Let me tell you about Pete.

College Republican buddy from the days. Older than me and thus one of the few folks I take wisdom from rather than dispense to. Also a lawyer and former military. So you can sit down and have a beer with Pete and pretty much be guaranteed that you will be talking about something slightly higher brow than Dawson's Creek. Runs a blog called Swanblog which is more law than it is economics, so if you want pit stop over there sometime and check it out.

Anyway, he forwarded me this article which is about a guy who got sued for defaming somebody over the internet through the use of a blog.

I know this is a deviation from our standard economic fare, but I'm sure there are some readers who are VERY interested in these sorts of lawsuits.

Sunday, October 29, 2006

Open Budget Index

My favorite is when I'm doing battle with a socialist, I have the budget pulled up on my laptop or the stats on my memory stick, and I show them, PROVE to them, beyond all reasonable and unreasonable doubt that they are wrong and/or misinformed to the point it would be glaringly obvious to a 5 year old that they're wrong and what do I get in return?

The standard leftist, knee-jerk reaction response;

"Well, you know you can't trust those figures. Bush and the Republicans are manipulating the budget to make it look that way."

And my standard response to them is, "OK, do you have an alternative budget or proof that would suggest that?"

Of course, the answer is "no."

"Well then, until you have some rival data or budget and that rival data or budget comes from a reputable source, it'll be the official US Federal Government Budget figures we'll be using."

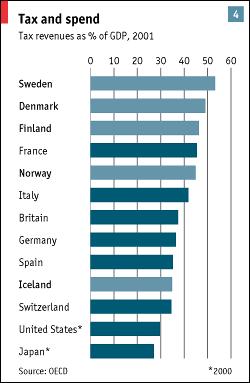

Thus, I was pleased when I saw this new chart from The Economist.

Measures how open a government is with its budget.

The standard leftist, knee-jerk reaction response;

"Well, you know you can't trust those figures. Bush and the Republicans are manipulating the budget to make it look that way."

And my standard response to them is, "OK, do you have an alternative budget or proof that would suggest that?"

Of course, the answer is "no."

"Well then, until you have some rival data or budget and that rival data or budget comes from a reputable source, it'll be the official US Federal Government Budget figures we'll be using."

Thus, I was pleased when I saw this new chart from The Economist.

Measures how open a government is with its budget.

Saturday, October 28, 2006

Banned Statistics on Education - Part II

This is appropriate to re-post as Minnesotans in 75 school districts are facing a vote on levies this November.

There are two things that you probably know about me in reading my little economic posts from time to time;

1. I live in Minneapolis

2. I do not like children.

Thus you can imagine my happiness when I conducted the research for the second portion of my foray into whether or not more money = better schools and found out that not only do Minneapolis property tax payers pay 44% more than the Minnesota average to educate our precious little children, but those children performed 15% below the state average in standardized tests.

Of course many people will claim those tests are biased, archaic and practically racist for they only test those abhorred evil Eurocentric subjects; reading and math (GASP!).

But test them on the merits of diversity and the drawbacks of Western Civilization, America and Capitalism and it will be on par with their indoctrinators’…er…I mean “teachers’” college dissertations.

As an economist I do not so much contest whether everybody should somehow pay to educate our children (I do agree with that), but can we at least get a bang for our buck???

Apparently economic efficiency is not on Education Minnesota’s (teacher’s union) agenda, and especially not so in Minneapolis, for while it takes only $8,739 a year to educate the average Minnesota student, it takes $12,537 to educate the average Minneapolis student (and $15,845 if you include loans and levies).

Alas, I made two calculations.

First, I’m all about the opportunity cost and so I calculated how much it costs to educate a child in the Minneapolis public schools for the 13 years they’re in there (even though some spend a couple more years than that). And this came out to be just shy of $163,000, $3,000 more than what I paid for my house some time ago. And granted property prices have risen, but ask yourself the question;

“Why bother educating some of these morons when they’re only going to go out and live off the system anyway. Hell, just buy them their own damn house and save us the bill on future public housing. Kid is born, and if it doesn’t get its act together by the 1st grade, BOOM, “here ya go kid, the American dream! Now leave us alone and never come back.”

Of course how can you ascertain whether the kid is going to be a good or bad student by the first grade? But you can get a pretty good idea by the 4th or 5th grade I’d imagine. And who says that $12,537 a year can’t be invested in a mutual fund or some other investment? Earning a reasonable 8% a year starting after the 5th grade, there would be over $120,000 in the kid’s housing account. Certainly enough to get them a condo, even in the hot property market of Minneapolis. And who is to say this would be “cruel” or “evil.” We’re buying these losers a free house, the American dream for doing nothing, yet at the same time getting them out of the classroom so the remaining 4 students in the Minneapolis public school system can get a real education uninterrupted.

Now, admitted, I am being a bit satirical, but sadly the economics of it are just so compelling, one really has to wonder if society wouldn’t just be better off doing it this way.

The second calculation I made was to further advance our excursion into the question whether more money = better education. Previously, I looked at state spending per pupil for all 50 states and compared it against average standardized test scores for those states. Interestingly the more spent per pupil the lower the standardized tests scores were for the COLLEGE BOUND, but the higher the standardized test scores were for all students, thus indicating more resources were spent on achieving mediocrity and not excellence.

However, I frankly don’t care too much about what New York spends on its students, for I am not paying the property taxes out there. It’s largely a local issue for me and thus I ran the same correlation for each school district in entire state of Minnesota and the findings were very interesting.

It seems it literally doesn’t matter how much money you spend on education FOR THERE IS NO RELATIONSHIP BETWEEN MONEY SPENT PER PUPIL AND STANDARDIZED TEST SCORES!!!! And if there is one, it’s SLIGHTLY NEGATIVE!

The correlation coefficient between money spent per pupil and the MCA tests (Minnesota’s standardized state tests) is -.08 and -.10 depending on which spending per pupil measure you want to use. And with a sample size of 323 there’s a pretty good statistical argument that this is significant.

In other words the system is bust. Throw all the money you want at the system and it isn’t going to do squat.

Of course, the question is whether you’re going to want to believe this (though since it's factual, I hardly see how one can). No doubt it’s much easier to just regurgitate what the teacher’s union told you to regurgitate. To sit and feel good about yourself when you advocate spending more money on the children. But I wonder, how many of you in Minnesota (right or left) ever bothered to take the time to research this and look it up before taking a position on it and then advocate forcing millions of people to spend billions of dollars on something you truly did not know whether it worked or not.

There are two things that you probably know about me in reading my little economic posts from time to time;

1. I live in Minneapolis

2. I do not like children.

Thus you can imagine my happiness when I conducted the research for the second portion of my foray into whether or not more money = better schools and found out that not only do Minneapolis property tax payers pay 44% more than the Minnesota average to educate our precious little children, but those children performed 15% below the state average in standardized tests.

Of course many people will claim those tests are biased, archaic and practically racist for they only test those abhorred evil Eurocentric subjects; reading and math (GASP!).

But test them on the merits of diversity and the drawbacks of Western Civilization, America and Capitalism and it will be on par with their indoctrinators’…er…I mean “teachers’” college dissertations.

As an economist I do not so much contest whether everybody should somehow pay to educate our children (I do agree with that), but can we at least get a bang for our buck???

Apparently economic efficiency is not on Education Minnesota’s (teacher’s union) agenda, and especially not so in Minneapolis, for while it takes only $8,739 a year to educate the average Minnesota student, it takes $12,537 to educate the average Minneapolis student (and $15,845 if you include loans and levies).

Alas, I made two calculations.

First, I’m all about the opportunity cost and so I calculated how much it costs to educate a child in the Minneapolis public schools for the 13 years they’re in there (even though some spend a couple more years than that). And this came out to be just shy of $163,000, $3,000 more than what I paid for my house some time ago. And granted property prices have risen, but ask yourself the question;

“Why bother educating some of these morons when they’re only going to go out and live off the system anyway. Hell, just buy them their own damn house and save us the bill on future public housing. Kid is born, and if it doesn’t get its act together by the 1st grade, BOOM, “here ya go kid, the American dream! Now leave us alone and never come back.”

Of course how can you ascertain whether the kid is going to be a good or bad student by the first grade? But you can get a pretty good idea by the 4th or 5th grade I’d imagine. And who says that $12,537 a year can’t be invested in a mutual fund or some other investment? Earning a reasonable 8% a year starting after the 5th grade, there would be over $120,000 in the kid’s housing account. Certainly enough to get them a condo, even in the hot property market of Minneapolis. And who is to say this would be “cruel” or “evil.” We’re buying these losers a free house, the American dream for doing nothing, yet at the same time getting them out of the classroom so the remaining 4 students in the Minneapolis public school system can get a real education uninterrupted.

Now, admitted, I am being a bit satirical, but sadly the economics of it are just so compelling, one really has to wonder if society wouldn’t just be better off doing it this way.

The second calculation I made was to further advance our excursion into the question whether more money = better education. Previously, I looked at state spending per pupil for all 50 states and compared it against average standardized test scores for those states. Interestingly the more spent per pupil the lower the standardized tests scores were for the COLLEGE BOUND, but the higher the standardized test scores were for all students, thus indicating more resources were spent on achieving mediocrity and not excellence.

However, I frankly don’t care too much about what New York spends on its students, for I am not paying the property taxes out there. It’s largely a local issue for me and thus I ran the same correlation for each school district in entire state of Minnesota and the findings were very interesting.

It seems it literally doesn’t matter how much money you spend on education FOR THERE IS NO RELATIONSHIP BETWEEN MONEY SPENT PER PUPIL AND STANDARDIZED TEST SCORES!!!! And if there is one, it’s SLIGHTLY NEGATIVE!

The correlation coefficient between money spent per pupil and the MCA tests (Minnesota’s standardized state tests) is -.08 and -.10 depending on which spending per pupil measure you want to use. And with a sample size of 323 there’s a pretty good statistical argument that this is significant.

In other words the system is bust. Throw all the money you want at the system and it isn’t going to do squat.

Of course, the question is whether you’re going to want to believe this (though since it's factual, I hardly see how one can). No doubt it’s much easier to just regurgitate what the teacher’s union told you to regurgitate. To sit and feel good about yourself when you advocate spending more money on the children. But I wonder, how many of you in Minnesota (right or left) ever bothered to take the time to research this and look it up before taking a position on it and then advocate forcing millions of people to spend billions of dollars on something you truly did not know whether it worked or not.

Friday, October 27, 2006

I'm Sorry, WHO Should Be Embarrassed?

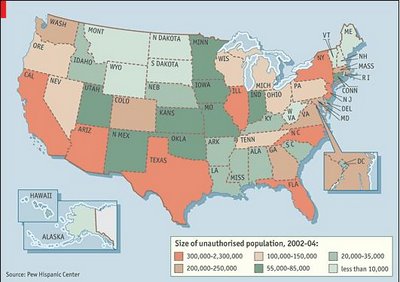

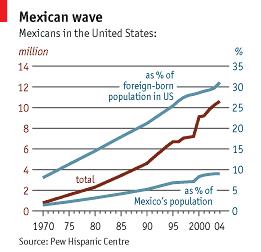

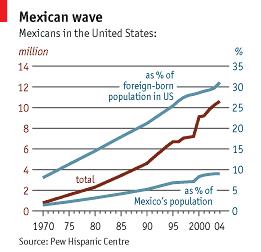

So I hit Drudge and see that Calderon, who I’m happy won Mexico’s presidential election, seems to be suffering from the same dementia that Vicente Fox was suffering from. This illusion that somehow Mexicans run the US or have authority to tell us what to do despite the minor ass kicking we delivered to them back in 1846-1848.

But it seems to me what would be truly embarrassing is if your country was so poorly managed and inept that 10% of its population would leave. I mean, that would really be a blow to your pride wouldn’t it? That 1 in 10 people, 1 in 5 of your workers, are so fed up with the ineptitude of the place, that they leave their HOME, you know, turn their backs on their homeland and culture and go elsewhere because it’s so hopeless. I mean that would REALLY be embarrassing. It would be like your wife leaving you for another man. Or your children disowning you. Or U of Minnesota students cheering for the Wisconsin Badgers when they play against the Gophers. That, to me anyway, would be WAAAAAY more embarrassing that a country putting up a fence.

But it seems to me what would be truly embarrassing is if your country was so poorly managed and inept that 10% of its population would leave. I mean, that would really be a blow to your pride wouldn’t it? That 1 in 10 people, 1 in 5 of your workers, are so fed up with the ineptitude of the place, that they leave their HOME, you know, turn their backs on their homeland and culture and go elsewhere because it’s so hopeless. I mean that would REALLY be embarrassing. It would be like your wife leaving you for another man. Or your children disowning you. Or U of Minnesota students cheering for the Wisconsin Badgers when they play against the Gophers. That, to me anyway, would be WAAAAAY more embarrassing that a country putting up a fence.

Thursday, October 26, 2006

Chicks Dig Charts!

I mean, when doesn't it happen that you're just sitting there at a quiet jazz joint working on your Excel spreadsheets and then some babe comes up and says, "Oh my! Is that a chart you're working on? Wow, I've never seen one like that before! I can't explain it, but I suddenly find you irresistably sexy. I know this may be forward, but are you looking for some company tonight?"

Seriously, every day it's like that.

So be careful and aware of your surroundings all aspiring male economists when you look at the chart below. It's the Housing Market Index. In short it measures the health of the housing market and with all this talk from Greenspan and so forth about the worst being over, I thought it appropriate to compile this chart. But be warned of its effect on women!!!

Seriously, every day it's like that.

So be careful and aware of your surroundings all aspiring male economists when you look at the chart below. It's the Housing Market Index. In short it measures the health of the housing market and with all this talk from Greenspan and so forth about the worst being over, I thought it appropriate to compile this chart. But be warned of its effect on women!!!

The Best of Captain CapitalismFrom My Beloved Sister

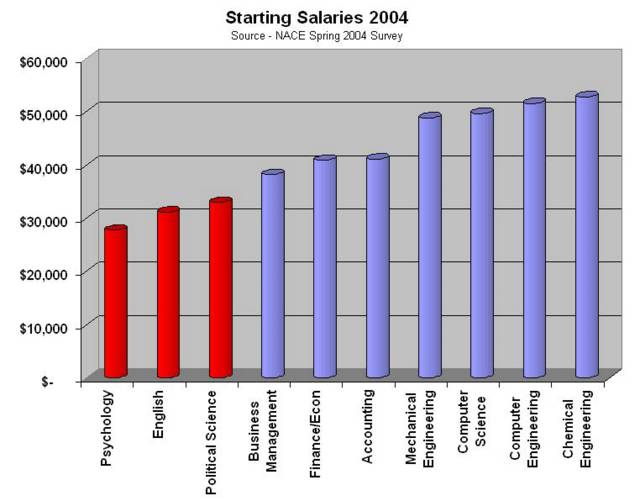

This is one of my favorites, thanks to my sister. The chart should be up in ever classroom in the world.

As some of you know, my sister is a communist. Of course, this isn't her fault as she is currently pursuing her doctorate at UC Berkeley and if she were not an avowed communist, they'd shoot her.

That being said, it brings a tear of pride to my eye when I see the little aspiring economist in her send me a chart like this;

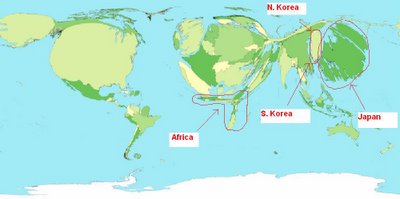

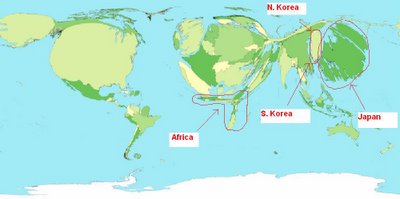

This is a "cartogram."

Sure, whatever.

But what is neat about it is that it magnifies each country by the size of its GDP.

Couple interesting observations;

1. Africa. Good lord, it's as skinny as the people, large amount of land, very little GDP.

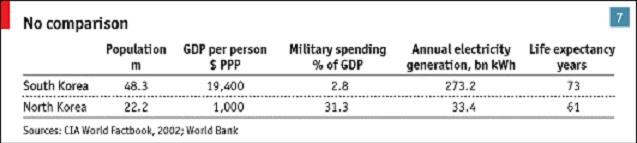

2. North versus South Korea. Can you see that sliver on top of South Korea? Yeah, that's North Korea. If there's a visually stunning argument against communism, there it is folks.

3. Japan. You might at first mistake it for China, but if you look closely, it is an island. It's just that Japan's economy is so big that it once again distorts its geography.

4. When comparing Japan against China, it shows Japan bigger than China. This leads me to believe that they are NOT using PPP adjusting GDP figures. Sloppy sloppy sloppy.

As some of you know, my sister is a communist. Of course, this isn't her fault as she is currently pursuing her doctorate at UC Berkeley and if she were not an avowed communist, they'd shoot her.

That being said, it brings a tear of pride to my eye when I see the little aspiring economist in her send me a chart like this;

This is a "cartogram."

Sure, whatever.

But what is neat about it is that it magnifies each country by the size of its GDP.

Couple interesting observations;

1. Africa. Good lord, it's as skinny as the people, large amount of land, very little GDP.

2. North versus South Korea. Can you see that sliver on top of South Korea? Yeah, that's North Korea. If there's a visually stunning argument against communism, there it is folks.

3. Japan. You might at first mistake it for China, but if you look closely, it is an island. It's just that Japan's economy is so big that it once again distorts its geography.

4. When comparing Japan against China, it shows Japan bigger than China. This leads me to believe that they are NOT using PPP adjusting GDP figures. Sloppy sloppy sloppy.

Wednesday, October 25, 2006

Bribery

Monday, October 23, 2006

There's Hope for Us All Yet!

Best of Captain Capitalism - Investing Against Conventional Wisdom

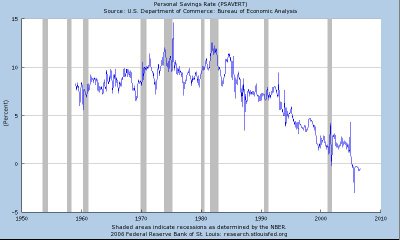

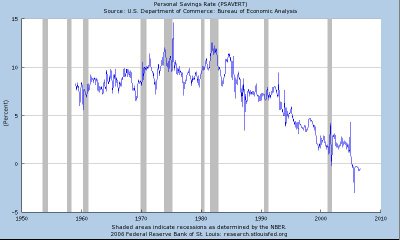

This is an older one, harkening back to 2004. Still think it's one of your best moves to pay down debt...which of course makes me more hated than a pedophile in this land of home-equity-loan junkies.

DISCLAIMER-BY READING THIS YOU WAIVE THE RIGHT TO SUE ME! IF YOU FOLLOW ANY OF THIS ADVICE AND YOU LOSE MONEY OR DON'T MAKE AS MUCH AS YOU WOULD HAVE OTHERWISE, TOUGH! AND EVEN IF YOU WERE TO SUE AND WIN, I'D GUARANTEE YOU'D HAVE MORE PRESSING MATTERS TO WORRY ABOUT!

Everything clear? OK, good, let's move on.

Several times now that I have run into the classical "starving student" while teaching economics at the local community college, where of course, we accept only the finest the public schools have to offer. And it is obvious these starving students received their education at the public schools, because their logic is so solid.

For example, one particularly starving student was so desperate for money, he had to sign up for MinnCare (Minnesota's state sponsored health care system). This means myself and other lucky fellow (and self-supporting) Minnesota taxpayers now provide this student in need with health care if he can manage to pay the $20 a month required of MinnCare. Unfortunately, I don't think he can even afford that because he bought himself a portable DVD player and the entire "Family Guy" series on DVD.

Another classic example would be the poor, tortured soul who stormed into my classroom tirading about the financial aid department's refusal to disperse any further financial aid to her. Don't these people realize that this is the same girl that needs to get hammered every weekend at the bars? And don't they realize that drinks nowadays cost about $5 a pop? I'm scared to speculate if she has a child.

Regardless, I could go on with endless examples of how students' choices to spend their money serves only to utterly destroy the broken record track of the left that 80 gazillion people are without health insurance, but that is not what this article is about. For while I certainly can critique the parasites of society for insisting the taxpayer subsidize their lives whilst they go and booze it up and buy the latest electronic gadgetry, the public school-educated youth are not the only ones guilty of making poor investment decisions.

For example, take the good little Jessica-Simpson-Americans. They work hard. They maximize their contributions to their 401k's. They get a house in the suburbs. Set aside some money in a 529 plan for little Jr. And if they have some extra money they perhaps contribute that to a Roth IRA.

What could possibly be wrong with that?

Nothing from moral standpoint. You certainly aren't having me pay for your health care (much appreciated). You certainly are contributing to GDP and thus society. You're probably doing more for your children than most by setting up a 529 plan. And despite Jessica Simpson making me want to gag, as an advocate of self-reliance I couldn't critique anything about it.

However, from a financial or economic standpoint rarely do I see anybody putting forth the effort to thoroughly and fully analyze what they're throwing their money into. And while it isn't an obvious waste like choosing Jack Daniels over college books, there are some things you should consider before you just blindly invest with the masses into your 401k.

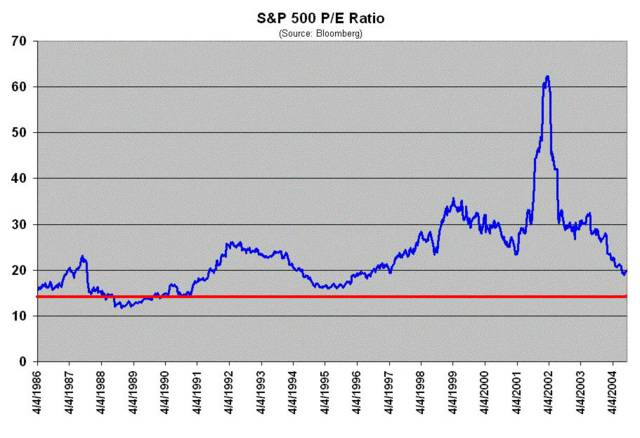

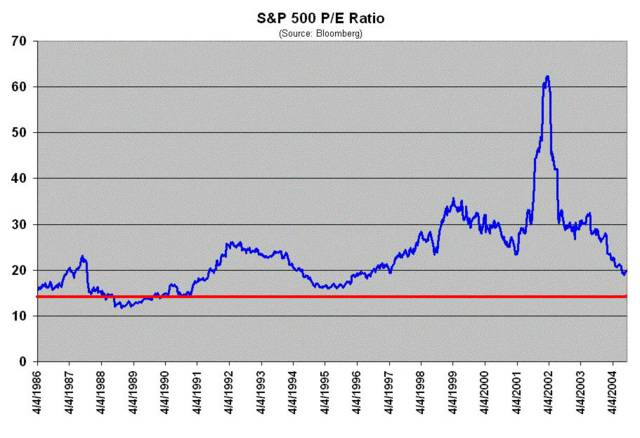

First off is the crazy, outside chance that maybe, just maybe, with the entire Baby Boomer generation throwing all their money into their 401k's that this may have overvalued the stock markets. Beforehand people would just retire off the farm, sell the business, or (here's a foreign concept to the Baby Boomers) work until they died. But it is only recently that we've opted to use the stock market as our main investment for retirement. Using the S&P 500's P/E ratio (for those without a degree in finance, this a measure used to gauge how over/undervalued a stock is), you'll note that US stocks, despite the crash are still overvalued by about 25% from their historical average of 15 as notated by the red line. Furthermore, ever since the Baby Boomers have entered their "prime earning years" say in the late 80's the stock market has always traded above this average, suggesting this overvaluation is persistent and fundamental.

Worst still is what will happen when the Baby Boomers start to retire and withdraw their money from the stock market? Well, you just keep on contributing to that US equity fund of yours and see what happens 2009-ish.

Another item you might want to consider is that precious house of yours. Why, at all the cocktail parties who doesn't brag about how much the value of their house has increased? Certainly a considerably loose monetary policy and abnormally low interest rates hasn't artificially boosted housing prices. Well, very similar to the S&P 500's P/E ratio is the price to rents ratio for housing in the US. Put out by HSBC, this measures the average price of a US house to its plausible rents.

Alas, it seems the housing market is not only too pricey, but bound to correct a little.

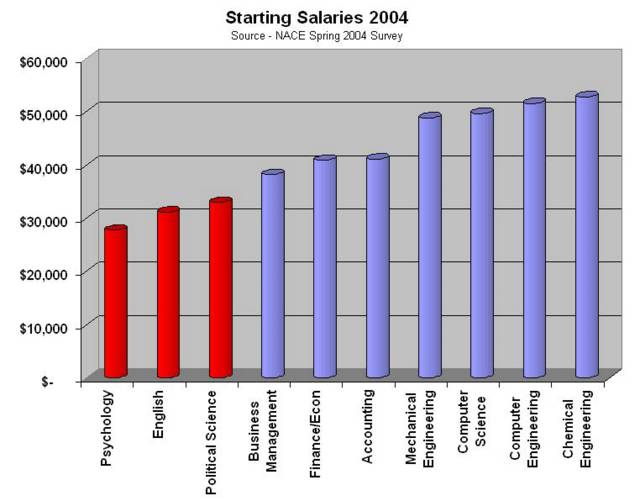

But how about education? Specifically, your child's education. How can a 529 plan possibly go wrong? Well it can go wrong since you have to invest the money just like you would a 401k plan and thus face the same overvaluation risks. Best bet is to go with the prepaid tuition option for the 529's. But then again, and me being forever the cynic, your child will no doubt major in some crap study like "sociology," or "peace studies" or "feelings," effectively wasting all your money anyway.

Perhaps you should just buy yourself a boat.

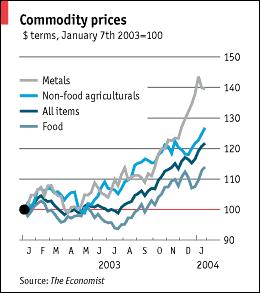

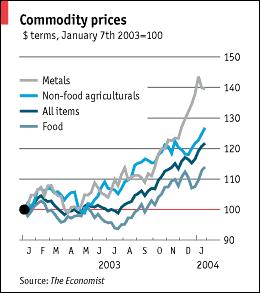

So what's left to invest in if the stock and property markets are overvalued? Sure you could go overseas and invest there, but you'd be facing various exchange rate and political risks. You can invest in bonds...and earn a whopping 5.5%. What about commodities? They've had a bold performance.

Of course, that bold performance is solely due to China's blistering economic growth and voracious demand for raw materials, sure to reverse itself once China's economy slows down to a more rational 8% GDP growth.

But there is another option...an option that nobody considers. Well, perhaps somebody has considered it, but financial advisors aren't too keen to tell you about it, because they won't make money. Matter of fact, neither will you, but it certainly has more benefits than any other investment I've seen in a long time.

Pay off your debts.

Car loans, student loans, credit cards and even your mortgage; pay off your debts.

Now conventional wisdom had it that you should consolidate your debts under a home equity loan. This in turn would allow you to write off all that nasty interest from your taxes. But I am not conventional. And while I do subscribe to consolidating your debts so that its interest is tax deductible, I much prefer to pay off all that debt prematurely and forego the interest deduction.

Now MBA's from Ivy League schools are probably scratching their heads just as they were when Dotcom Mania came crashing down because it says in the Official Ivy League Textbook of Finance that you should always hold that interest deduction in high and holy regards. No matter what you do, you need that interest deduction. Shoot the children, sell the dog, but whatever you do, do not give up that interest deduction.

Here's the problem. Do you want to hold on to that holy and sacred interest deduction, or would you rather just not pay the $300,000 in interest expense over the course of the mortgage in the first place?

Yeah, I thought so.

But there are more benefits to paying off your mortgage and debts early than the cash flow you'd save. Converted into a rate of return, you'd actually be earning a better rate than you would most bonds. Below are the returns you'd realize on a standard 30 mortgage rate at 8%.

(Note - this "rate of return" is somewhat misleading. Sure if you pay off additional principal you save future interest payments, however you won't see an "annualized rate of return" out to 30 years simply because in paying off additional principal, you bring your mortgage to a pre-mature end. If this doesn't make sense, don't worry, I just put this in here as a technicality incase some math/econ/finance geeks were interested).

However, this "rate of return" is actually a misnomer since you aren't really investing in anything as much as you are paying off your debts to save future cash flow. This brings up another benefit to paying off your debt; it's risk free. You are not the one taking a risk, it is the mortgage company that loaned you the money that is taking the risk on you. Thus it is a completely risk free investment to pay off your debts early, even less risky than investing in US Treasuries.

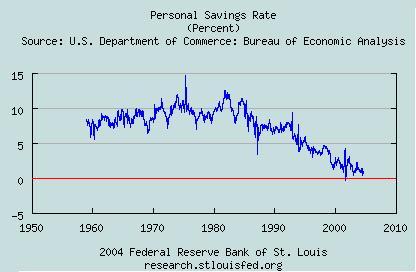

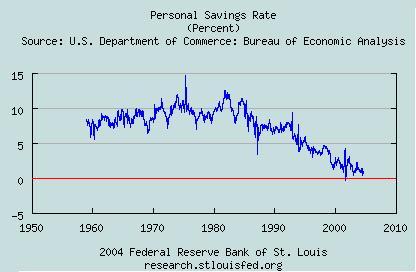

While this is all well and good for you, there are also benefits to society and the economy as well. Realize Americans have saved themselves and the world from arguably two recessions with one thing;

Insatiable spending.

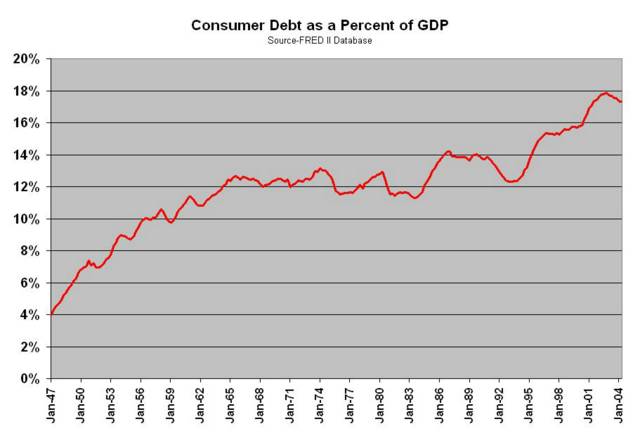

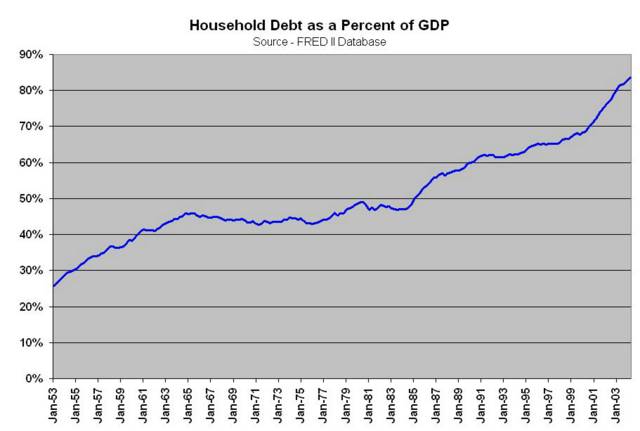

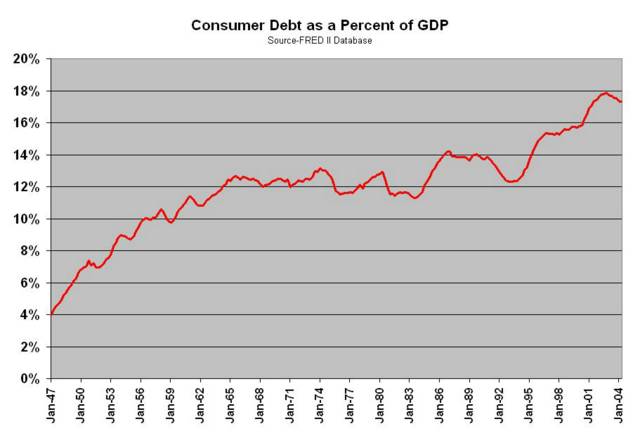

By spending like we're married to a ketchup heiress, and borrowing the money to do so, we not only merely post-pone an inevitable decrease in consumer spending into the future, but we rack up massive amounts of debt in the process. This has resulted in an amassing of $2 trillion in consumer debt, putting it at a historical high of over 17% of the economy's GDP.

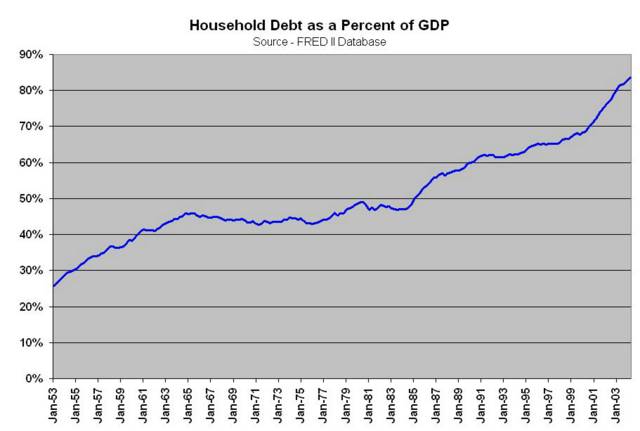

But that is nothing compared with the level of household debt (consumer debt + mortgages and some other liabilities) currently standing at $9+ trillion, roughly 85% of our GDP. Thus, the coincidence of the rise in household debt and the rise in property prices suggests the property "bubble" is driven by debt-always a good thing (for those of you with real lives and the ability to attract members of the opposite sex, this was a joke that only economists would get and find funny. A debt-driven stock or property bubble is a VERY BAD thing, so this was meant as sarcasm).

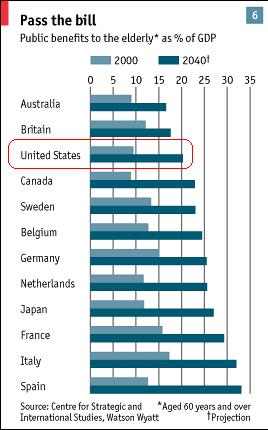

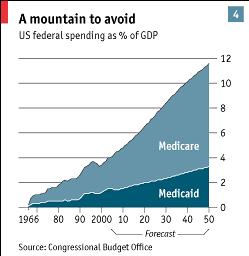

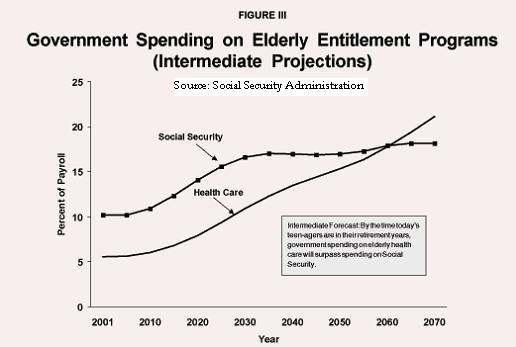

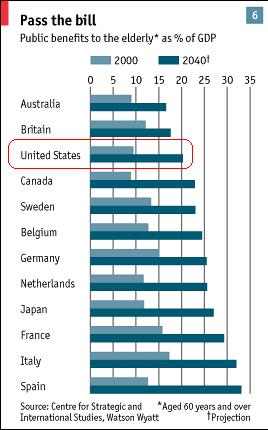

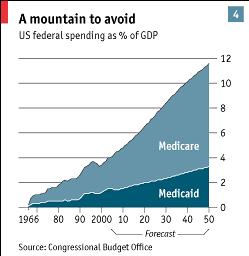

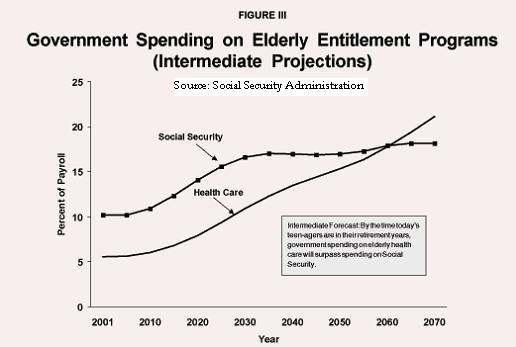

Worse still is it's incredibly poor timing to be racking up these massive debts on the precipice of the impending Baby Boomer generation retiring which demands MUCH MORE saving. While Social Security and Medicare currently consume 10% of our nation's GDP, that number is expected to double by 2040 taking a full fifth of our economy, Medicare inevitably about to eclipse its senior sibling, Social Security.

If these massive entitlements the Baby Boomers have promised themselves are to be funded, it will require additional "forced" savings in the form of increased payroll taxes. These taxes are expected to be doubled by 2040, taking a full 30% of your salary in order to pay for these things.

The whole point is that you can't afford to be blowing your money on BMW Z3's and pocket bikes for junior simply because in the future, your disposable income will be pinched, perhaps to the point that you may not be able to pay off your debts if you still have those debts. Thus it is important that you pay off your debts NOW while you still have the ability to do so and before the government takes a larger and larger share of your salary.

But spending less, saving more and paying down your debts should not be as painful as all that. As you've seen significant asset categories like stocks, property and commodities seem to be currently overvalued. Bonds are also not terribly attractive with their mere pittance of an interest rate they pay. But with a risk-free guaranteed rate of "return" by paying off your debts early, you take advantage of what could arguably be today's best and safest investment option. Furthermore, there are macro-economic benefits by Americans paying down their debts en masse. Interest rates would remain low, allowing for businesses and people to borrow cheap money to pursue ventures and grow the economy. The dollar would strengthen, increasing purchasing power and making imported goods cheaper. But most importantly, it will soften the blow and fortify the economy for the inevitable retirement of 70 million Baby Boomers. It is literally an economic, once in a lifetime "win-win situation."

Alas this last reason may not convince you to take the money you had earmarked for a European trip and instead pay down your mortgage. So perhaps I should be a bit more blunt. How about the threat of a massive recession that would put the Volcker Recession to shame and throw you into poverty and bankruptcy and make the likes of "pocket bikes" the things dreams are made of? For such a scenario is not likely, but guaranteed if Americans do not change their course. Of course that is my opinion, it's just up to you to convince yourself otherwise so you can sleep well at night.

Pleasant dreams.

DISCLAIMER-BY READING THIS YOU WAIVE THE RIGHT TO SUE ME! IF YOU FOLLOW ANY OF THIS ADVICE AND YOU LOSE MONEY OR DON'T MAKE AS MUCH AS YOU WOULD HAVE OTHERWISE, TOUGH! AND EVEN IF YOU WERE TO SUE AND WIN, I'D GUARANTEE YOU'D HAVE MORE PRESSING MATTERS TO WORRY ABOUT!

Everything clear? OK, good, let's move on.

Several times now that I have run into the classical "starving student" while teaching economics at the local community college, where of course, we accept only the finest the public schools have to offer. And it is obvious these starving students received their education at the public schools, because their logic is so solid.

For example, one particularly starving student was so desperate for money, he had to sign up for MinnCare (Minnesota's state sponsored health care system). This means myself and other lucky fellow (and self-supporting) Minnesota taxpayers now provide this student in need with health care if he can manage to pay the $20 a month required of MinnCare. Unfortunately, I don't think he can even afford that because he bought himself a portable DVD player and the entire "Family Guy" series on DVD.

Another classic example would be the poor, tortured soul who stormed into my classroom tirading about the financial aid department's refusal to disperse any further financial aid to her. Don't these people realize that this is the same girl that needs to get hammered every weekend at the bars? And don't they realize that drinks nowadays cost about $5 a pop? I'm scared to speculate if she has a child.

Regardless, I could go on with endless examples of how students' choices to spend their money serves only to utterly destroy the broken record track of the left that 80 gazillion people are without health insurance, but that is not what this article is about. For while I certainly can critique the parasites of society for insisting the taxpayer subsidize their lives whilst they go and booze it up and buy the latest electronic gadgetry, the public school-educated youth are not the only ones guilty of making poor investment decisions.

For example, take the good little Jessica-Simpson-Americans. They work hard. They maximize their contributions to their 401k's. They get a house in the suburbs. Set aside some money in a 529 plan for little Jr. And if they have some extra money they perhaps contribute that to a Roth IRA.

What could possibly be wrong with that?

Nothing from moral standpoint. You certainly aren't having me pay for your health care (much appreciated). You certainly are contributing to GDP and thus society. You're probably doing more for your children than most by setting up a 529 plan. And despite Jessica Simpson making me want to gag, as an advocate of self-reliance I couldn't critique anything about it.

However, from a financial or economic standpoint rarely do I see anybody putting forth the effort to thoroughly and fully analyze what they're throwing their money into. And while it isn't an obvious waste like choosing Jack Daniels over college books, there are some things you should consider before you just blindly invest with the masses into your 401k.

First off is the crazy, outside chance that maybe, just maybe, with the entire Baby Boomer generation throwing all their money into their 401k's that this may have overvalued the stock markets. Beforehand people would just retire off the farm, sell the business, or (here's a foreign concept to the Baby Boomers) work until they died. But it is only recently that we've opted to use the stock market as our main investment for retirement. Using the S&P 500's P/E ratio (for those without a degree in finance, this a measure used to gauge how over/undervalued a stock is), you'll note that US stocks, despite the crash are still overvalued by about 25% from their historical average of 15 as notated by the red line. Furthermore, ever since the Baby Boomers have entered their "prime earning years" say in the late 80's the stock market has always traded above this average, suggesting this overvaluation is persistent and fundamental.

Worst still is what will happen when the Baby Boomers start to retire and withdraw their money from the stock market? Well, you just keep on contributing to that US equity fund of yours and see what happens 2009-ish.

Another item you might want to consider is that precious house of yours. Why, at all the cocktail parties who doesn't brag about how much the value of their house has increased? Certainly a considerably loose monetary policy and abnormally low interest rates hasn't artificially boosted housing prices. Well, very similar to the S&P 500's P/E ratio is the price to rents ratio for housing in the US. Put out by HSBC, this measures the average price of a US house to its plausible rents.

Alas, it seems the housing market is not only too pricey, but bound to correct a little.

But how about education? Specifically, your child's education. How can a 529 plan possibly go wrong? Well it can go wrong since you have to invest the money just like you would a 401k plan and thus face the same overvaluation risks. Best bet is to go with the prepaid tuition option for the 529's. But then again, and me being forever the cynic, your child will no doubt major in some crap study like "sociology," or "peace studies" or "feelings," effectively wasting all your money anyway.

Perhaps you should just buy yourself a boat.

So what's left to invest in if the stock and property markets are overvalued? Sure you could go overseas and invest there, but you'd be facing various exchange rate and political risks. You can invest in bonds...and earn a whopping 5.5%. What about commodities? They've had a bold performance.

Of course, that bold performance is solely due to China's blistering economic growth and voracious demand for raw materials, sure to reverse itself once China's economy slows down to a more rational 8% GDP growth.

But there is another option...an option that nobody considers. Well, perhaps somebody has considered it, but financial advisors aren't too keen to tell you about it, because they won't make money. Matter of fact, neither will you, but it certainly has more benefits than any other investment I've seen in a long time.

Pay off your debts.

Car loans, student loans, credit cards and even your mortgage; pay off your debts.

Now conventional wisdom had it that you should consolidate your debts under a home equity loan. This in turn would allow you to write off all that nasty interest from your taxes. But I am not conventional. And while I do subscribe to consolidating your debts so that its interest is tax deductible, I much prefer to pay off all that debt prematurely and forego the interest deduction.

Now MBA's from Ivy League schools are probably scratching their heads just as they were when Dotcom Mania came crashing down because it says in the Official Ivy League Textbook of Finance that you should always hold that interest deduction in high and holy regards. No matter what you do, you need that interest deduction. Shoot the children, sell the dog, but whatever you do, do not give up that interest deduction.

Here's the problem. Do you want to hold on to that holy and sacred interest deduction, or would you rather just not pay the $300,000 in interest expense over the course of the mortgage in the first place?

Yeah, I thought so.

But there are more benefits to paying off your mortgage and debts early than the cash flow you'd save. Converted into a rate of return, you'd actually be earning a better rate than you would most bonds. Below are the returns you'd realize on a standard 30 mortgage rate at 8%.

(Note - this "rate of return" is somewhat misleading. Sure if you pay off additional principal you save future interest payments, however you won't see an "annualized rate of return" out to 30 years simply because in paying off additional principal, you bring your mortgage to a pre-mature end. If this doesn't make sense, don't worry, I just put this in here as a technicality incase some math/econ/finance geeks were interested).

However, this "rate of return" is actually a misnomer since you aren't really investing in anything as much as you are paying off your debts to save future cash flow. This brings up another benefit to paying off your debt; it's risk free. You are not the one taking a risk, it is the mortgage company that loaned you the money that is taking the risk on you. Thus it is a completely risk free investment to pay off your debts early, even less risky than investing in US Treasuries.

While this is all well and good for you, there are also benefits to society and the economy as well. Realize Americans have saved themselves and the world from arguably two recessions with one thing;

Insatiable spending.

By spending like we're married to a ketchup heiress, and borrowing the money to do so, we not only merely post-pone an inevitable decrease in consumer spending into the future, but we rack up massive amounts of debt in the process. This has resulted in an amassing of $2 trillion in consumer debt, putting it at a historical high of over 17% of the economy's GDP.

But that is nothing compared with the level of household debt (consumer debt + mortgages and some other liabilities) currently standing at $9+ trillion, roughly 85% of our GDP. Thus, the coincidence of the rise in household debt and the rise in property prices suggests the property "bubble" is driven by debt-always a good thing (for those of you with real lives and the ability to attract members of the opposite sex, this was a joke that only economists would get and find funny. A debt-driven stock or property bubble is a VERY BAD thing, so this was meant as sarcasm).

Worse still is it's incredibly poor timing to be racking up these massive debts on the precipice of the impending Baby Boomer generation retiring which demands MUCH MORE saving. While Social Security and Medicare currently consume 10% of our nation's GDP, that number is expected to double by 2040 taking a full fifth of our economy, Medicare inevitably about to eclipse its senior sibling, Social Security.

If these massive entitlements the Baby Boomers have promised themselves are to be funded, it will require additional "forced" savings in the form of increased payroll taxes. These taxes are expected to be doubled by 2040, taking a full 30% of your salary in order to pay for these things.

The whole point is that you can't afford to be blowing your money on BMW Z3's and pocket bikes for junior simply because in the future, your disposable income will be pinched, perhaps to the point that you may not be able to pay off your debts if you still have those debts. Thus it is important that you pay off your debts NOW while you still have the ability to do so and before the government takes a larger and larger share of your salary.

But spending less, saving more and paying down your debts should not be as painful as all that. As you've seen significant asset categories like stocks, property and commodities seem to be currently overvalued. Bonds are also not terribly attractive with their mere pittance of an interest rate they pay. But with a risk-free guaranteed rate of "return" by paying off your debts early, you take advantage of what could arguably be today's best and safest investment option. Furthermore, there are macro-economic benefits by Americans paying down their debts en masse. Interest rates would remain low, allowing for businesses and people to borrow cheap money to pursue ventures and grow the economy. The dollar would strengthen, increasing purchasing power and making imported goods cheaper. But most importantly, it will soften the blow and fortify the economy for the inevitable retirement of 70 million Baby Boomers. It is literally an economic, once in a lifetime "win-win situation."

Alas this last reason may not convince you to take the money you had earmarked for a European trip and instead pay down your mortgage. So perhaps I should be a bit more blunt. How about the threat of a massive recession that would put the Volcker Recession to shame and throw you into poverty and bankruptcy and make the likes of "pocket bikes" the things dreams are made of? For such a scenario is not likely, but guaranteed if Americans do not change their course. Of course that is my opinion, it's just up to you to convince yourself otherwise so you can sleep well at night.

Pleasant dreams.

Sunday, October 22, 2006

Where are They?

Saturday, October 21, 2006

Got a Question? E-mail the Captain!

Hi All,

Got a post recently that I had to think about whether I would post it or not. The reason why is that it wasn't pertinent to the original post I made and would actually lessen a future article I plan on writing not to mention it's in regards to a lawsuit so I'm erring on the side of caution and not posting anything (my apologies to the person who sent in the question). regardless, I do want to answer all relevant and pertinent questions the readers may have. All of you can certainly e-mail me (person who sent me the question included) any questions you have that may not be related to a particular post. Besides which, I like getting e-mail.

captcapitalism@yahoo.com

Make sure you copy and paste it, people have been mispelling it.

And tune in TODAY to The Economics Supper Club! To quote Bill Cosby, "It'll make ya smart!"

Got a post recently that I had to think about whether I would post it or not. The reason why is that it wasn't pertinent to the original post I made and would actually lessen a future article I plan on writing not to mention it's in regards to a lawsuit so I'm erring on the side of caution and not posting anything (my apologies to the person who sent in the question). regardless, I do want to answer all relevant and pertinent questions the readers may have. All of you can certainly e-mail me (person who sent me the question included) any questions you have that may not be related to a particular post. Besides which, I like getting e-mail.

captcapitalism@yahoo.com

Make sure you copy and paste it, people have been mispelling it.

And tune in TODAY to The Economics Supper Club! To quote Bill Cosby, "It'll make ya smart!"

Friday, October 20, 2006

Edumacation

Remember to tune in this weekend to The Economics Supper Club!

You can listen online at www.am1500.com

This Saturday, 1-3PM Central Standard Time!

Thursday, October 19, 2006

The Great Latin Let Down

I remember, very early, just when I was getting interested in economics a couple articles or teachers mentioning how Argentina and Latin America would be the new America. All we had to do was export capitalism and some capital and boom! It should flourish.

If it's all the same with you, I'll be investing in the Baltics or Ireland.

If it's all the same with you, I'll be investing in the Baltics or Ireland.

Wednesday, October 18, 2006

Mind the Lag

Something I noticed which I have not the time to explore, but perhaps one of you aspiring junior deputy economists can figure this one out.

But previous to the past two recessions we’ve had, unemployment peaked at the end of recessions. This only makes sense as so long as the economy is retracting, then unemployment would go down until growth took over again.

But now it seems unemployment lags behind the economy. Eyeballing it, it looks like about a year to a year and a half lag before unemployment peaks and then starts to recover;

But previous to the past two recessions we’ve had, unemployment peaked at the end of recessions. This only makes sense as so long as the economy is retracting, then unemployment would go down until growth took over again.

But now it seems unemployment lags behind the economy. Eyeballing it, it looks like about a year to a year and a half lag before unemployment peaks and then starts to recover;

Tuesday, October 17, 2006

The Best of Captain Capitalism - Dear Penthouse Forum

This was arguably the most popular post and taught me a great lesson in the economics of blogs;

Smut and sex sells and ain't none of you honyakers interest in economics as much as you are dirt on people's dating lives.

Alas, what am I to do, a true capitalism responds to the market.

It was several weeks ago I was sitting at one of my favorite jazz clubs. And as always I was reading the most recent issue of The Economist. I had set it down on the table and turned my attention to do some tax work when an rather attractive Asian woman walked by. But while I was looking at her, I noticed that she was looking at the cover of The Economist.

At first I was hopefully impressed, thinking that somehow this may be the legendary "video-game-playing, Economist-reading, sexy-lingerie-wearing, totally hot babe capitalist economist that likes to serve Irish economist men martinis while they listen to Frank Sinatra." The one that the Holy and Sacred Elder Economists of Yore spoke so much of. But when I saw what was on the cover of The Economist, "China and the Key to Asian Peace" I realized she must be Chinese and was naturally just looking at the cover.

She proceeded to sit down at a table about 10 yards from me and ordered a glass of wine. She was dressed provocatively enough that I figured she had a date or was meeting some friends, so I just left it at that and returned to doing some tax work. However, 20 minutes had passed and I noticed that she was still sitting by herself.

Did her date fail to show up?

Were her friends the tardy types?

Or...could she be like me! A Napoleon Solo type character who is actually secure and cool enough with themselves to go to clubs and read The Economist?!?!

Realizing that my finite resource of time was being used up, I decided to gather up the courage and ask her if she was alone. Upon asking her, she said she was waiting for friends, but they were very late. And in my politest, least forward and non-threatening way, I asked her if she would like to join me so that I may keep her company until her friends arrived.

She agreed.

Happily we sat down at the couch I had previously ornamented with my papers and files and started talking. A very nice and attractive woman, but what impressed me the most was that she was not bashful about asking me about myself, alleviating me of the typical male duty of keeping the conversation going. And within one minute of asking me questions, it seemed the prophecy of the Holy and Sacred Elder Economists of Yore were to come true. For in that brief minute of conversation it was established that;

1. She reads The Economist

2. She was a financial manager at a money management firm

3. She had her undergraduate in finance

4. She was getting her masters in economics

The next hour of conversation was tantilizing and insanely intelligent. We talked about econometric modeling. We talked about efficient frontier theory. We talked about Miller-Modigliani. And then she talked about her specialty, behavioral economics.

I love it when chicks talk dirty to me.

And thinking that the night could not get better, it did. Her friends showed up. All of them finance majors and all of them just as capable of holding intelligent conversation which lasted the next hour.

But I knew inevitably I would have to make my play. And at a table full of economists and finance majors you're not really going to impress anybody by quoting correlation coefficients between GDP growth rates and unemployment figures because that’s just par for the course for them. So I decided to play my trump card. My master stroke of genius. My coup d'etat.

I can dance.

Fortunately for me there was a jazz band. And fortunately there was a dance floor. So sitting there patiently, engaging in conversation, I waited for the perfectly timed song to play and then asked, "do you know how to dance?"

The expression on her face could not be repeated.

"No, but I would love to learn how!"

So I said, "I can teach you."

"Well, not now, but I'd certainly love to go dancing sometime later."

And boom! There was my in.

The scenario could not have been more perfect;

* I established we had insane amounts in common.

* We established we could have that insanely rare thing called "intelligent conversation"

* I mingled well with her friends

* I established that I was unique and could offer her something fun that would make for one hell of a date.

* She wanted me to take her out dancing.

And like George Castanza, knowing that he should exit at the top of his game, I proceeded to give the woman my card, said I would love to take her out dancing, and bid her and her friends farewell.

Leaving the jazz club I had a smile on my face. I was supremely confident she would call.

Which reminded me of a theory I had developed back in my college days;

“If you are supremely confident a girl will call, she won’t.”

Sure enough, time had passed, and no call.

Alas, I concluded she must not have been too smart, for how stupid do you have to be not to call a dancing, video-game-playing economist? Especially one with his very own subscription to The Economist! I mean come on, ladies, how can you resist?

But don’t cry for me Argentina, for there is good news to this story. For immediately after I had left the jazz club, and while I was still riding high on the prospects of meeting a potential intellectual equal, I felt it necessary to share my experiences with those who I thought at the time were at least in part responsible for making this meeting happen; the kind ladies and gentlemen at The Economist. In a drunken stupor, I had sent off a letter to London detailing my exploits that night, not expecting what would happen two weeks later.

For two weeks later, at the insanely early hour of 10AM, I was awoken by a call from none other than the chief editor of The Economist asking if I had taken her out yet! It seems the good blokes and dames at The Economist had a running wager on me and whether I’d be successful in getting her out on a date. The chief editor, recognizing the obvious fact that anybody who subscribes to The Economist and who is in fact an economist himself, is so studly that they would practically be guaranteed of getting a date, wisely bet on me. Sadly, perhaps he is too wise, for he is 72 years of age and perhaps still subscribes to the romantic notions of the 1940’s; chivalry, tradition, romance, and other such BS. Whereas his younger, less senior counterparts are fully aware of the insanity of modern day women and their incapability to appreciate the concept of carpe diem, and thus bet against me.

But regardless of the outcome, as an economist, one must think. For while girls that shoot me down are a dime a dozen, how often is it that you get a call from the chief editor of The Economist?

As far as my econometric models tell me, that’s worth getting shot down at least 348 times with a 2.5% margin of error.

Smut and sex sells and ain't none of you honyakers interest in economics as much as you are dirt on people's dating lives.

Alas, what am I to do, a true capitalism responds to the market.

It was several weeks ago I was sitting at one of my favorite jazz clubs. And as always I was reading the most recent issue of The Economist. I had set it down on the table and turned my attention to do some tax work when an rather attractive Asian woman walked by. But while I was looking at her, I noticed that she was looking at the cover of The Economist.

At first I was hopefully impressed, thinking that somehow this may be the legendary "video-game-playing, Economist-reading, sexy-lingerie-wearing, totally hot babe capitalist economist that likes to serve Irish economist men martinis while they listen to Frank Sinatra." The one that the Holy and Sacred Elder Economists of Yore spoke so much of. But when I saw what was on the cover of The Economist, "China and the Key to Asian Peace" I realized she must be Chinese and was naturally just looking at the cover.

She proceeded to sit down at a table about 10 yards from me and ordered a glass of wine. She was dressed provocatively enough that I figured she had a date or was meeting some friends, so I just left it at that and returned to doing some tax work. However, 20 minutes had passed and I noticed that she was still sitting by herself.

Did her date fail to show up?

Were her friends the tardy types?

Or...could she be like me! A Napoleon Solo type character who is actually secure and cool enough with themselves to go to clubs and read The Economist?!?!

Realizing that my finite resource of time was being used up, I decided to gather up the courage and ask her if she was alone. Upon asking her, she said she was waiting for friends, but they were very late. And in my politest, least forward and non-threatening way, I asked her if she would like to join me so that I may keep her company until her friends arrived.

She agreed.

Happily we sat down at the couch I had previously ornamented with my papers and files and started talking. A very nice and attractive woman, but what impressed me the most was that she was not bashful about asking me about myself, alleviating me of the typical male duty of keeping the conversation going. And within one minute of asking me questions, it seemed the prophecy of the Holy and Sacred Elder Economists of Yore were to come true. For in that brief minute of conversation it was established that;

1. She reads The Economist

2. She was a financial manager at a money management firm

3. She had her undergraduate in finance

4. She was getting her masters in economics

The next hour of conversation was tantilizing and insanely intelligent. We talked about econometric modeling. We talked about efficient frontier theory. We talked about Miller-Modigliani. And then she talked about her specialty, behavioral economics.

I love it when chicks talk dirty to me.

And thinking that the night could not get better, it did. Her friends showed up. All of them finance majors and all of them just as capable of holding intelligent conversation which lasted the next hour.

But I knew inevitably I would have to make my play. And at a table full of economists and finance majors you're not really going to impress anybody by quoting correlation coefficients between GDP growth rates and unemployment figures because that’s just par for the course for them. So I decided to play my trump card. My master stroke of genius. My coup d'etat.

I can dance.

Fortunately for me there was a jazz band. And fortunately there was a dance floor. So sitting there patiently, engaging in conversation, I waited for the perfectly timed song to play and then asked, "do you know how to dance?"

The expression on her face could not be repeated.

"No, but I would love to learn how!"

So I said, "I can teach you."

"Well, not now, but I'd certainly love to go dancing sometime later."

And boom! There was my in.

The scenario could not have been more perfect;

* I established we had insane amounts in common.

* We established we could have that insanely rare thing called "intelligent conversation"

* I mingled well with her friends

* I established that I was unique and could offer her something fun that would make for one hell of a date.

* She wanted me to take her out dancing.

And like George Castanza, knowing that he should exit at the top of his game, I proceeded to give the woman my card, said I would love to take her out dancing, and bid her and her friends farewell.

Leaving the jazz club I had a smile on my face. I was supremely confident she would call.

Which reminded me of a theory I had developed back in my college days;

“If you are supremely confident a girl will call, she won’t.”

Sure enough, time had passed, and no call.

Alas, I concluded she must not have been too smart, for how stupid do you have to be not to call a dancing, video-game-playing economist? Especially one with his very own subscription to The Economist! I mean come on, ladies, how can you resist?

But don’t cry for me Argentina, for there is good news to this story. For immediately after I had left the jazz club, and while I was still riding high on the prospects of meeting a potential intellectual equal, I felt it necessary to share my experiences with those who I thought at the time were at least in part responsible for making this meeting happen; the kind ladies and gentlemen at The Economist. In a drunken stupor, I had sent off a letter to London detailing my exploits that night, not expecting what would happen two weeks later.

For two weeks later, at the insanely early hour of 10AM, I was awoken by a call from none other than the chief editor of The Economist asking if I had taken her out yet! It seems the good blokes and dames at The Economist had a running wager on me and whether I’d be successful in getting her out on a date. The chief editor, recognizing the obvious fact that anybody who subscribes to The Economist and who is in fact an economist himself, is so studly that they would practically be guaranteed of getting a date, wisely bet on me. Sadly, perhaps he is too wise, for he is 72 years of age and perhaps still subscribes to the romantic notions of the 1940’s; chivalry, tradition, romance, and other such BS. Whereas his younger, less senior counterparts are fully aware of the insanity of modern day women and their incapability to appreciate the concept of carpe diem, and thus bet against me.

But regardless of the outcome, as an economist, one must think. For while girls that shoot me down are a dime a dozen, how often is it that you get a call from the chief editor of The Economist?

As far as my econometric models tell me, that’s worth getting shot down at least 348 times with a 2.5% margin of error.

Friday, October 13, 2006

Yes, Communism STILL SUCKS...Again..Like it Always Has

No doubt you've seen this on drudge or perhaps before, but seriously, if you want ultimate proof as to just what a miserable failure socialism is as an economic system, you just have to look at this picture.

Think if you were aliens looking down on Earth. You lean over, "Hey Bob, look at this here peninsula!"

"What about it?"

"At it kind of odd right at the 38th parallel it all of the sudden goes black?"

"I thought it was a lake!"

"No, no, we're picking up signs of human life. Weak, but they're there."

"Well where the hell are all the lights???"

"Got me."

"Well hell, who the hell is running that joint anyway???"

It really makes you question whether leftists REALLY believe that the actually have the key to a better society or are just a bunch of lazy whinners that want other people's wealth transferred to them.

Think if you were aliens looking down on Earth. You lean over, "Hey Bob, look at this here peninsula!"

"What about it?"

"At it kind of odd right at the 38th parallel it all of the sudden goes black?"

"I thought it was a lake!"

"No, no, we're picking up signs of human life. Weak, but they're there."

"Well where the hell are all the lights???"

"Got me."

"Well hell, who the hell is running that joint anyway???"

It really makes you question whether leftists REALLY believe that the actually have the key to a better society or are just a bunch of lazy whinners that want other people's wealth transferred to them.

Thursday, October 12, 2006

Conspiracy Theories Coming to a Theater Near You!

I forecast the following conspiracy theories as we approach the election;

1. Flag of Our Fathers was timed to be released for maximum Republican advantage. The left will demand Clint Eastwood shoot himself and renounce the use of guns.

2. Harry Reid's real estate deals were obviously the work of the right wing MSM.

3. The George Bush made this last tropical depression fail to become a hurricane only because of the mid term elections. Otherwise he would have called his cronies and made that tropical depression a force 5 hurricance to wipe out another town populated with minorities.

4. The paper cut I got the other day was the result of a diabolical plot by Bush, Inc. when I criticized him for spending too much money.

1. Flag of Our Fathers was timed to be released for maximum Republican advantage. The left will demand Clint Eastwood shoot himself and renounce the use of guns.

2. Harry Reid's real estate deals were obviously the work of the right wing MSM.

3. The George Bush made this last tropical depression fail to become a hurricane only because of the mid term elections. Otherwise he would have called his cronies and made that tropical depression a force 5 hurricance to wipe out another town populated with minorities.

4. The paper cut I got the other day was the result of a diabolical plot by Bush, Inc. when I criticized him for spending too much money.

Wednesday, October 11, 2006

Fat Chicks Allowed

We've been going at it the wrong way gentlemen. Barking up the wrong tree. Pissing into the wind.

As I've said before I often think that society spoils very attractive women and gives them a free pass in many things. Simply because a woman is attractive means that one-half the population wishes to sleep with her and thusly will buy her food, drinks, dinner, dates, houses, jewelry, heck I remember a personal injury lawyer scamming on a girlfriend of mine promising to pay for her college (I was a wealthy security guard at the time). This effectively shields these women from the harsh realities of life that turns you from a child into an adult. So while the rest of us schlepps have to slave away at work, earn a degree, pay a mortgage, and fill our own gas tanks, Bambi is being chauffered around by Winston Winthrop III.

Now not to be arrogant or bragging, but truthfully, I keep myself in enough shape and ask out such a volume of girls that inevitably one is drunk enough, slips up and says yes. Thusly I do tend to date very attractive women.

However, these never or rarely make it past the first date as they quickly prove themselves to be complete morons and ditzes.

For example, in my recent trip to Rapid City a very attractive girl GAVE ME her number and e-mail without me even asking and DEMANDED stay in town one extra day so that we could go out on a date...only to stand me up the next day.

Another would be the "Norwegian Goddess" who got so hammered one night she not only got into fisticuffs with her friends, but was so drunk she couldn't tell if she was in St. Paul or Minneapolis and thusly needed me to pick her up (below is a thing called a "map" that shows you the geographic difference between the two).

Or perhaps my personal favorite, the neice of one of the top dogs inTaiwan's Kuomintang party whose family had a net worth in excess of $1 billion that literally LECTURED ME FOR 15 STAIGHT MINUTES after I had filled up the tank, went into the station to pay, and came back and had the audacity NOT TO ASK HER IF SHE WANTED SOMETHING TO DRINK!

Obviously the common theme among these very attractive women is they're all psycho. They're mean. They're spoiled. They're immature.

In short, their personalities suck.

This presents a paradox to any guy who wishes to date attractive women;

physical attraction is inversely related to personality.

Here is a formula developed by U of Chicago economists;

Thus the question becomes how do you solve this paradox, and date a girl that is not only attractive, but nice as well. Well, gentlemen, I think I have the answer.

Ask yourself the question, what is easier to change?

A person's looks

or

A person's personality?

And now the merits of my genius plan becomes apparent. For while a person's personality is more or less set by the age of 24, their physical appearance is not. And while a person's personality can be changed, it is infinitely easier to change somebody's physical appearance.

Thus, guys, men, hombres and dudes, we've been going about it all the wrong way.

Instead of chasing after hot chicks that no doubt have wretched and unchangible personalities, we should be keeping a keen eye out for overweight women that you could see it that if they lost 20, 30, 50 pounds, etc., they'd be hot. And since society is anything but nice to fat chicks, you can practically be guaranteed that they know how to support themselves, they don't expect society to take care of them, they have personality and have had to develop some kind of intellect or skill in order to have a social life, just like the rest of us. It's literally only a matter of slimming them down.

Now, there are of course problems with my new-found theory.

One, friends have pointed out they don't want to date fat chicks. And I concur, but that is not what the theory portends. Much as we may lament it, you must be physically attracted to somebody to date them. But that doesn't mean you can't be friends and go running or walking.

Secondly, dissenters brought up the issue of how exactly do you put it to an overweight girl that she needs to lose 40 pounds? Simple, you don't. You just say, "hey, do you ever go running?" Get them out dancing. Some form of exercise without mentioning that she needs to lose weight.

Also is the issue of how "blunt" and "mean spirited" this is.

Well that's because if you're insulted by such an idea you are probably of the lefter-leaning sorts because you dont' like the truth and rather lie to somebody to spare their feelings than to truly help them out.

It may be blunt, it may be cold- hearted truth, but it is not mean spirited. Mean-spirited would be something like not telling an overweight person they need to lose weight knowing full well their life expectancy will be 15 years shorter if you don't.

That's mean spirited.

"Asking" not "TELLING" a woman to go running pulls off the delicate balance of being polite yet being truthful as well.

Regardless, the theory has merit and is a win-win-win situation as far as I can tell.

1. The monopoly super attractive women have would be broken and they'd be forced to compete by becoming nicer people.

2. Overweight women would slim down, making them not only more attractive, but healthier.

3. A good looking dame with a great personality might not be a mutually exclusive event.

As I've said before I often think that society spoils very attractive women and gives them a free pass in many things. Simply because a woman is attractive means that one-half the population wishes to sleep with her and thusly will buy her food, drinks, dinner, dates, houses, jewelry, heck I remember a personal injury lawyer scamming on a girlfriend of mine promising to pay for her college (I was a wealthy security guard at the time). This effectively shields these women from the harsh realities of life that turns you from a child into an adult. So while the rest of us schlepps have to slave away at work, earn a degree, pay a mortgage, and fill our own gas tanks, Bambi is being chauffered around by Winston Winthrop III.

Now not to be arrogant or bragging, but truthfully, I keep myself in enough shape and ask out such a volume of girls that inevitably one is drunk enough, slips up and says yes. Thusly I do tend to date very attractive women.

However, these never or rarely make it past the first date as they quickly prove themselves to be complete morons and ditzes.

For example, in my recent trip to Rapid City a very attractive girl GAVE ME her number and e-mail without me even asking and DEMANDED stay in town one extra day so that we could go out on a date...only to stand me up the next day.

Another would be the "Norwegian Goddess" who got so hammered one night she not only got into fisticuffs with her friends, but was so drunk she couldn't tell if she was in St. Paul or Minneapolis and thusly needed me to pick her up (below is a thing called a "map" that shows you the geographic difference between the two).

Or perhaps my personal favorite, the neice of one of the top dogs inTaiwan's Kuomintang party whose family had a net worth in excess of $1 billion that literally LECTURED ME FOR 15 STAIGHT MINUTES after I had filled up the tank, went into the station to pay, and came back and had the audacity NOT TO ASK HER IF SHE WANTED SOMETHING TO DRINK!

Obviously the common theme among these very attractive women is they're all psycho. They're mean. They're spoiled. They're immature.

In short, their personalities suck.

This presents a paradox to any guy who wishes to date attractive women;

physical attraction is inversely related to personality.

Here is a formula developed by U of Chicago economists;

Thus the question becomes how do you solve this paradox, and date a girl that is not only attractive, but nice as well. Well, gentlemen, I think I have the answer.

Ask yourself the question, what is easier to change?

A person's looks

or

A person's personality?

And now the merits of my genius plan becomes apparent. For while a person's personality is more or less set by the age of 24, their physical appearance is not. And while a person's personality can be changed, it is infinitely easier to change somebody's physical appearance.

Thus, guys, men, hombres and dudes, we've been going about it all the wrong way.

Instead of chasing after hot chicks that no doubt have wretched and unchangible personalities, we should be keeping a keen eye out for overweight women that you could see it that if they lost 20, 30, 50 pounds, etc., they'd be hot. And since society is anything but nice to fat chicks, you can practically be guaranteed that they know how to support themselves, they don't expect society to take care of them, they have personality and have had to develop some kind of intellect or skill in order to have a social life, just like the rest of us. It's literally only a matter of slimming them down.

Now, there are of course problems with my new-found theory.

One, friends have pointed out they don't want to date fat chicks. And I concur, but that is not what the theory portends. Much as we may lament it, you must be physically attracted to somebody to date them. But that doesn't mean you can't be friends and go running or walking.

Secondly, dissenters brought up the issue of how exactly do you put it to an overweight girl that she needs to lose 40 pounds? Simple, you don't. You just say, "hey, do you ever go running?" Get them out dancing. Some form of exercise without mentioning that she needs to lose weight.

Also is the issue of how "blunt" and "mean spirited" this is.

Well that's because if you're insulted by such an idea you are probably of the lefter-leaning sorts because you dont' like the truth and rather lie to somebody to spare their feelings than to truly help them out.

It may be blunt, it may be cold- hearted truth, but it is not mean spirited. Mean-spirited would be something like not telling an overweight person they need to lose weight knowing full well their life expectancy will be 15 years shorter if you don't.

That's mean spirited.

"Asking" not "TELLING" a woman to go running pulls off the delicate balance of being polite yet being truthful as well.

Regardless, the theory has merit and is a win-win-win situation as far as I can tell.

1. The monopoly super attractive women have would be broken and they'd be forced to compete by becoming nicer people.

2. Overweight women would slim down, making them not only more attractive, but healthier.

3. A good looking dame with a great personality might not be a mutually exclusive event.

Militant Teachers Unions...In Mexico

I've kind of been following this half-heartedly. But my understanding of it is right wing thug regional governor won't give in to left-wing thug teacher's unions demands, protests and all hell breaks lose.

Like I said I haven't followed it that closely, but Mark in Mexico has. Here's his web site;

http://markinmexico.blogspot.com/

Once thing I did want to post was this photo taken of an open-minded leftist and their respect for the law.

Any time you leftists want to get lippy here in the US and resort to physical violence, set down the latte and your daddy's credit card and let's go.

Like I said I haven't followed it that closely, but Mark in Mexico has. Here's his web site;

http://markinmexico.blogspot.com/

Once thing I did want to post was this photo taken of an open-minded leftist and their respect for the law.

Any time you leftists want to get lippy here in the US and resort to physical violence, set down the latte and your daddy's credit card and let's go.

Well, Isn't This Interesting?

So this came out;

http://www.usatoday.com/news/nation/2006-10-10-internet-defamation-case_x.htm

I find it very, very interesting. I'm sure some other people will too!

http://www.usatoday.com/news/nation/2006-10-10-internet-defamation-case_x.htm

I find it very, very interesting. I'm sure some other people will too!

Tuesday, October 10, 2006

Monday, October 09, 2006

Yes, Communism Still Sucks

For some reason the hits have gone through the roof on this old post of mine from March. Web site called www.reddit.com linked it yesterday and BOOM! Hits go through the roof.

Anyway, it shows the world's worst cases of genocide by an interesting chart (and we know my affinity for charts). But I didn't want to repost it with a different date otherwise the links wouldn't work, so click on it. It shows how communists are effectively the world's best killer and that's DURING PEACE TIME!

Anyway, it shows the world's worst cases of genocide by an interesting chart (and we know my affinity for charts). But I didn't want to repost it with a different date otherwise the links wouldn't work, so click on it. It shows how communists are effectively the world's best killer and that's DURING PEACE TIME!

Sunday, October 08, 2006

Debt Junkies

Friday, October 06, 2006

Won't Somebody PLEASE Think of the Children?!

My favorite mantra to come from the 60's generation is "won't somebody think of the children."

Parading children around as an excuse to allocate resources to a whole bevy of programs. Demanding more money be spent on the children. Because we care for the children. And if you don't transfer wealth to the poor for the sake of the children, then you're a very very BAD PERSON!

Well, my question to you is, yeah, why won't somebody think of the children? It's one thing to say it, it's another thing to mean it.

Never has such a generation failed in their stewardship of future generations.

So you can only imagine my blood pressure when Ben Bernanke, who you know, is kind of a smart guy. Might know what he's talking about, being the head of the Federal Reserve and all gave a speech about the black and white realities of social security and medicare.