merger talk circulating around.

I originally invested at 60 cents a share in the hopes that the good socialists of Minnesota would vote for the government to bail them out. Fortunately I got lucky with the merger talk and the same effect occured. But there is something that concerns me and should concern those folks out there getting all giddy thinking NWA will arise from the ashes like a pheonix.

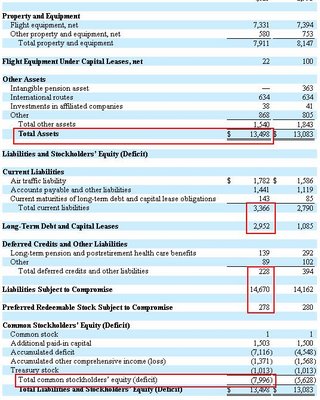

To legitimize the current stock price, a potential suitor would have to offer, at minimum $8.5 billion.

Right now NWA has $8 billion more liabilities than they do assets. So any acquirer of NWA would have to pay that minimum to take the creditors out of the deal. But with 87 million shares outstanding, each trading at $5 per share, this would mean roughly another $500 million would have to be added to the pot to make these shares worth it.

The question is whether NWA is worth $8.5 billion when Delta, a much larger carrier, was just offered $8 billion.

Regardless, I still listen to the investor relations web site of NWA.

Isn't this what economists call (in a rare moment of clarity/honesty) the "greater fool theory"? In other words, unload your shares on some unsuspecting sucker who didn't do his research and who'll be left holding the bag when it all comes crashing down?

ReplyDeleteNot to be slightly cynical or anything.

The key here is 'liabilities subject to compromise'. Without being an insider its hard to determine exactly how much of this NWA will be able to 'compromise'. At least one hedge fund (Owl Creek) thinks its significant. Another data point is to look at United's balance sheet just before and just after they exited bankruptcy this year. They managed to shed some $20B of liabilities. So there certainly is potential with NWA.

ReplyDeleteFine, high risk, probaby lose your ass, but if you're young without children, and have nothing to lose, take the money you'd spend on otherwise on a diamond ring for a girl that will only divorce you 5 years hence on Great Wall Motors.

ReplyDeleteWhen you lose all your money, you cannot sue me for I told you you'd lose all your money. It is only by luck, chance and bodacious red heads you made money on it.

I have spoken.