And then I seriously doubt whether we'll be able to continue borrowing money from the equity in our houses so that we can spend more than we make falsely propping up this economy...

http://research.stlouisfed.org/fred2/data/PSAVERT_Max.png

And then I seriously doubt whether we'll be able to handle the recession that will ensue due to drastically slowing consumer spending...

And then I really seriously doubt we'll be able to handle really bad timing that this recession should hit once the Baby Boomers start to retire and put a further strain on our economy.

But then again, I'm just a dumb economist. What do I know?

humbug. All you economists ever talk about is theories. theories aren't applicable to real life.

ReplyDelete< /sarcasm >

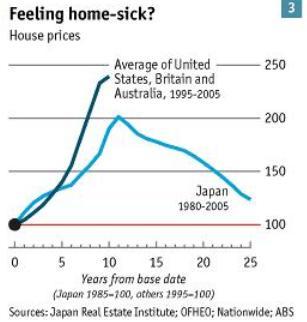

But seriously--- we're in for a scare here, but I don't think it will be anything like what happened in Japan in the late 1990s. Japan had some unique problems, which I don't think are applicable to the US (although I may be wrong)

A disporportionate amount of Japanese investment was done in SE Asia--- they were not diversified and thusly unable to cope with the shock of market crash.

But I think mostly to blame was the uber-conglomerate Keiretsu system of business in Japan.

In a nutshell--- think of Standard Federal Bank, General Motors, Wells Fargo Mortgage, Target Stores (and dozens of smaller firms) all exchanging minority stakes in one another, and then operating under an agreement where they are all treated as sister-companies.

The short version is, that Banks were basically lending money to themselves (because they owned stakes in their borrowers) and the borrowers were paying their increasing debt off with stock. In turn, firm A was borrowing from sister Co. B, buying supplies from another sister-co. C, and selling their product to sister-co D, who was paying A with money they had borrowed from B.

Or something like that.

I wrote a paper on that a few years back, I'll have to look into it.

didn't greenspan just say that homeowners have enough equity to weather the decrease in prices?

ReplyDeleteI'm not sure what Greenspan said, or who he might've been talking about. I work in Real Estate/Mortgage/Insurance, and I can tell you only firsthand what I see:

ReplyDeleteThe number of people who are taking cash-out refinances after 1 year (or less!) is absolutely astonishing. They're eating up any "equity" they may have acquired.

The number of people taking out a refi loan to pay off their existing indebtedness pales in comparison to the number of people who are diggin the hole even deeper.

Case in point: Mr. X bought a house last October for 359,000. He is refinancing his mortgage next week for $372,000.

Now, I suppose it depends what you do with that equity? Is he investing it in the market? In a retirement fund? In college education for his sons & daughters?

Or is he flying to Aruba? Buying a new car? Something even more capricious?

Your guess is as good as mine.

Honest truth, what really convinces me is the level of spoiled-bratness Americans (adult and children alike) have and how we're just not producing any real wealth or any real work ethic.

ReplyDeleteIt is social decay that is tanking the economy. The numbers are just a numerical reflection of that.

And yeah, Greenspan said we have the equity to weather a price crash, but if you look at the savings rate, it's obvious the only thing keeping our economy going is that we blow all our money.