Now, admittedly, some of the "societal ills" I accused the Baby Boomers of wreaking on America is simply opinion. It is only my opinion that Frank Sinatra's music was infinitely better than Jim Morrison. And it is only my opinion that dancing is a better way to meet women than to go to the bars and get them drunk. It is only my opinion that traditional religions are better than satanic ones. And it is only my opinion that the fashion and etiquette of Doris Day is forever superior to the likes of Janis Joplin.

But what is not my opinion is what happened to the bevy of various social and economic indicators by which we gauge and measure the quality, strength and performance of society under the reign of the Baby Boomers. Things like economic growth, divorce, debt, teen pregnancies, etc.; it is these things that provide us with the pulse of society and for which the Baby Boomer generation has much to answer for.

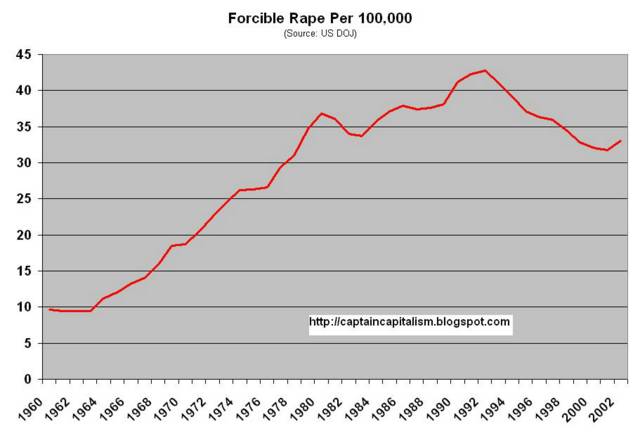

My favorite metric is crime. What better way to gauge a generation's stewardship of society than to look at how much crime that generation committed against society? Upon the Baby Boomers' entrance into adulthood offensive crime nearly quadrupled in the 20 years following 1960, peaking during the Volcker Recession. Property crime followed a similar pattern, and in both categories a resurgence in crime occurred as the Baby Boomer's offspring (with fine, stable upbringings) came of adolescence and crime-committing age. It wasn't until the economic boom of the 90's and the Baby Boomers entrance into middle age did crime start to fall.

(These crime measures are indices, incorporating all crimes (burglary, rape, assault, murder, etc.) into two overall crime measures)

Ironically, this skyrocketing crime coincides with another defining trait of the Baby Boomer generation; skyrocketing spending on government social programs, namely, "The Great Society." These programs were supposedly designed to lower or eliminate such social ills as crime, poverty, drugs, etc. However, it's almost as if the more money we spent on the social ills, the worse they became...something that liberals CERTAINLY to not want to hear!

Even more ironic than that, and what I find particularly disgusting, is the revolting increase in rape that occurred as the Baby Boomers became participating members or society. And what is particularly ironic about this, is that this was under the reign and heyday of the "women's liberation movement" which was allegedly supposed to decrease such atrocities.

Of course, some will argue this is due to the fact that women were being raped all the time, but never came forward. It wasn't until women were "liberated" that they felt comfortable coming forward, thus the increase in rape can be considered a good thing. However, I'm more inclined to subscribe to another theory; that feminists were 100% successful in eliminating that sexist and oppressive patriarchical behavior known as "chilvarly," yet, chivlary (or at least an upstanding father figure in the household) was the key ingredient in not only preventing rape, but instilling respect for women in men. But alas, I'm sure this correlation is spurious and I'm just some dumb economist jumping out of trees, running into the bushes and climbing rocks. I'm sure the women's lib movement has really improved the lives of women all around and has made them much happier.

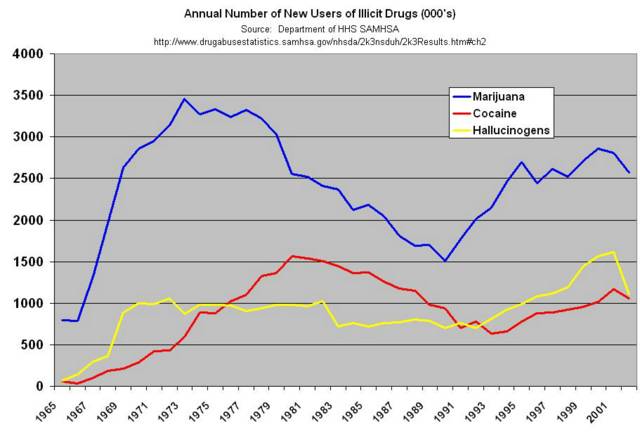

Closely related to crime and certainly contributing to it during the 70's and 80's was drugs, another ailment brought to prominence by the Baby Boomers. Before 1965 the recreational use of illicit drugs was practically non-existent. It wasn't until Jim Morrison and Janis Joplin started to eclipse Frank Sinatra in album sales that the first Baby Boomers entered (again) "adulthood" and made narcotics a booming industry. Marijuana alone experienced a 500% increase in new users in the eight years following 1965. Cocaine was a late bloomer, not reaching its peak of popularity until 1981; perhaps it was just a favorite among the younger Baby Boomers.

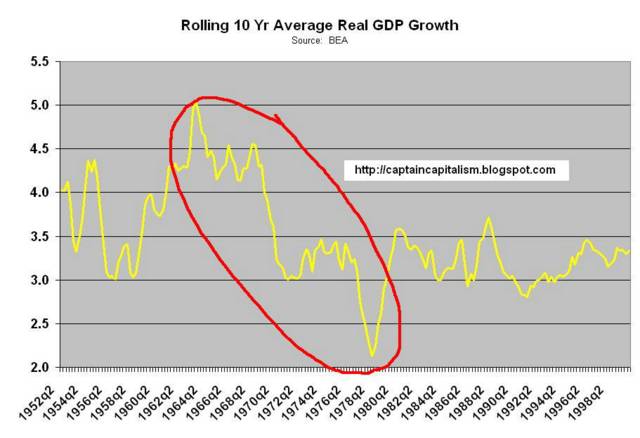

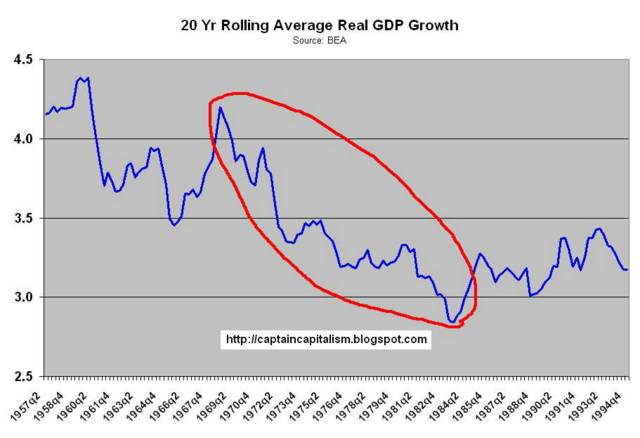

It should also come as no surprise that as drug use went up labor productivity might suffer. Averaging about a 3% annual growth rate during the 50's and 60's, labor productivity growth started to tank in 1965, once again coinciding with the entrance of Baby Boomers into the labor force. Labor productivity growth continued to tank for the next 15 years where it bottomed out at roughly 1/3 its 1965 high. Alas, it is a sad irony that droves of Baby Boomers entering the labor force seemingly "drove" (HAR HAR HAR!) labor productivity growth down.

(Note- I used rolling averages since labor productivity is very volatile and no trend would be able to be discerned visually. The rolling averages are not a trailing average, but a centered average, meaning the number you see in, say the 10 year rolling average takes the average of the past 5 and future five years to get its data point)

The negative effects of lower labor productivity may not be readily apparent to those who are able to attract members of the opposite sex - i.e. - those who aren't economists. However, the reason why labor productivity is so important is that all goods and services (i.e.-wealth) are derived from labor, which means ultimately our standards of living are based on how productive we are. This decrease in labor productivity growth, combined with oil embargoes and a politically placating monetary policy resulted in the pathetic economic growth rates of the 70's and the worst recession we've had since the Great Depression, the Volcker Recession (something older Gen X-er's may remember). When all was said and done a decade's worth of economic growth was wasted, standards of living had flatlined, inflation was running at 14% and unemployment was at European levels.

But to be fair, I must admit there was a silver lining to the economic malaise of the 1970's. A particular group of people were actually doing very well; divorce lawyers. Business for them almost tripled under the Baby Boomers, almost as if the Baby Boomers made divorce an Olympic event.

Of course, there is the argument often posed by feminists that divorce is a good thing and in some cases, it certainly is. However, the problem with divorce is not the hardship the husband and wife must go through, but what the children must endure. And here is where the children suffer on two fronts (and where I'm particularly livid with the Baby Boomers and especially my generation).

One is simply that the kid does not have a stable family household. Be it the parents arguing, abuse, using the kid as a chess piece in a tug of war match, or whatever, ultimately the kid is without one of his/her parents and the kid's dreams of going to Yellowstone park for a family vacation are somewhat dashed. Sadly the percentage of kids living under these households has gone from 11.9% of total households in 1970 to 27.9% in 1996.

The second front is that rarely do people contemplate the responsibility of having a child before they get married. Or more specifically, "If I were to marry person X, would we be able to provide a stable, nurturing environment to a child if we were to have one?" It's all about them, and no thought is given to the potential future would-be child. This is what I call "The SUV Kid Syndrome."

"The SUV Kid Syndrome" is where people have children not because they want to bring in another living human being that is in part a piece of themselves or because they want to share their lives with that child and bring it up the best they can. But because they "want a child" like they "want an SUV" or they "want an X-Box" as if children were an item, a piece of furniture to make the house complete. Forget whether they should have a child, or whether they can afford a child, or if they have the time for a child; such questions are inconsequential. It only matters if you want a child. Thus, the child takes on the characteristics of an object in that it can be "put away" or "turned off" in case it inconveniences you and your life.

Don't want to be inconvenienced bringing up your child? Outsource the responsibility to day care!

Can't afford day care? No problem, there's free government babysitting programs called Head Start and the public schools!

Don't want to teach them morals or ethics? Let Paris Hilton and Snoop Dogg do it for you!

Is your kid running around, all full of energy, bouncing off the walls like...well... a kid? Give him ritalin!

Really don't like the spouse you chose and wish you could trade him/her in for a better model, but you have a child? Heck, get divorced anyway!

Would you like to go out and get drunk, but you have to deal with that annoying kid? Lock him up in the trunk!

And is that kid interrupting your drug binge again??? That bastard! How dare he! Let the little twerp starve.

And when you're done pursuing your busy career and life, maybe you can stop in sometime and pick him up from the kennel for a walk...er...I mean "spend some quality "family" time together."

Alas, such a selfish and shallow approach to children did not exist in the 1940's, but give it two generations and a women's liberation movement and look how far we've come.

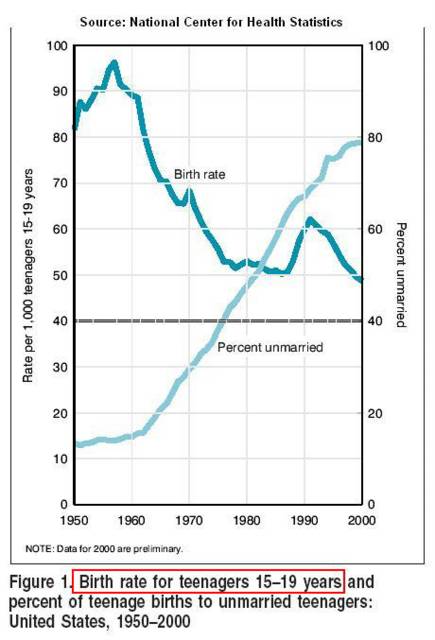

But hey, let's not go so hard on those people who have children and then get divorced. Some, don't even bother getting married at all. In 1960 only about 5% of all births in the United States were to unmarried women (the politically correct version of "illegitimate births"). Today that number is 33% and for blacks an inexcusable and pathetic 67%.

But again, I could be wrong. Feminists in all their wisdom contest that there's nothing wrong with single-parent households. Some even go so far as to admire those truly independent women that are single-mothers on purpose. And while there are instances where a poor parent certainly should be jettisoned from the household leaving a single mother or father to rear the children, it is the utmost of greed, self-centeredness and arrogance to purposely become a single-parent. It is these people whose desire to have a child supercedes the upbringing they can give to the child, and thus they impose fatherless or motherless childhoods on children. These are the people are the epitome of "SUV Kid Syndrome."

But let's be open-minded...reeeally open-minded. Let's just let the feminists and feminized men have that one. Let's just toss out all the research that says otherwise and accept that a child is going to be just as well served under a single-parent household as they would a nuclear family. Show me the argument then that shows children do just as well with unmarried teenage mothers as they do older more "traditional" parents.

Ahhh yes, another social indicator through the roof during the Baby Boomer-inspired American cultural renaissance called "The 70's." I'm not going to even bother arguing why teenage pregnancy is "bad" but no doubt feminists are working 'round the clock on a rationale as to why it "is a good thing."

But while the economy was tanking, our labor productivity slowing, responsibility being thrown out the window, and children being raised in broken homes, there was an element festering in America that posed a much greater and long term threat to America. An element so evil the devil could only envy it. A force so despicable, one could say it is the moral opposite of the US soldier who landed at Omaha beach; lawyers.

Ahhh, yes, lawyers.

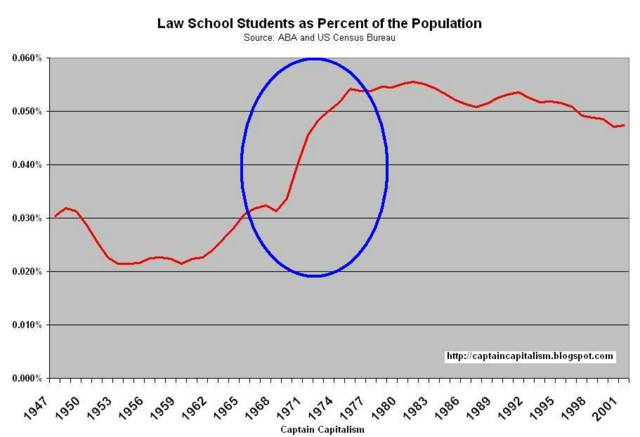

I had always had this stereo-type or perhaps "sneaky feeling" that a lot of Baby Boomers had entered law. For example, whilst working security at college, I noticed that the majority of the law professors were not only of Baby Boomer age, but also had the most anti-American, leftist propaganda on their office doors. Another thing was the poster-children of the Baby Boomers (Bill and Hillary Clinton) were both lawyers, Hillary being the true embodiment of the backstabbing, Machiavellian lawyer. But what really clinched it was a 60 Minutes special I saw about the 1968 democrat convention riot in Chicago where they interviewed a now 50 year old pony tailed hippie protestor and an old retired cop. The cop was retired, the hippie was now a trial lawyer.

Alas I was compelled to investigate further and created the "Lawyer Index;" an index which measures the percent of the population that is lawyers and law students. And what do you know, I was right. In the mid sixties only about .025% of the population was in law school. Ten years later that number more than doubled to .052%, again coinciding with the Baby Boomer generation entering college age.

Five years later when these students graduated and entered the profession the number of lawyers as a percent of the population jumped from .2% of the population to .27%. (This jump occurred from 1979 to 1983 which coincidentally are the exact same years the US suffered its worst recession since the Great Depression.)

The question though is, did they really do any damage? Sure, opinions and anecdotal experiences with lawyers has earned them a very poor reputation with the public. And we crack jokes about them everyday, but do they deserve it?

And the answer is a resounding, "Hell yes."

And I say that not just because I've had to deal with now two personal injury lawyer parasitic scum in my own life, but because the costs to society imposed by lawyers truly are disgusting.

Frivolous law suits (tort) cost America roughly 2% of it's GDP each year, which is up from .5% back in the 1950's. The increase YET AGAIN coincides not only with the entrance of the Baby Boomers into the labor force, but with their disproportionate participation in law. Notice the particular jump in costs from 1984-1987, which immediately followed the bumper-crop generation of Baby Boomers that graduated from law school from 1979-1983. This suggests that this increase is a "supply led" increase, meaning fundamental demand for such services has not increased (people aren't really getting hurt more), as much as it has been lawyers going out and trying to find any reason to sue; thus fat people suing McDonald's and smokers cigarette companies, and other such outlandish law suits that are highlighted in the news today.

As an economist, though I think about two things. One, I speculate about the opportunity costs of losing a full 2% of our GDP each year to what are most likely frivolous lawsuits. That money could have been spent or otherwise reinvested back into the economy, producing easily enough wealth to solve our little social security problem. And a rough estimate in the head gives me a figure of at least a 10% increase in our income per capita. Money now currently going to pay for increased insurance premiums and Lexuses of lawyers. Two, I'm wondering if it was possible lawyers at one time had a reputable reputation before the Baby Boomers entered the field and drove up insurance premiums and tort costs. Perhaps we will never know.

Now I could go on and on about untold numbers of various social indicators and how their deterioration amazingly coincides with the advent of the Baby Boomer generation;

I could talk about SAT scores;

I could talk about alcoholism;

I could talk about infanticide and child abuse;

I could talk about welfare;

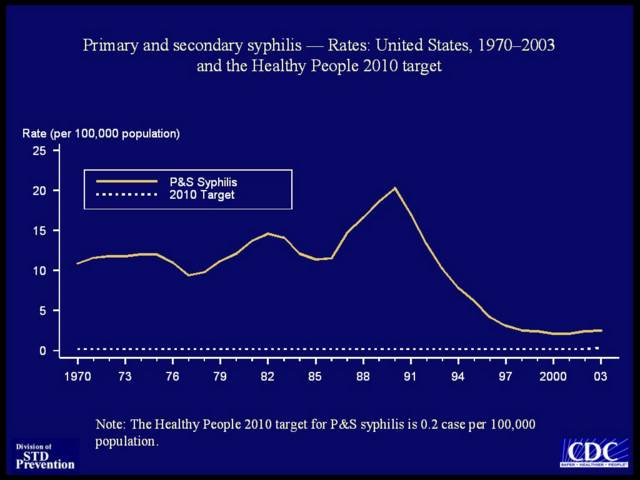

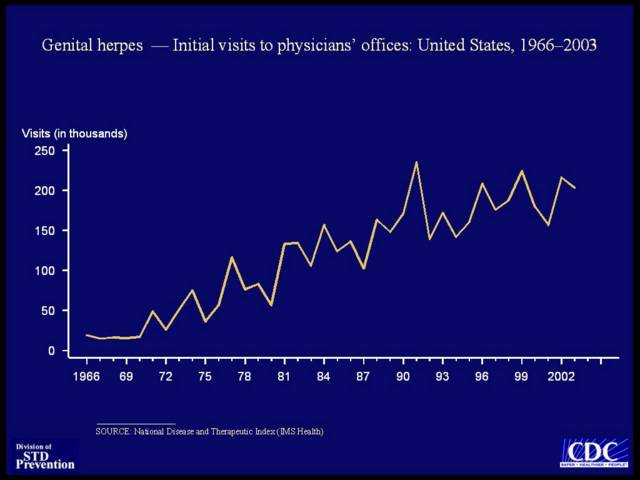

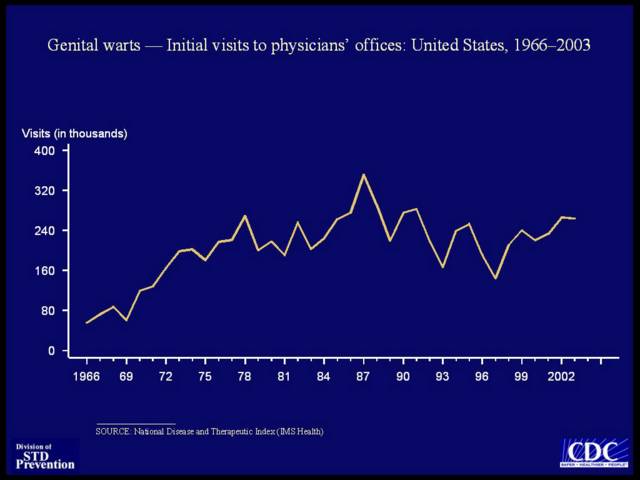

I could talk about STD's;

I could talk about "stagflation;"

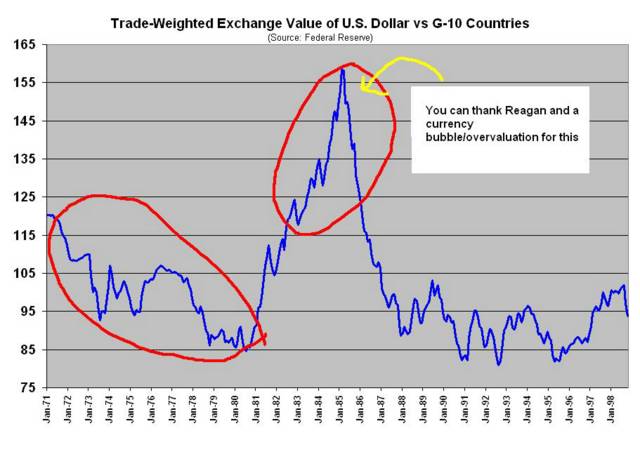

I could talk about a tanking dollar;

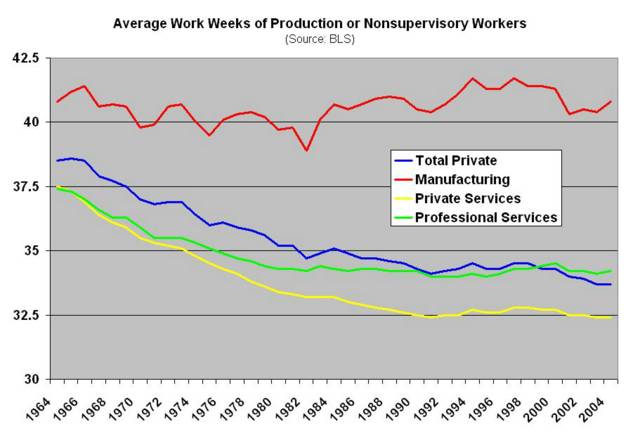

I could talk about tanking work weeks;

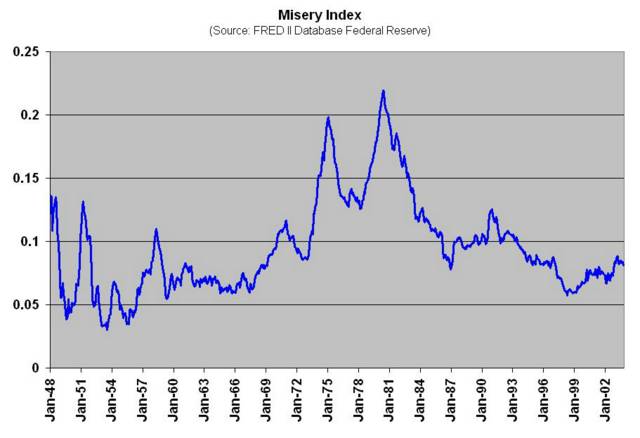

I could even talk about the "Misery Index;"

I could talk about practically any social indicator and metric you could ever think of and in the vast majority of cases they will have worsened under the Baby Boomers.

But forget all of it. Forget everything I've ever said. Take all the various social ailments I addressed above and throw them out the window. Forget the atrocious increase in crime. Forget that "work ethic" was not part of the vocabulary during the late 60's and 70's. Forget that pot replaced milk as a staple of diet. Forget that the economy tanked and that the lawyer population exploded. And forget how children became more and more like furniture. Forget it all!

Matter of fact, just write me off as a raving lunatic "age-ist" with an agenda and that I'm just bigoted towards people between the ages of 40-62 simply because of a bad experience in the 3rd grade where I got questions 40-62 wrong on a test, and thus I'm forever psychologically scared for life. Whatever it is, just disregard everything I just said.

No matter how "bigoted" I am, no matter how hate-filled you may find me, and no matter how much you may disagree with me there is no denying that the Baby Boomers have fumbled the ball worse than Daunte Culpepper when it comes to;

Fiscal responsibility

Spending money as if they were married to a ketchup heiress, never has a generation ran such a deficit between the amount of resources they've consumed and the amount of wealth they've provided in return. Incapable of producing enough goods and services to satisfy their demands, yet still wishing to maintain the consumption of kings, the Baby Boomers needed a way to enjoy higher standards of living without having to do all that pesky additional work.

Enter in the master stroke of genius. The mantra by which the Baby Boomers have lived since the 1970's. The legacy the Baby Boomers will leave behind, pass onto their children and for which all of history will remember them for; this ingenious little concept called "debt."

Debt is a magical thing. Impervious to time and adhering to no laws of physics, space or time, debt allows you to have your cake and eat it too.

The way debt works is the following;

1. You want something/s

2. You want something/s now.

3. You're too damn lazy to get off your fat ass to get a job and work up the money for it.

4. Thus, you take somebody else's money, promising to pay them back, but maybe you do or maybe you don't...but hey, that's their problem.

And boom! The magic of debt has worked. You've been able to acquire wealth on somebody else's dime.

Of course we operate under the assumption that people will always pay their debts back, and thus debt is not bad. But let me address that later. First let's take a look at just how much debt the Baby Boomers (and Generation X as well) has racked up over the course of their lives and then we'll worry about the issue of paying it back.

First, let's look at household debt. Household debt is the total amount of debt people have incurred, including mortgages.

(Adjusted for GDP so we know truly just how much debt has been incurred)

Now most would point out that "a house is a good investment" and that if there's something to take debt out for, a house is certainly not as frivolous as say a portable DVD player. And for the most part they're right. On principle I have no problem with people borrowing money to pay for a house.

The problem I have with people taking money out for houses now is that property is insanely overvalued.

Enter in the fact that the Baby Boomers will soon begin their journey towards nursing homes, retirement communities, and ultimately death, that means there will be a glut of property hitting the market for sale, thereby driving down prices. Barring a huge wave of immigration (and that's assuming these immigrants have the money to buy houses, which they don't) you can expect a drop or at least a long term decline or stagnation of property prices. But, don't listen to me, rack up that debt, take out that home equity line and buy yourself a fancy SUV, I'm just a dumb, bigoted economist.

But let's just assume for the moment that I truly am a dumb, bigoted economist and ignore the issue of overvalued property. Let's assume that property is a great reason to take out a loan and focus on the portion of household debt that is for non-mortgage (read "frivolous") items. We call this consumer debt.

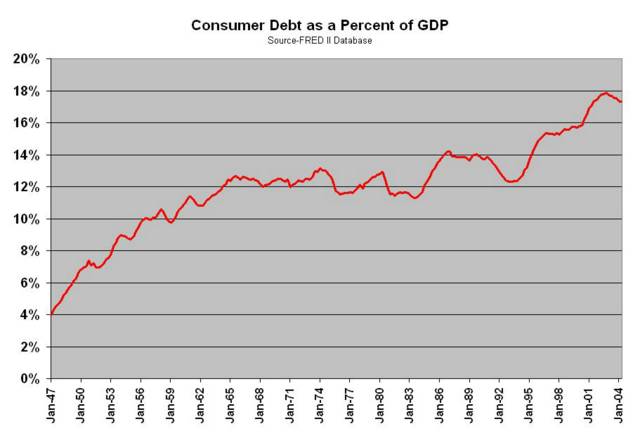

Consumer debt has increased from 4% of GDP during the WWII Generation to now 18% of GDP (equivalent to the entire US Federal budget). And unlike the rest of this post, the Baby Boomers are not the only ones to blame for this increase. Generation X has some explaining to do as well.

Now on the face of it, consumer debt of only 18% GDP is really not all that bad. It would only require some astute fiscal discipline for a year or six to pay that back. Maybe you'd have to forego that plasma TV or little Jr.'s pocket bike, but it could be done. And thus, you're probably concluding, "hey, the amount of debt we've accumulated isn't that bad."

But, oh you foolish little boy. For that's just the beginning of the debt legacy the Boomers (and Gen X) have built up. We have much further to go. For households and individuals are not the only entities that can accumulate debt. Governments can accumulate debt too! Oh goodie!

If there is an example of having their cake and eating it too, government debt is the prime example. Wanting all these various social programs and the attainment of the "Great Society" the Baby Boomers voted politicians into office to increase spending on welfare, social security, education and the limitless number of other various social programs. And while on the face of it, it was to address the social ailments that arose during the 60's and 70's, methinks it was more to provide employment for people who were too lazy to major in engineering and computers, and thus wanted to become social workers, counselors, teachers and other varied sorts of lazy AFSCME members, but I digress.

Whichever the case, these programs needed money.

"What, you want MONEY to fund these programs?" the people would say.

Hearing their indignation, and worried about losing their cushy government jobs, politicians had to come up with a plan. The people wanted the government to pay for more things, and lavish them with money, but they didn't want to pay the taxes necessary to finance such operations(anybody remember The Bear Patrol from "The Simpsons?").

Enter in "the free lunch."

The free lunch was an ingenious concept developed by politicians in the 70's and 80's. How it worked was that the politicians realized if they could borrow money to pay for these various government social programs four things would result;

- The programs would be funded and the people would be happy.

- Not only would the people NOT have to pay for the programs (now), but politicians could even promise them tax cuts.

- People with lower tax bills and increased government programs would be more prone to vote for these politicians, thus extending their political careers.

- The politicians would die before the people realized the piper had to be paid and there really is no such thing as a free lunch and escape their wrath.

And the result of two decades worth of deficit spending? $5 trillion in debt.

Unfortunately, the problem is that unlike consumer or household debt, government debt can (actually, must) be passed one from one generation to the next. It doesn't go away. The question is who will bite the bullet? Who will have to work to pay off these debts? Will it be the people who incurred the debt in the first place and used it to pay for cushy government programs and subsidized tax cuts? Or will we just roll over the debt allowing future generations to pay it off instead? With the imminent retirement of the Baby Boomer generation upon us, you can expect Generation X to carry the torch and inherit the $5 trillion in accumulated government deficits because there is not enough time for the Baby Boomers to work up the money to pay back what they borrowed.

Alas it seems the Baby Boomers got to enjoy all the "benefits" of The Great Society and Generation X gets to pay for it.

Ain't debt a bitch?

But what's $5 trillion between friends? More so, what's $5 trillion between family? I'm constantly told by my Baby Boomer predecessors that blood is thicker than water. And besides, it's only money.

Truth is, even if I believed that, if all we'd have to inherit from our Baby Boomer predecessors was the $5 trillion, I would be the happiest man in the world. I would gladly accept that $5 trillion in debt from my parent's generation. But sadly, that $5 trillion is not all we will get to pay for. For that $5 trillion is all the debt that has been accumulated thus far. That $5 trillion is historic, it's all in the past. It says nothing about what we get to pay for or how much more debt we will accumulate in the future.

Enter in the two greatest scams...errr...I mean "achievements" of the democratic party and their patron saint, FDR;

Social Security and Medicare.

Every month I get a card in the mail from a comedy company and it is hilarious. I rarely laugh harder. My good friends at the Social Security Administration send me my "account balance" for social security. I open it up with my friends while we're drinking and boy do we have a good guffaw. Some guys laugh milk through their nose, others cry because it's so funny. Oh, those funny clowns at the SSA!

And the reason it's so funny is they actually act like they're concerned about us. Like we're really going to get this money we've socked away. Now, forking over 15.3% of my income every year, one would naturally ask "where is this going?" An investment account? An IRA? My own safety box at the SSA?

You're almost as funny as the SSA!

No, silly, it goes right out immediately as payment to current recipients on social security.

The next natural question to ask is "well, where did all their contributions go?"

Weren't you paying attention?

Their contributions are gone. The government has been running deficits ever since the Baby Boomers took over in 1971.

And where did they piss it all away...er... I mean "spend" this money?

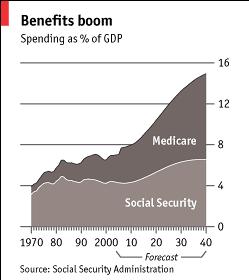

I'll post it again;

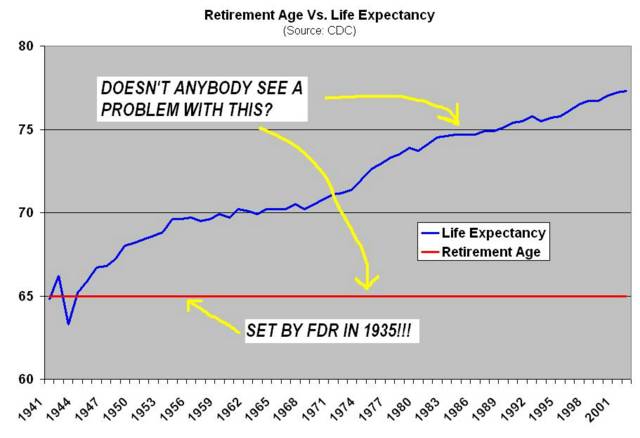

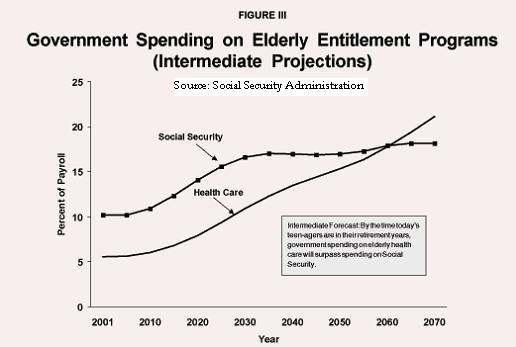

But if you think that's funny, just wait till you hear this one! What I love is how politicians, the media, pundits, lawyers or even AARP make it sound like social security is this vast, insanely complex issue with complex problems and no simple solutions. That you morons, you Red State plebs, you Wal-Mart workers are too stupid to understand this and thus we need journalists, professors, Hillary Clinton and other intellectual elites to solve this problem for us. Why you just can't possibly understand this chart here below!

(Rimshot - Thank you, thank you! I'm here every Thursday! Don't forget to tip your waiters and waitresses!)

And we wonder why social security is in such a mess.

But like I said, we can't dwell on the past. What's done is done. We have that $5 trillion in debt to deal with and we'll just have to accept it. Besides, there are more pressing issues to worry about. Namely, how much more these programs are going to cost us in the future.

And will you look at that. If you thought $5 trillion was a lot, get ready for some fun times because the amount of money spent on just those two items; social security and Medicare, is set to double going from 7% of GDP to about 15% in 2040 once the Baby Boomers start retiring.

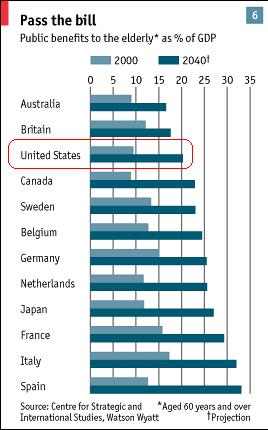

Add to that all the various social programs outside the realm of social security and Medicare that go to the elderly, and total spending on the elderly is predicted to consume a full fifth of our GDP; equivalent to spending the ENTIRE US FEDERAL BUDGET ONLY ON THE ELDERLY!

Yeah, kiss that cabin up north good-bye.

Could it possibly get any worse? Could we have put ourselves in more of a hole? Could other people have promised themselves so much without thinking of the true cost of their actions?

Oh, of course.

That just covers spending on the elderly. The Great Society promised everything for everyone! When all future promised obligations and entitlements are considered (things like welfare, income security, bailing out the underfunded pensions, Fannie Mae, Fannie Mac, etc.) and is compared to estimated tax revenues, the IMF estimates that our true debt level doesn't stand at roughly 40% GDP, but actually more like 250% GDP. That means you'd have to work 2.5 years, and be taxed at 100% to pay for all this. I think they have a similar arrangement in North Korea.

Now of course, these figures are all estimates and not set in stone. Some estimates are as low as $22 trillion, some as high at $44.2 trillion. Regardless of the figure, that's still a lot of dough. And the question then becomes how are we going to pay for this?

Thus far our Asian friends have been nice enough to loan us the money to at least finance our deficits (not pay for them). However, the point will come where they probably won't loan us anymore and ultimately we'll have to pay for it. The reason why? Quite bluntly, put yourself through the conversation;

Hu Jintao - "So, you'd like to borrow $30 trillion?"

You - "Yes."

Hu Jintao - "What will you spend it on?"

You - "The elderly, namely social security and Medicare."

Hu Jintao - "So let me get this right. You're going to borrow $30 trillion from us."

You - "Yes."

Hu Jintao -"Spend it on old people who are not working, thus providing you with no wealth in return. It's strictly an income transfer. It will do nothing to increase the US' ability to pay us back."

You - "Yes."

Hu Jintao -"And then you'll spend some of that money to help keep them alive for another 6 months only to have them die and not work in return, again, no return for the People's Republic of China."

You - "Yes."

As cold and callous as that may sound, that is exactly how any creditor is going to look at the arrangement. Thus, you can be rest assured that we're going to have to pay for this baby ourselves via hard work, more work, and higher taxation because (Baby Boomers, plug your ears)

THERE IS NO SUCH THING AS A FREE LUNCH!!!!

The result? You can expect your payroll taxes to increase by roughly another 10-15% points depending on how old you are today...unless of course you are a Baby Boomer, which means you'll not have to pay these taxes because you'll be retiring soon.

Now would be the point in our show where I give the standard "ol' funny economist prep talk" and make some commentary about how chicks dig me and what we need to do in order to fix this problem, and continue on into a bright, happy economist future. But I have one more joke for you. It's the biggest joke of all time.

You have this massive financial crisis that threatens to destroy America's economy, a threat that in my humble opinion dwarfs the threat of terrorism, and who do we call upon to save the country?

Generation X.

It's like asking for Superman and getting Cheech and Chong.

I don't know if you've noticed this, but my generation ain't exactly the quality and caliber of the WWII generation. This is the generation that has made reality TV and hip-hop culture popular. This is the generation that made Kirk Cobain go platinum and grunge a popular fashion. This is the generation that grew up on MTV and thinks being a good citizen means you "Rock the Vote" or get your news from The Daily Show with Jon Stewart. And this is the generation whose only response to tragedy seems to be candle-light vigils or grown men crying.

Now, of course to be fair, much of the above are social criticisms and has no bearing on the fiscal discipline, work ethic or wealth generating ability of Generation X. And truth be known, I'm a member of Generation X and I hold to the most rigorous fiscal austerity. I also know many members of Generation X who are contributing members of society and a borrower nor lender are. So just how good is Generation X with money management and debt, and how capable are they to face the oncoming financial crisis?

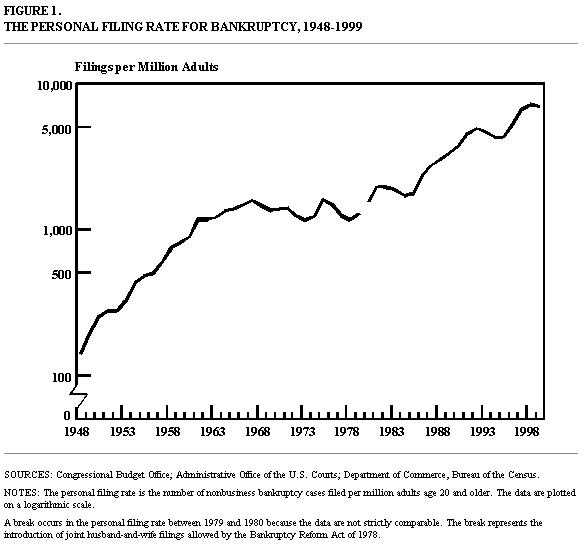

(Please note that the scale of this chart is logarithmic and bankruptcies have skyrocketed under Generation X.)

You might as well be asking the French to defend Paris.

7 comments:

Hi Lunky,

No, please don't be offended. It's not like all the Boomers were smoking pot, majoring in sociology, having 4 illegitimate children and then expecting to retire at 62. I know there's some out there that we good responsible citizens and contributing members of society. There just isn't enough. Sadly, those that did keep their nose clean and have some wealth to show for it are going to have to pay for those that don't. I'm just trying to get my house paid off and then looking at Australia, Ireland or New Zealand as a place to head out to. BUt you are right, it's predicting where those curves are going to go that's the trick.

Cpt. Capitalism

PS-You're right, the charts are nice, I have them plastered up on my walls next to pictures of Frank Sinatra and Humphrey Bogart. Chicks dig them.

A great treatise on the debacle we have created.

Well we doesn't mean me. I joined the military for my higher education and live debt free. I pay high taxes to pay for all this foolishness I hate. I doubt my social security will be worth much either.

Here is Southern California the results of this bubble from Hell are apparent. Housing is way out of control. The roads are crowded with morons on cell phones yapping away in their SUV's. Building is booming as all empty space is constructed on.

Our so-called leaders are blind or lying or both. There is no way to sustain this. Our so-called recovery is based on unsustainable stimuli like interest rate cuts and tax cuts.

When I rant about the economy others look at me as if I was insane. They think it is all OK. I fear the future and am not sure what to do. It seems our government and big money interests want to lock me into this like the wasp that paralyzes the spider alive to feed its offspring.

Yep, that about sums it up. The tax cuts would be a more long term, permanent stimulus if we could cut spending, but all Bush has really done is just deferred the taxes into the future.

If you're in southern California and concerned about property, think you might find the post "Investing Against Conventional Wisdom" useful. Highlight the overvalued property sector and then make some recommendations (although, you already have no debt). Might want to consider foreign currencies.

Cpt. Capitalism

Dear Captain,

All the social ills seem to accelerate at the same time that the Pill came out. Everyone laughs when I say contraception destroys marriages, but I recommend you see Dr Janet Smith "Contraception Why not?" video. (I would also recommend "Demographic Winter" for some background too,in which economists and demographers look at the broad picture).

Hi Aaron

I've decided to go through your blog form the very beginning.

I'm trying to read "Ode to the Baby Boomers - Part 1" but I'm getting a missing page...

Hi Sith,

I would recommend buying "Captain Capitalism Top Shelf" and ALL my best posts are in there. You'll save yourself a ton of time. definitely worth the 19 bucks or whatever it is.

Cpt.

Cappy:

The link to Part I no worky.

Me so sad.

Fixee please?

ca

wrsa

Post a Comment