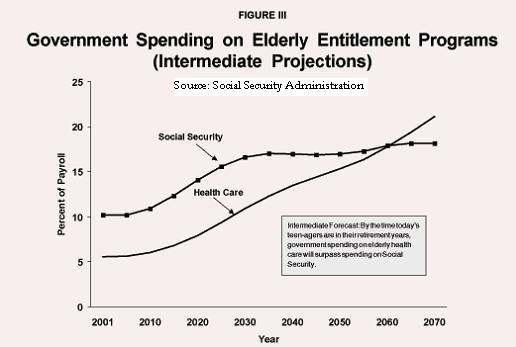

Worse still is it's incredibly poor timing to be racking up these massive debts on the precipice of the impending Baby Boomer generation retiring which demands MUCH MORE saving. While Social Security and Medicare currently consume 10% of our nation's GDP, that number is expected to double by 2040 taking a full fifth of our economy, Medicare inevitably about to eclipse its senior sibling, Social Security.

If these massive entitlements the Baby Boomers have promised themselves are to be funded, it will require additional "forced" savings in the form of increased payroll taxes. These taxes are expected to be doubled by 2040, taking a full 30% of your salary in order to pay for these things.

The whole point is that you can't afford to be blowing your money on BMW Z3's and pocket bikes for junior simply because in the future, your disposable income will be pinched, perhaps to the point that you may not be able to pay off your debts if you still have those debts. Thus it is important that you pay off your debts NOW while you still have the ability to do so and before the government takes a larger and larger share of your salary.

But spending less, saving more and paying down your debts should not be as painful as all that. As you've seen significant asset categories like stocks, property and commodities seem to be currently overvalued. Bonds are also not terribly attractive with their mere pittance of an interest rate they pay. But with a risk-free guaranteed rate of "return" by paying off your debts early, you take advantage of what could arguably be today's best and safest investment option. Furthermore, there are macro-economic benefits by Americans paying down their debts en masse. Interest rates would remain low, allowing for businesses and people to borrow cheap money to pursue ventures and grow the economy. The dollar would strengthen, increasing purchasing power and making imported goods cheaper. But most importantly, it will soften the blow and fortify the economy for the inevitable retirement of 70 million Baby Boomers. It is literally an economic, once in a lifetime "win-win situation."

Alas this last reason may not convince you to take the money you had earmarked for a European trip and instead pay down your mortgage. So perhaps I should be a bit more blunt. How about the threat of a massive recession that would put the Volcker Recession to shame and throw you into poverty and bankruptcy and make the likes of "pocket bikes" the things dreams are made of? For such a scenario is not likely, but guaranteed if Americans do not change their course. Of course that is my opinion, it's just up to you to convince yourself otherwise so you can sleep well at night.

Pleasant dreams.

This comment has been removed by a blog administrator.

ReplyDelete