This presented a problem to me because unlike say, a bond, a stock, or a rental property, currencies (crypto or not) do not produce income. They are a tool of economic exchange, a store of value, and naturally forming and evolving economic phenomenon since humans existed. Silver bars do not poop out little silver coins and gold coins do breed to make little gold coins. And since all currencies produce nothing, there is no means by which to value them. The value of currencies are therefore determined by their rarity relative to one another, whether they have intrinsic value (precious metals), utilitarian/commodity value (silver is used in electronics), purchasing power (the Big Mac Index) and the amorphous, whimsical, and impossible-to-measure trust and faith of the entire world's people.

So what I employed was a technique used to value traditional currencies where a stable currency (such as gold or the US dollar) was used as a base and the historical exchange rate or "ratio" between that base currency and the one I was attempting to value established an average. This average would then allow me to determine whether a currency was overvalued or undervalued relative to the stable base currency and we would have a rough estimate as to what a currency should be "worth."

For example, historically (when allowed to trade freely) the gold to silver ratio has been 47 to 1. During my lifetime the British Pound would fetch 1.8 US Dollars. And the Euro vs. Dollar exchange rate has been around 1.2. These exchange rates have been volatile, but you can ever so roughly determine a currency to be undervalued or overvalued depending on how far away from these averages they trade. But instead of using gold or the US dollar as the base, I used Bitcoin as the "base currency" by which all other cryptocurrencies would be valued.

This presented some obvious drawbacks.

Bitcoin, the eldest of all cryptocurrencies, isn't even 10 years old, providing little if any kind of historical performance by which a stable, long term average base can be established. Also, for the short 9 years it's been in existence, its price performance has been HORRENDOUSLY volatile as such a revolutionary idea as a cryptocurrency would be. Further complicating matters is that new cryptocurrencies are younger than bitcoin and all cryptocurrencies tend to move in concert with one another. This has relegated the pricing of various cryptocurrencies merely a theoretical exercise and me admitting to the client that all I could provide was a methodology that might work in 50 years time from now, but was completely worthless today.

In short, it was impossible to value a cryptocurrency today.

But my research had an unintentional side benefit. And that was a look into the INSANE underworld of crypto-currencies. A look that immediately flashed me back to 1998 because the parallels between the cryptocurrency market of today and the Dotcom market of 1998 are eerily similar.

First, both cryptocurrencies and dotcoms were revolutionary advances in technology that promised to revolutionize the economy. They were so new and society had yet to figure out what role they would play in the future economy and world, their values were impossible to assess. But we did know they were going to play a major and upheaving role in the future economy. There was profit to be made, but we didn't know precisely where, or how.

Second, there was a flood of them. Dotcom Mania had so captured the nation companies who never produced a profit in their entire existence were getting hundreds of millions in financing from venture capitalists. IPO's were celebrated when there was no profits to celebrate. And if you simply put an "e" or an "i" in front of your company's name, your market cap would septuple overnight. It was so bad you had Gen X'ers acting like millennials - achieving nothing, while being highly rewarded for it.

This easy money merely attracted more money as everybody thought they would transfer the entire world economy from bricks and mortar to digital in a mere year. And soon every industry, sector, and facet of the economy was going online. If I recall my dotcom history correctly, there was even a fish company that decided to sell shoes online. Yes, it was that insane.

However, the same insanity has infected the minds of the cryptocurrency market.

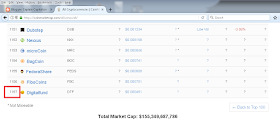

I'm no economist, but as far as my logic takes me, the world should only need ONE cryptocurrency. Maybe three or four in order to account for the fact people would want to diversify out of being reliant upon just ONE cryptocurrency. But when I did the research for my client...now approaching 4 months ago...there were....(drum roll please)

967 cryptocurrencies!

But wait, it gets better! In those four short months the number of cryptocurrencies has increased by 200!

Do not tell me this isn't Dotcom II all over again.

Third, and perhaps more eerie is how the cryptocurrency market has morphed from what should be a currency market to its own culture or society. And even the words "culture" or "society" understates this morphing. More like "religion" or "cult."

In doing my research I happened upon discussion boards, comments sections, facebook pages, and all other forms of social and not-so-social media where its participants were so far removed from the fundamentals of currency economics, it was now their daily personal hobby they'd obsess about because (as far as I can tell and I hate to sound so harsh) they really had nothing going on in their lives.

"Did you hear they're coming out with a new cryptocurrency with DOUBLE encryption???"

"I like BloggerCoin because they're backing up their currency with the intrinsic value of blog posts!"

"I heard about BloggerCoin, but I like FARTCOIN better! They're capturing people's farts so you can exchange your cryptocoin for human methane!"

In other words, people were discussing, talking, and buying cryptocurrencies not because of any economic fundamental value, but more like trading cards or Beanie Babies. It was novelty, a hobby, a culture unto itself that had nothing to do with intrinsic value. This too was the case during Dotcom while CNBC and the various "professionals" they had on were talking about Krispy Kreme donuts, upcoming IPO's and ill-understood technologies that had ne'er been tethered to profits or reality.

Which perhaps leads to the eeriest similarity of them all - ICO's and technospeak.

While the Dotcom bubble heralded IPO's (Initial Public Offerings) of the latest dotcom company that traded dog manure for Styrofoam widgets, this same "crypto-cult-culture" heralds "ICO's" (Initial Coin Offerings) with the same fanfare AND complete lack of profitability, intrinsic value, and sanity.

Never mind there's 1100 currencies out there already.

Never mind these coins don't produce dividends, rent, interest, or income.

Never mind the world really only needs 3-4 cryptocurrencies.

Nope, you got yourself an ICO! Let's uncork the champagne while cashing in our 401k's to buy FECESCOIN!!!

Worse, coupled with this unwarranted fanfare is the scariest hallmark of Dotcom Mania, "technospeak."

If you're too young to remember (or just too ashamed to admit you got duped by it) in order to get financing aspiring dotcom companies would talk over investment bankers' and investors' heads with technical jargon. Remember, the internet was relatively new technology and you could easily fool a Harvard MBA at a bulge bracket investment bank that you knew what you were talking about.

"If we increase the RAM on the baud information super highway, then the TCP protocol packets will be redirected to our mainframe servers, resulting in increased bandwidth and profit for our firewall. And if you invest $1.5 billion in 'E-genuity' you'll get a 20% share of our firewall profits!"

In a very Dilbertian way you could almost also guarantee funding by uttering the phrase "I understand if you don't get this technology, because it's pretty complex and over most people's heads." Bankers, investors, finance professionals and other incompetent egotists would trip over themselves to cut you a check to save their pride.

The same thing is happening in the crypto-currency market. In a desperate attempt to differentiate themselves from already-established crypto-currencies increasingly petty, even pointless technological traits and characteristics are being added (and heralded) as a reason to give THAT cryptocurrency at $4 billion valuation and not Bitcoin.

"Double encryption, triple encryption, double blockchain technology." I'll admit I don't know what that is and I don't care. But I know it stinks to high heaven when you're desperately trying to tie blog posts, tweets or some other faux-commodity to a cryptocurrency to vainly give it "intrinsic value." It's like I'm 24 all over again, they just happened to change the vocabulary this time.

The real question is: does all this mean the cryptocurrency market has no value? And the answer is "no, of course not." Just like Dotcom Mania there WERE companies that DEFINITELY had value and they are some of the largest and most successful companies today. Amazon, Google, Betterment, not only do these companies have value unto themselves, but brick and mortar that are explicitly "dotcoms" inevitably incorporated digital/internet technology universally. But like the dotcom market, it will only be a small minority of cryptocurrencies that have value today and will be around tomorrow. The question is how to determine who these are?

While there's no way to predict this or guarantee one cryptocurrency that's around today will be around tomorrow, I came up with a final, albeit simple metric for my client. The "We Accept Index" aka the number of Google search results of "We Accept Bitcoin" or "We Accept Dogecoin" etc.

Very simply "The We Accept Index" reconnects and measures the only thing that matters with a currency - whether it is accepted as such. Whether you can use that currency to purchase ACTUAL TANGIBLE PHYSICAL THINGS IN THE REAL WORLD. Whether other people deem it to have value. And it is here we find out just how few cryptocurrencies have value.

In all honesty, only two, MAYBE four have value:

Bitcoin

Litecoin

Ethereum, and

Dogecoin (and this was started on a lark!)

The remaining 99.7% of cryptocurrencies, in literal economic terms, have no value.

Thankfully, the entire cryptocurrency market is only $150 billion (today anyway) and does not present the threat to the economy the $6 trillion crash in dotcoms did. You don't have to worry about this article tanking the cryptocurrency market and then next, the world economy. But do be reasonable and rationale when it comes to "investing" in cryptocurrencies. You are gambling on a market that is eerily similar and stable as Dotcoms in 1999. If you must, invest in a diversified portfolio of them and do not cash in your 401k. Even I own a full Bitcoin that I paid $800 for some years ago.

The only problem is I can't find the digital wallet and have completely forgotten how to access that @&%*ing Bitcoin.

Which is of course another drawback to cryptocurrencies.

____________________________________

Check out Aaron's other neato stuff below!

Podcast

Asshole Consulting

YouTube Channel

Books by Aaron

Amazon Affiliate

I have been approached many times by laypersons if they should 'invest' in xxxxxxcoin. My response -- "Are you a FX money manager? Of course not. Get yourself a ewallet and use it to make your life easier, but the average person does not arbitrage in currencies." And they are average joes that ask.

ReplyDeleteAs to your article, pretty much spot on. I think the bit you glossed over was utility. Bitcoin has first mover advantage which gives them a head start on the rest of them. But their utility is a single facet -- monetary exchange. The Achilles heel is that to use that utility you generally have to move thru an exchange converting to local currency. Etherum I believe has the ability to beat Bitcoin over the long haul. The reason being that it has a wider utility value. Etherum can be out fitted with contract, settlement and third party participation in the code. One could write a Etherum based deal that trades x bushels of wheat for y bushels of corn. Bitcoin cannot do that today.

Great post Cappy! There are other angles to cryptocurrencies that appeals to the silver and gold "stackers": the ability - or assumed ability - to avoid the banks and/or governments. As you know, I touch on this in my book, Trade the Ratio!

ReplyDeleteYour best post in some time. I first ran into Bitcoin back in 2010. I heard about it online and even looked up and read Satoshi's now famous paper that described the software design behind Bitcoin. I immediately saw the entire idea as the first original idea about money in centuries. Bitcoin described a way to separate currency and state and frankly, we need to get governments out of the money creation, regulation, and taxation business as soon as possible.

ReplyDeleteIt didn't take long to enumerate the problems with Bitcoin. Problems that are now, nearly ten years later, beginning to manifest themselves. I consider Bitcoin a first-generation implementation. It, and most derived coins, commonly suffer from:

1) Mining algorithms (coin production) that favor deep pocket concentration. The sudden interest by the Wall Street vampire squids of the world in Bitcoin is because they now see a way to indirectly control mining. Oligopolies are always corrupted and we are within five years of a thoroughly manipulated Bitcoin mining pool. There are fixes to this and I expect new mining algorithms with fully formal mathematical proofs demonstrating their inherently hard to centralize nature arising.

2) The Blockchain is too transparent. The only thing that matters is, are the funds legitimate? There is no need to display amounts and histories to the world. A financial system that is not highly private and secure invites institutional abuse. Just ask anyone that's ever given money to political entities how wonderful full disclosure is. An advanced privacy preserving cryptocurrency should be close to a perfect money laundering tool. All the recent chummy talk about regulating Bitcoin is happening because the Blockchain is easily de-anonymized allowing tax authorities to easily track alleged tax cheats.

3) The IP addresses of wallets and miners are easily detected and all transactions are sent in plain text. Again, a proper network should be nearly invisible, difficult to block, immune to man in the middle attacks, and beyond the control of national or international agencies. That's the FREE part of Free Trade! You cannot see how many dollars I have in my wallet or what I choose to do with them. If your money isn't free then neither are you.

Because Bitcoin is a first generation system I expect Bitcoin's value to quickly fall to zero in the not too distant future. The dumb money is just now pouring in so now is a good time run scams. I used to work with for Dotcom companies and even as a lowly programmer I could see that the real business model was to float an IPO, collect a big pile of unearned cash, sell the company to a bigger fool and then cash out your stock options. The ICO is just an echo of this naked ape fraud.

Years ago one of these starry-eyed Bitcoin fans wrote: Why Whiskey Was Money, and Bitcoins Might Be.

ReplyDeleteHe was comparing the fact the whiskey was quite often used as a 'currency' in the US's infancy. Brand-new government, brand-new 'money' (though they were copper, silver and gold) that didn't have any historical 'track record'. Whiskey's fairly easy to make, and kept in a sealed container has a very long shelf life. It, of course, is easily divisible - another problem with (specifically) Bitcoin, in the book-selling example I've used before, how do you price your book in Bitcoin? The smallest unit is .0001 BTC, which at it's exchange rate at this moment is 1 BTC = $4828.50. So slide that dot over three places and you get $4.8285 as the smallest possible unit. Uh, yeah, so you price in units of +/-$5, that's not going to work very well. Another reason why Bitcoin can't be a currency. And don't even get me started on sales taxes. Also, and yes it matters, Bitcoin needs two things to function; electricity and an internet connection - cut off one or both and those cryptocurrencies vanish into thin air. What use are they in Puerto Rico now? Nada.

Bitcoin and other crypto-currencies are a pyramid scheme however noble they may have been in intent, (and I'm really doubtful there was ever any noble intent).

ReplyDeleteFor most people, your experience of Bitcoin will be just like the average experience of the Rainbow vacuum scam, and the original Amway and Mary Kay schemes: you won't make any money, and you'll lose a lot of time and effort, but you'll be comforted in the knowledge that some people did get rich, so you weren't a total sucker.

When all else fails, the only things you can take with you and trade for what you need are knowledge and skill.

ReplyDeleteI take your point and then some, Captain.

ReplyDeleteBut the lads on the Venture are ready to ride the bubble to the moon. Check out HIVE...It's the weed stock of cypto...

https://www.hiveblockchain.com/

EXCELLENT POST.

ReplyDeleteI had a discussion with a buddy a couple of years ago about cryptocurrencies, and I told him that I didn't trust it precisely because the market was so new and it was too faddish; I worried that as soon as the novelty wore off the market would crash and a lot of minimally-knowledgeable people would be out their life savings.

Great analysis. I am quite happy to leave crypto-currenies alone since I have no need to buy drugs or have someone killed.

ReplyDeleteGreat analysis. I am quite happy to leave crypto-currencies alone since I have no need to buy drugs or have someone killed.

ReplyDeleteOnce again, reputation has value, and it's not the reputation of a single person ...

ReplyDeleteSomeone should have told that to Paris Hilton.

http://www.businessinsider.com/paris-hilton-backs-ico-lydian-celebrities-endorsing-cryptocurrencies-2017-9

Also once again, the Smart Gremlin has better investment advice: "Right now we are advising all our clients to put everything they've got into canned food and shotguns!"

Both tend to retain their value at the least, although I suggest buying premium canned food so you're not literally eating your own dog food ...

The blockchain technology will have value in itself. As services using the blockchain are being created. Cryptocurrencies have only one use for society and that is money laundering.

ReplyDeleteBitcoins market cap is all media hype and now you even have forex exchanges that let you trade bitcoins.

ICOs are pump and dumps were the creators and venture capitalists dump that shit onto people that think they are going to become millionaires.

Consumers usually spend Ethereum via its built-in smart contract system. I would expect "We accept Ethereum" to miss most of its reach.

ReplyDeleteI bought into Bitcoins at 6.5 cents each. Still have a few, but spent the most of them actually buying stuff in the years in between. I understand, at a deep technical level, how Bitcoin works, and even personally had a hand in the naming of the smallest unit of a bitcoin, the satoshi. That said, even *I* think Bitcoin is in a bubble presently. BTW, Bitcoin already uses "double encryption", as two encryption operations are the standard way that Bitcoin 'creates' addresses out of private keys. Bitcoin's core system is highly modular, and is quite capable of adapting any novel ideas that it's younger siblings might come up with. There are many interlocking security features in Bitcoin that are not mentioned in the whitepaper, and digital contracts (the killer feature advertised for Etherem) can also be enabled in Bitcoin, as it was designed to use them from the beginning.

ReplyDeleteKeep your bitcoins on paper. Use a laser printer (inkjets fade with time) or a good ink pen. Make several copies and store them independently. Triple check everything then delete them from your computer.

ReplyDeletePaper can't be hacked and is harder to lose in practice.

https://www.theburningplatform.com/2017/06/17/digital-currencies-are-all-a-scam/

ReplyDeleteKarl Denninger rips apart cryptocurrency on the most fundamental, technical level.

What are your thoughts on Ripple? It’s finite, no more will ever be created, and it serves a purpose outside being a currency. It serves a a means of clearing transactions between banks, taking the place of Swift. It makes Swift look the Pony Express compared to email.

ReplyDeleteIs this what you meant when you wrote…"Silver bars do not poop out little silver coins and gold coins do breed to make little gold coins." Or, did you mean to put a "not" after the "gold coins do" … breed to make little gold coins.

ReplyDeleteIn just last few days bitcoin went up bringing investors about 70%. How "there is no interest"?

ReplyDeleteNow I'm just sad I thought it was to late to hop on the train when it was around $4000.

Yes, it may drop any minute now as analitics say, just like they said that Hillary can still win or russians can attack. Ofc it wouldn't be wise to bet your whole retirement fund on cryptos but why avoid striking the iron when it's hot? (Protip: it's been hot last 5 years).

"There is no need to display amounts and histories to the world."

ReplyDeleteThis is how you know if the funds are legitimate. All bitcoins come from somewhere; their history can be traced back to the blocks they were mined in. This is why you can't counterfeit them. (At least without compromising an absurd amount of encryption.)

My best investing advice is to ignore others' advice. worked for stocks, bitcoin, etc. It seems many people are just really bad at prediciintg this stuff . You got to enjoy the ride and not overthink it .

ReplyDeleteThe silver - gold ratio historically was 16 to 1.

ReplyDeleteThe current level is being caused by rampant wash shorting ( fake shorts bought by a sockpuppet of the person offering the short ) to hold prices down for clandestine buying.

And SLV is a house of cards, 400 paper ounces to each real ounce.

Bitcoin is being driven by Chinese investors who want to get assets out of the PRC.

The same kind of errors of fact get repeated even among the otherwise intelligent and educated people. Bitcoin has it's faults, but the following are not among them.

ReplyDelete@YIH... Bitcoins are stored in a 64 bit integer variable, with the noble unit (bitcoins) arbitrarily fixed at the 33rd bit. So there are 32 bits to represent a sub-single-bitcoin unit. Said another way, in the decimal system, there are 8 places to the right of that decimal point; so a satoshi is 0.00000001 of a bitcoin. You only missed it by 4 decimal places. And if that wasn't enough, Bitcoin is capable of storing a sub-satoshi balance simply by the creation and use of a different type of address that uses a floating point variable instead of a 64 bit integer. The bitcoin addresses start with a "1" only because that is the address version (the testnet uses addresses that start with "a"), so I'm pretty sure there is room to create different types of addresses. 8 more types, at a minimum.

@John Baker... 1) & 2) No objections. #3) Masking of a client is possible, but comes with technical disadvantages not worth discussing here. Such a client is called a "dark client", and works best with a VPN or over Tor. I actually ran one for myself for many years, and I would have been very impressed if you were able to have discovered it, whether or not I transacted with you personally or not. Direct connections between clients are neither necessary nor the default action of a client, the network functions as a self-healing mesh network, if you know what that means. Yet, direct & off internet connections are possible too, so I could still transact in person using bluetooth over cell phones in the woods, or over a radio modem (TNC) using a ham radio transceiver. (I actually did the last one, so I know it works, it's just not something you would want to do, not easy)

@Tucane Services... Bitcoin was originally designed with a simple digital contract scripting language, that was disabled due to concerns that it might not be secure. This could be re-enabled at any time, but more likely Bitcoin would just steal or replicate Etherum's contract code if it works out. Bitcoin is modular, and designed so most modifications can continue without interrupting the rolling blockchain.

I looked into bitcoin mining a long time ago. When I realized that it required specialized ASIC (chips) to be viable, I laughed and flagged it.

ReplyDeleteRecently at work (because of the papers talking up the highs, etc) us IT geeks have been starting to talk about bitcoin. When IT geeks in New Zealand (out in BFE) suddenly start going on about it, because the papers are suddenly going on about it, you know that it's a bubble getting ready to burst.

Even a smart, smart person like Sir Isaac Newton got sucked in and burned by the hype surrounding the South Sea Bubble. Us IT geeks, we ain't as smart as Newton. It is an indication that things are getting up towards the top. Tulip Mania FTW!

Hang on there, O Captain My Captain, you left off the bit (no pun intended) that the crew still needs: How do we make use of this? I saw what the dot-com bubble was just a few months before it popped, and made some modest money out of it. (Would have been more, but I'm not an economist at all and didn't trust my instincts enough to really milk it.) Now we've got this new bright, swirly bubble. What would be a good way to actively gain from it?

ReplyDeleteThe other cryptocurrencies that are gaining prominence these days are designed to be a direct threat to Bitcoin. You see, Bitcoin's strength is that there is only a limited quantity of them that will ever exist. They can't be printed to infinity. However, if other cryptocurrencies take hold and overtake Bitcoin in value or popularity it will be the death of Bitcoin (and all cryptocurrencies) since it will then become evident that although Bitcoin is limited as to quantity there is no limit to how many new cryptocurrencies can be created. Some people already know this (at least subconciously) but since Bitcoin has remained the dominant one by far the reality of it has not yet sunk in. If people are willing to just jump to the next fashionable cryptocurrency that comes along Bitcoin will become worthless. Who wants to miss the boat on the next big thing? Who wants to be stuck with something that is falling out of fashion? That's the real reason behind the big push on etherium and some others.

ReplyDeleteAlso, I don't believe that Bitcoin is secure. If it was then why does the wallet program (on your own computer) show you that there are incoming transactions for your account before the 'block' containing that info even gets finalized and released into the blockchain and before it reaches your computer. There must be some sort of secondary connection going on at all times. The only cryptocurrency that I've seen that doesn't seem to alert you before hand that a transaction is incoming is DEVCOIN. Now, I'm not an expert on Bitcoin so I may be wrong; but someone should bring up the matter with those in the know.

I am the " slow kid" where investing is concerned. Soooo, riddle me this: The economy has collapsed due to hyperinflationary money printing, pretty much as all fiat currences do. You need food, water, shelter, and the means to keep it. Would you rather have Bitcoin or

ReplyDeleteA huge pile of canned goods, whiskey in glass bottles, several water purifiers, or self contained trailer suitable for boondocking?

@Peter_Littlehorse... Bitcoin is secure for reasons that cannot be explained in detail to those without a basic education in cryptography, and by basic I mean most people with who lack a higher mathematics degree are unlikely to understand, no matter what their IQ might be. To simplify it, the Bitcoin network uses a *continuous* encryption scheme that has no precedent, it was completely novel in it's approach. As each block is created and added to the blockchain, every block that follows it adds to the cryptographic "difficulty" in "breaking" that block (for lack of better terms without using jargon that would have to be well defined). As each block is added, the difficulty rises *exponentially* at such a rate that the consensus has been that it takes 6 blocks (or roughly an hour) before the network is satisfied that said block is not "broken". So you can see your transaction in your client because your transaction has already been processed by the network & added to a block, but the client is waiting for 6 blocks to arrive behind it before it will let you spend it again. This is actually not necessary under the rules, but a transaction that is formed from the funds inside a block that is less than 6 blocks deep into the blockchain is likely to be ignored by the network until the 6th block anyway. It's just a convention.

ReplyDelete@ Faithless Cynic.... I'd prefer a stash of canned goods, firearms & ammo, clean water supply, and a solar powered refrigerator. Oh, wait; I've got all that also.

Bitcoin is exhibiting classic bubble signs. Every time a chart looks like a moon shot like bitcoin does... it comes back down to earth. Just look at the gold chart around the time of the recession. For some reason during that time no one seemed to think that you could lose money on GOLD. But just look at the chart.

ReplyDeleteI've generally taken a watch and see opinion on bitcoin because it's impossible to tell how stable a currency is going to be for sometimes decades. The dollar is stable because EVERYONE takes it.

I think generally this is a VERY dangerous market. People who have no experience in currency trading (which is sorta what this is) are putting a ton of money into this. And until you've done some currency trading - you don't really understand all the forces at play. Any bank can take your money, but bitcoin has yet to be tested in a crisis situation. i.e a bank/bitcoin run. Only then will we know the true value of bitcoin.

@she_said... Bitcoin is likely in a bubble right now, yes. The root economic activity could justify about one tenth the current price. However, the dollar is stable (mostly) because it's the reference point by which we "value" goods & services. Because we (Americans) have all lived our lives thinking about the value of those goods & services with the US dollar (and other fiat currencies) as the *metric". Once upon a time, we had a different metric, a troy ounce of gold. If you were to think of the troy ounce as the value metric today, and then look at a chart of the price of gold in dollars over the past 150 years or more, the US dollar wouldn't look so stable anymore. It would look more like a crash of the dollar.

ReplyDelete