Every guy has had the experience at least once during his earlier days at college of sticking around till the party is all but completely dead, the good looking people hooked up long ago and in a half-drunken daze you wander aimlessly thinking that some babe is going to pop up out of nowhere.

The hosts of the party give you subtle hints to leave and are somewhat wary of your presence. But there you are, ignorantly blissful and optimistic that you're still going to get some play that night hoping the party continues on and re-ignites itself.

Such is the situation with our beloved real estate developers in this beloved nation in this beloved housing bubble, ESPECIALLY CONDOS

Good Christ, half my day is spent explaining to middle aged men, who should know better that "no, starting another condo development is not worth the while."

And that, "no, we are not going to refinance or look at funding alternatives."

And that, "no, I don't care how "luxurious" or "unique" it is, "Westcreekwillowpalmheightsoakdaleway" is not anything special and is no different than the other of billions of condo developments out there."

I’m surprised I haven’t seen any proposals to build condos on the now-frozen lakes in Minnesota.

But no, they still keep coming. Like freaking zombies. Developers who all they've known is

construction and real estate. Hammer whacking, framing and landscaping. For 15 glorious and uninterrupted years, they don't realize that the chart has precipitously dropped on them and that the capital markets have dried up on them. They think the party is still going on.

So, for all you analysts, researchers, bankers, and economists, particularly in the Twin Cities market, mayhaps I can interest you in some spiffy charts I’ve found. Some charts that will repel the horrid condo-zombie horde by showing them that not only is the market flooded, but that they would lose their shirt if they tried to squeeze another condo in.

One, the market is saturated.

All that pent up demand by empty nesters and "cool hip Gen-Xer’s" looking to live in the "cool hip murderous town."

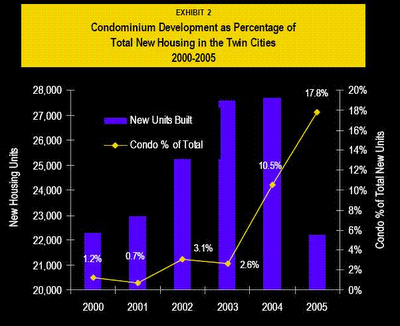

Yep, plum ran out of them, everybody who wants a condo has one. Because in the past 3 years YOU FLOODED THE MARKET WILL 11,000 CONDOS!!!!! Whereas historically about 100 or so hit the market each year.

Two, when ONE IN FIVE UNITS BEING CONSTRUCTED IN THE ENTIRE TWIN CITIES REGION IS A FREAKING CONDO YOU MIGHT JUST HAVE AN OVERSUPPLY ISSUE HUH!!!!????

And this data doesn’t even include the full spectacularly horrible year of 2006!

Regardless, there is a lesson to learn here in the condo market and the overall housing market. And that lesson is the importance of teaching EVERYBODY the basics of economics.

Imagine that if instead of wood shop, all these developers and contractors would have taken basic economics. Imagine the LITERALLY HUNDREDS OF BILLIONS OF DOLLARS THAT WOULD HAVE BEEN SAVED! But I kid you not when I say that of all the real estate deals I’ve looked at in the past 3 years ONLY 2 HAVE HAD ABSORPTION studies done. Ie-only two developers bothered to gauge how well their housing would sell.

Scores, arguably a hundred real estate deals passed through my hands the majority of which didn’t even bother to calculate whether they’d actually be able to sell their inventory of houses. Heck, I remember one a couple years back where this developer added 220 housing units to a town with a population of 2,800. Assuming 3 people per unit, that’s 660 new people that have to fill those houses. In other words, the population of this town is going to grow by 24% OVERNIGHT????

But what really gets me is how these people think nothing of asking to borrow millions of dollars of other people’s money and then are so irresponsible, or it just plain doesn’t occur to them, that they don’t even bother to find out whether they’d be able to pay it back or not.

2007 and we’re making mistakes that are as stupid and as egregious as Holland Tulip Bulbs, Dotcoms and electing Hugo Chavez into power.

The people will pay for their ignorance, oh yes, the people will pay.

Don't the people who will be lending the money investigate how the developer plans to sell these? And if that plan will work?

ReplyDeleteJunam

You'd think. But bankers and brokers get commish on the deals so there's an incentive for volume, not necessarily quality.

ReplyDeleteI'm a Contractor myself, in Fl. and Ga. I saw the light and got out of the spec market in July, 2005. Now I'm no Economist but having passed two Economics classes in the course of getting an AA degree, coupled with some common sense, I can spot a flooded market...hehehe. Those guys in your area are looking at a big inventory sellof. That's just insane. Rest assured not all of us Contractors/Developers are idiots.

ReplyDeleteAbout those tulip bulbs, the mania over those wasn't quite as crazy as most people think. The Dutch Parliament passed a law that turned all futures contracts in tulip bulbs into options contracts, so when the risks of tulip speculation dropped through the floor overnight, prices predictably went through the roof. Prices tend to be a reflection of risk vs reward, and when the risk goes down, prices go up.

ReplyDeleteHere's a 2002 paper by Earl A. Thompson and Jonathan Treussard of UCLA that goes into a little more depth on the subject. Just download the pdf and give it a shot. I certainly found it interesting.

http://www.dklevine.com/archive/thompson-tulips.pdf