Tuesday is the new Monday.

Economists are the new studs.

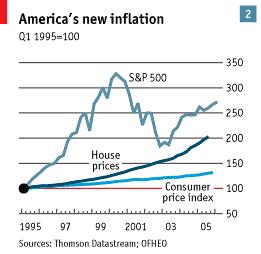

And house prices and stock prices are the new inflation.

It's an interesting discussion being circulated on whether or not monetary policy should target asset prices. Traditionally "inflation" only referred to consumer items as a means by which to gauge whether or not prices were increasing. But that doesn't account for all the money being floated around in the system. And if enough money is floating around, prices are bound to go up somewhere.

When it hits consumer goods, we call this "inflation." And it is bad.

When it hits housing or stock markets, we call this "a bull market." And is deemed good.

The problem is, assets or consumer goods, if prices get too out of whack, then this leads to a misallocation of resources. Idiots flooded the stock market during Dotcom mania days. Idiots today leverage up 100% to buy a house or property whose plausible rents could never come close to covering the mortgage payment, thereby driving the prices further. And in both cases savings tanked.

We're in a particularly precarious situation now, where a fair amount of economic growth is due to consumer spending and a fair amount of spending is due to morons squeezing every penny of equity out of their homes.

Of course, as always, when resources are misallocated to a large enough scale, recessions occur.

But you don't want to hear that, you just go ahead and take out that remaining $10,000 in equity in your house to buy that SUV.

3 comments:

working in real estate - -- I couldn't tell you how many people bought a house a year ago for $350K and refinanced it 7-8 months later for $370. And 6 months from now they'll refi again. And a year hence, etc.

I suppose there is nothing wrong with that provided you can continue to make payments on a debt that is "fixed" in principle, but in actuality is a perpetuity.

Problem is, most people can't. Defaults are at a record high right now in Michigan. I see that end of it too.

might be time to capitalize on the foreclosure "boom"

I am sitting like a crouched ninja waiting to strike. These dumbshit suburbanites who went from daddy's coffers to the homes' equity and can't reel in the spending and must constantly have everything they want have eaten through all their equity, it's amazing. And once these ARMS come due and interest rates go up, they're hosed. And thats when they default, and that's when there's a foreclosure and that's when I'll strike.

We're all screwed.

Post a Comment