There’s a novel concept for you. 60 years ago there was no such thing as a 401k, 403, IRA or SIMPLE plan. People retired by selling the family farm, enough heads of cattle or the family business. Less fortunate people had to rely on their children for retirement and some unfortunate souls, believe it or not, had to work till death.

But retirement programs are funny things and they have funny consequences. Especially when ALL of the retirement programs designate financial securities (read stocks) as the only medium by which you can save for retirement.

Let me repeat that again;

RETIREMENT PROGRAMS ARE FUNNY THINGS AND HAVE FUNNY CONSEQUENCES ESPECIALLY WHEN ALL OF THE RETIREMENT PROGRAMS DESIGNATE FINANCIAL SECURITIES AS THE ONLY MEDIUM BY WHICH YOU CAN SAVE FOR RETIREMENT!

Translated into English, this means with the advent of 401ks, 403bs IRA's, etc., this has channeled all retirement money into the stock market with little regard as to whether or not this would artificially inflate stock prices, thereby causing a bubble.

ie-are the cash flows below;

contributing to a long term bubble?

contributing to a long term bubble?

Of course history has told us that any time you abandon fundamental value as the only reason to invest in something, bubbles always occur.

For example, the famous Holland Tulip Bulb Bubble shows you what happens when you no longer value a tulip bulb for the fundamental value that it will bloom and look pretty, but rather value it based on the idea that you can sell it for more than what you paid for it because the person buying it from you doesn't care what they pay for it, because they know they can turn around and sell it to another person because they don't care what they pay for it because they know they can...etc, etc..

Or Beanie Babies. Paying $600 for something that is nothing more than cloth and beads. Doesn’t clean the house. Doesn’t pay a dividend. Just sits there. Once again, you have abandoned its fundamental value and paid $600 for (as far as I’ve been able to figure it) something to feed a middle-aged woman's midlife crisis.

Alas, today's modern stock markets I contest are no different For people no longer invest in stocks for their potential cash flows, profits and dividends, but rather invest in stocks as a vehicle for retirement. And in a very zombie-like fashion I might add.

Every month, every paycheck, without even thinking, there they are, millions of them, zombie Americans doing what their HR overlords and financial advisors told them to do;

HR Director - “You WILL invest in a 401k”

In unison - “We will invest in a 401k”

Government - “You WILL invest in an IRA!”

In unison - “We will invest in an IRA.”

With little or no regard as to whether the mutual funds (and underlying stocks) are actually worth the value.

Now couple this dramatic change in investment behavior with several factors;

1. The entire Baby Boomer generation is the first generation en masse to use the financial markets as their mainstay for retirement

2. The Baby Boomers are a plurality of the population

3. And are in their prime income earning years

Is it any shock the average S&P 500 P/E ratio has been consistently trading above its 80 year average of 15? The question is what will happen when the Baby Boomers start to retire? And instead of contributing every month to their 401k’s like sheople, they withdraw?

The question is what will happen when the Baby Boomers start to retire? And instead of contributing every month to their 401k’s like sheople, they withdraw?

Of course, there are arguments that a rise in the average P/E is legitimate and sustainable. One could argue that this is a behavioral change that is permanent. That the Gen Xer’s are contributing nicely and will pick up any slack. One could also make the argument that with the advent of the internet and online trading that prices to trade have fallen, allowing millions of Americans to flood the market with billions of dollars that would not have been invested otherwise.

Good arguments, and I agree.

But I wanted to check out to see how much of the past stock market performance was due to the market just being flooded with new money and not necessarily an increase in the profitability of companies.

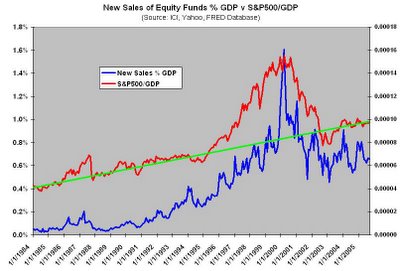

So the first thing I did was compare the S&P 500 against new mutual funds sales (going back to 1984 which is as far back as ICI has the data), resulting in the chart below. In obvious bubbles and crashes you can see the correlation, however, the S&P, as well as monthly contributions to mutual funds are in nominal dollars. Inflation alone would increase the correlation, so I adjusted the figures (and the S&P 500) for inflation (this causes for some unconventional measures, but they are meritous just the same).

In obvious bubbles and crashes you can see the correlation, however, the S&P, as well as monthly contributions to mutual funds are in nominal dollars. Inflation alone would increase the correlation, so I adjusted the figures (and the S&P 500) for inflation (this causes for some unconventional measures, but they are meritous just the same). The relationship still stands, and is particularly noticeable in the Dotcom Mania/Bust days. But girls aren’t impressed by economists who only adjust for inflation. Economically savvy and drop-dead gorgeous girls that have IQ’s of 490 and double as super models can see the obvious shortcomings of this chart and would say,

The relationship still stands, and is particularly noticeable in the Dotcom Mania/Bust days. But girls aren’t impressed by economists who only adjust for inflation. Economically savvy and drop-dead gorgeous girls that have IQ’s of 490 and double as super models can see the obvious shortcomings of this chart and would say,

“Hey, Mr. Economist. If you want to stand any shot with me, you better darn well adjust those figures for the size of the economy and population!”

And we accommodate them, for we wish to stand a shot with them.

So then you have this, the S&P 500 divided by GDP (another weird figure, but interesting enough in itself) versus monthly contributions as a percent of GDP

(notice in Dotcom Mania, new sales of equity only funds accounted for more than 1% of GDP, as opposed to less than .2% just 15 years prior).

This is where it gets interesting because the two data series alone tell us many things;

1. Our broadest stock market index divided by GDP provides an interesting ratio, showing that it has consistently been increasing as denoted by the green line. ie-We apply more value to stocks, regardless of the amount of wealth our economy is producing.

2. Monthly new sales of equity only funds are amazing in themselves. Going from literally less than 1/10th of 1% of our GDP as late as 1992, monthly contributions have skyrocketed to .6% of GDP in all of 13 years! Furthermore, the insanity of Dotcom Mania had convinced people to forefeit money on the order of 1% of GDP a month into equity only funds for a solid year (1.6% in one month!).

3. Of course this could be because people had higher profit expectations of companies, and thus flooded the market with money, driving up prices, but it had nothing to do with the actual increase in our ability to produce wealth (from which profits derive). Even after the crash, we're still on an upward trend contributing a higher percentage of our wealth into the stock market, thereby increasing the value of the stock market, regardless of our wealth producing abilities.

However, there are more pertinent adjustments to be made.

In trying to find the appropriate base by which to adjust for inflation and economic growth, I was predisposed to use GDP as GDP is typically the base you adjust for. But after contemplation what mutual fund flows and indices should really be compared against is corporate profits as corporate profits are what ultimately drive the value of a stock. Here, a similar correlation again, but this focuses on the heart of the matter; corporate profits. The only one true thing that should dictate stock prices.

Here, a similar correlation again, but this focuses on the heart of the matter; corporate profits. The only one true thing that should dictate stock prices.

Note the behavior of the S&P 500 relative to corporate profits. The stock market bubbles of 1987 and 1999 are obvious. Also note the highly correlated behavior of the monthly new sales of equity only funds as a percent of corporate earnings.

Ideally this should be a constant ratio, meaning people apply the same amount of market value to corporate earnings, thus, if corporate earnings go up, demand for that stock would go up by a corresponding amount, thus keeping the ratio constant (ie-if corporate profits go up 5%, demand for stocks would go up by 5%). Of course this ratio is not going to be constant because people's expectations of future profitability is changing and people's perception of value changes as well.

This is VERY obvious in the run up to Dotcom Mania. Traditionally sales in new equity funds would amount to no more than a percent or two of corporate profits. However, when people started having irrational expectations of corporate profits, this skyrocketed monthly sales to almost 70% of corporate profits. Arguably the clearest sign there was a bubble.

Regardless of temporary and irrational fluctuations in people's perception of value and expectations, look at the long term trend. After the stock market crash and people becoming disenchanted with stocks, new sales of equity only funds dropped down to a more "sane" 20%. While a significant drop, it still is significantly higher than the 2 or 3% and shows a general trend upward since the 1980's.

This suggests something a bit more permanent than just the random and chaotic whims and emotions of the market is afoot. And this something is disconnecting the relationship between what we pay in stock price and their corresponding profits, further suggesting to me we have once again abandoned profits, dividends and cash flow as reason to invest in stocks and are purchasing them for ulterior reasons. Given the high correlation between the increase in the S&P500 relative to corporate profits and new sales of mutual funds as a percent of corporate profits (.89) it suggests to me that gains in the market are primarily due to retirement money flooding the market and not so much increases in corporate profits.

All this being said, there is one final adjustment that should be made. Thus far all the charts and correlations have been made with "Monthly New Sales of Equity Only Funds" provided by ICI. This tells us nothing of redemptions that were made, ie-people pulling their money OUT of equity only mutual funds. If pure volume of retirement dollars flooding the equities markets is to blame for higher prices and not corporate profit-chasing dollars, then the net flow into equity only funds would be a more appropriate measure. Thus I ran the same figures of "Net New Flows into Equity Only Funds" as a percent of corporate profits versus the S&P 500 divided by corporate profits. Albeit not as pretty as the previous charts, there is a correlation again, .30. Not as high as the New Sales figures, but a postive one none-the-less. And with with 262 data points, it is probably statistically significant.

Albeit not as pretty as the previous charts, there is a correlation again, .30. Not as high as the New Sales figures, but a postive one none-the-less. And with with 262 data points, it is probably statistically significant.

However, speculate as we might that all this is being caused by new retirement money entering the market, we cannot know for sure. In Dotcom Mania was it just people’s irrational expectations of unrealistic profits that flooded the market with money? Is the rise in money entering the market now due to lower trading costs? Will Gen X continue this investment behavior? Or all of these things in play at once?

Alas, it seems all we’ve accomplished is proving that when a market is flooded with money, prices tend to go up.

Economists are very good at proving something that we already know.

31 comments:

I want to take exception to the idea of "intrinsic value" that you mention.

I thought most economists had abandoned this concept?

Perhaps I misunderstood, and just need a little clarification as to your definition of "intrinsic value". Do you mean, the value which one attaches to a thing based on his/her own preferences - i.e. valuing an object for what it's worth to you, dependent on the amount of pleasure you derive from it?

Or do you mean, like, intrinsic value, which the socialists used to demonstrate the exploitation of labor by capitalists?

I don't think it's the latter. But an ambiguous term like that might lead to some confusion.

I do believe babeboomers investment bringing more supply money into market, which created bubble. For next 20 years, boomers start retiring and withdrawing out of market, which will depress stock value for next 20 years even though economy and corporate are doing good. Stock price is combination of fundamental value, and market value. Like crack cocaine, its price can go up due to demand without change of its quality. The same principle apply to stock. The consequence is stock will become cheaper and cheaper for next 20 years even though its fundamental value keep going up. Just think of price of TV set or computer, even though these tech products get better and better, but its price keep dropping. A million dollars house will not be worth million if no body want it. A squre inch dirt might worth million if every one want it (like that somewhere in manhatton)

If Bush succeed privatizing social security and young people can channel their social security tax for investiment, that will bring additional money supply into stock market which might compesate boomers retiring.

FUNDAMENTAL VALUE!

There! That was the owrd I was looking for!

I currently work for the Third Party Administrator of pension funds, that's currently growing quite rapidly and has clients in almost all 50 states.

I look forward to the rest of your comments. I might forward the link on to some of the sales associates here.

excuse my typo. I mean I work for "a" third party administrator.

I'd like to, but Christmas is upon us and I have a couple dates. I've still yet to find a topic in economics that will detract me from some play.

Wouldn't you expect the PE ratio to be higher when interest rates are low? When the returns on bonds are low, people will accept a lower return on stocks. And looking at your PE graph, it appears as though we're not that much higher than the long term PE ratio, but we're much lower than the long term average for interest rates.

That's the problem with all of this - even when the managers don't like the look of available stocks, they can't simply sit on the cash. They basically have to buy, thus forcing the price of many stocks upwards.

It's gonna be a shitstorm of epic proportions when the baby-boomers retire and the fund managers are forced to sell buttloads of equity shares on the market in order to come up with the cash required to fund the annuities...

Fundamental value is important like I said before. But market value manipulation is also important for investors.

One of solutions to babeboomers retirement depression of stock market is to encourage foreign investment into USA market.

http://captaincapitalism.blogspot.com/2006/09/you-gonna-spend-that.html#comments

Like your previous post about Official foreign reserve indicates those Asian countries especially China and Japan with huge amount foreign money which need to buy some thing at end. When those money infused into American market, it would help to compesate babeboomers retirement. However, let us hope Congress or policticians not longer interfere free market like they did with China Unical deal or Dubai port deal again. These stupid politicians can be real problem for free market.

Certainly my old idea about Bush's plan of privatizing Social Security is always helpful for boosting market.

I figured you'd like this one, Captain:

http://i5.photobucket.com/albums/y171/Empyrrean/Suckers.jpg?t=1202515461

While I do believe there is a lot of frothiness to the market. I have to say that the caveat to the "historic" high P/E's for the S&P 500 has to be looked at with the context of interest rates and marginal tax rates.

Part of the reason that we have high valuations is due to historically low interest rates and long-term capital gains tax rates.

What will prick this bubble is the expiration of the preferential rates in 2010 and the the rise of interest rates once this reflation madness subsides.

That being said - it all comes back to Graham/Dodd "margin of safety" stock picking if you don't want to lose your shirt

Can you do a post explaining CAFR's for the federal state and local governments, and why we are being taxed and running defecits despite the government since owning so much additional holdings in market investments.

Hmmmm.

When the Iron Chancellor started the idea of retirement - at age 65 - the expected life expectancy was less than 65 IIRC.

You could argue that a lot of problems related to modern retirement would be rapidly solved by inserting the "age of retirement" as today's demographic equivalent.

When the boomers start to cash in those investments,

the money still stays in the economy.

In fact, it should lead to more consumption, spending what they've been saving their whole lives.

Wouldn't that counter balance things a bit?

If the money that is taken out of these retirement plans is spent, then you can imagine that this will improve the profits of existing companies.

So you can weigh the effects of the stocks being sold, thus lowering prices, against the effects of the companies selling more, thus increasing earnings and causing stocks to earn more. So what is lost in future value is gained in earnings.

I'm positioning myself for a fantastic buying opportunity here.

Sean-

I think you are assuming something too circular. First, many boomers' stock sales will be to shift into fixed-income assets, not all at once for consumption. Second, much of retirees' consumption will be for food, rent, medical care, mortgage payments, etc. Many of the places they spend their money will also be private businesses, where no benefit will go to stockholders.

Additionally, many will be paying income tax and property taxes, further reducing the amount that goes back into corporate earnings.

I don't think that you can assume such a closed-loop economy.

Your logic also assumes that net consumption of those companies' products will INCREASE as retirees spend their retirement money.

So you're saying that the retiree spending will be a net INCREASE after they begin selling off stocks.

This is not likely, since the key component missing here is current income. Retirement savers save out of current income, and they also consume out of current income.

When they retire, they consume out of savings, and MOST retirees consume LESS in retirement. They drive less, buy fewer cars, less clothes, etc.

Even if their consumption remained the same, that would not, in your example, increase any company's earnings.

You have also not factored in the net loss of economic productivity from such a large portion of the population entering old age at once.

I'd like to see what these same charts show when updated to include the last few years including the financial meltdown.

Just adding my inflation-adjusted $.02, but the tulip bubble got started when all futures contracts written after November 30th 1636 were effectively rewritten as options contracts by parliamentary decree, and the opt-out fee was apparently pretty low. Also, short selling contracts were declared unenforceable.

That puts a hell of a lot of momentum on upward price movements, and bubbles tend to be self sustaining as long as there are more people with money to climb onto the failboat before the whole thing sinks.

My retirement plan is basically diet and exercise. I'm going to work for 70 more years and then die.

You assert that 401(k)s led to more investment in equities. Where else would you propose the money go?

Or, another way to approach, where did the money go before 401(k)s?

Nowhere, because there wasn’t any money. We saw the shift from defined-benefit to defined-contribution. And defined-benefit has proven to be almost universally under-funded.

If people in the 50s and 60s and 70s had been putting away the necessary reserves to cover their promises/expectations, there would have been no 401(k) bubble. The value would have already inflated the market.

Thanks for the comment about the Beanie Babies. They're the best example for explaining bubbles, value, cost, and price to the current generation of college students.

Per Dave Ramsey's advice (Money Makeover author), I've stopped my 401k deposits since January 2010 and applied the amount each payday to my consumer debt (CHASE credit cards). Then I'm going to diversify into buying gold coins which I will hold at my house (never a bank vault!!). I have already invested heavily in "the new precious metals" of steel, aluminum, and lead: GUNS...

OK, all this is interesting, but what would be more interesting to a later baby boomer is being able to predict when the bubble will burst or for that matter when any bubble will burst.

I'm thinking we're in a pretty good bubble right now.

Of Beanie Babies - "...and paid $600 for...something to feed a middle-aged woman's midlife crisis."

I knew of a lot of "men" who traded in BB's.

Captaiun, I'm surprised you are not all over this Issue:

http://voxday.blogspot.com/2010/10/one-nation-under-fraud.html

Stupid banks...

Of course even if your 401K doesn't take it in the shorts, the Democrats are considering stealing your 401K money and use it to bail out busted union pension plans. Watch your wallet during the lame duck session between November and January.

http://www.humanevents.com/article.php?id=39336

CC, you've again explained what the problem is, but failed to suggest a solution. If an individual could make a rational investment for retirement, what would it be? I don't see any really good options. It almost seems like the safest for the individual, and most stabilizing for the economy, would be to merely stick it under the mattress.

If you believe this scenario regarding public equity markets, a rational alternative would be private equity markets.

An interesting post. My father came from a large family, and a couple of older brothers retired the the late 60's to early 70's. Both had a wife and child at home. They had at least one car and a modest home.

One worked various odd jobs over the years and the other the parts and warehouse for a well known agriculture implement maker.

These were not formally educated men, but they still had all the comforts of living when they retired and while working.

Post a Comment