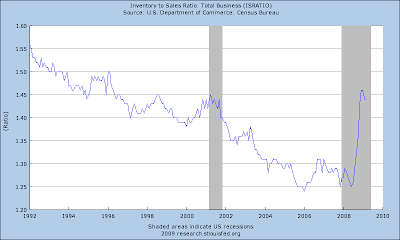

That being said, inventory to sales seems to have leveled off. Normally this would suggest an end to a recession, but when you misallocate $2 trillion in a $14 trillion in the form of a "stimulus," well that kind of fiscal policy will mute any traditional, natural means by which the economy heals itself.

4 comments:

I'm not at all familiar with this metric, so maybe I need a better explanation of this ratio.

If this is Inventory over Sales then I/S declines when:

1. Inventories are high due to supply-chain inefficiencies,

2. Inventories of durable goods are built up when they are cheap in expectation of rising prices later,

3. Inventories are built up based on overly optimistic forecasts of sales in a stable economy,

4. Plunging sales in an unstable economy.

The vertical launch in the series gives me concern too. Recoveries happen over time. Spikes in a data series are usually the result of some sudden exogenous shock.

I don't see how this is any indication of a recovery, much less good news.

Hi Major,

Well the I/S ratio shows you how much inventory a company has relative to its sales. This ratio has been increase because the numerator has been increase while the denominator has been decreasing.

THis happens during a recession as sales slow and inventories start to pile up.

However, if this ratio stops going up and looks like it's leveling off or even going down, that's a good sign because it shows employers are starting to work through their excess inventories. They won't hire anybody until inventories are low enough they need to be replaced, but once that ratio turns the corner and heads down, then it is just a matter of time until they hire people again to make more goods.

Of course, we're a service based economy...

And all of our goods are imported...

Because little Suburbanite Cindi doesn't like to work, but rather "work" as a school counselor...

But back in the day if this ratio tanked it was a signal to the end of a recession.

I agree with Robert. This doesn't look like news to me either.

"Of course, we're a service based economy...

And all of our goods are imported..."

Captain, the US exports about 2/3 as much in goods as it imports and US manufacturing comprises a bit over $2.8 trillion of US GDP.

If "all of our goods" were imported our trade deficit would be several times the size that it actually is. Speaking of the trade deficit, it's dropped below 400 billion from over 800 billion in 2006. I'm sure the mercantilist idiots will be just giddy about this. Our economy is doing so well! We actually got into a trade surplus during the Great Depression. If only we could reach those glory days again.

And while we're obsessing about how much cash we've got, the Fed has about 600 billion in the mix in the form of loans to financial institutions. This is up from damn near zero going back from 2007 to the creation of the Fed.

Biggest hockeystick ever: http://research.stlouisfed.org/fred2/data/BORROW_Max_630_378.png

That's what happens when banks don't know what their balance sheets actually look like, the Fed is keeping the Fed Funds Rate as close to zero as they can get it and the Federal government decides to run a budget deficit over a trillion dollars.

The government's either going to monetize their debt or the Fed's going to open the floodgates on quantitative easing like we've never seen in this country. Either way, the dollar's boned. It's going to get even weaker as other countries move further from the dollar as their reserve currency of choice. The Obama administration is actively encouraging the Chinese to stop selling stuff to us, further encouraging them to stop holding dollars.

Don't think so Cappy. From Kraft to GM everybody is cutting product lines. The Baltic Dry Index might be up but dockworkers at Long Beach aren't clocking any overtime.

Post a Comment