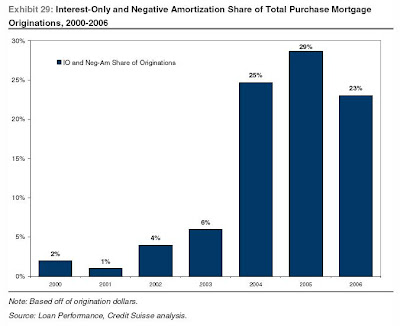

This chart doesn't even include ARM's. Just interest only and neg-am loans. What is particularly disgusting about this chart is that it's for original purchases. Not to take out equity in an already purchased home, BUT THEY USED NEG AM'S AND INTEREST ONLY LOANS TO BUY THE DAMN HOUSES!

The level of stupidity that not only the lenders, but the borrowers that caused this bubble is incomprehensible. How banks could make such stupid loans is beyond the jurisdiction of common sense and sanity. And to the point that over a QUARTER OF ALL ORIGINAL PURCHASE MORTGAGES WERE MADE TO HAVE NO EQUITY IN THE DEAL???

When this spills over into the larger economy and we all start to suffer because of these peoples' stupidity, I want not only the idiots that borrowed money they couldn't pay back, but I want the bankers and mortgage brokers that enabled this soon-to-be-recession taken to task too.

The regulators better be getting off their asses pretty soon.

7 comments:

Used responsibly (granted, this is often not the case), I think negative amortization and interest only loans actually make a lot of sense sense, for reasons I outlined here.

"The regulators better be getting off their asses pretty soon."

SOCIALIST!!!!

hehe me funny :)

Anyway, this is proof that socialism is the answer. If people weren't allowed to have their own initiative then they wouldn't be allowed to do stupid things.

Correct, but these are for original purchase. Not a retired person trying to withdraw equity from their already existing home to supplement retirement.

Frank,

Correct. If we had socialism, we wouldn't have property ownership in the first place. Your wisdom continues to amaze!

I am sending my latest predictions, here in future news format. Post it if you find it useful. Other forums seem to have no comment. You would think someone would pick this apart, wouldn't you?

News of the future, 50 years from today

Waste recycling and curbing have shaped the political, economic, and environmental landscape over the past 50 years. Curbing, which began as a backlash to the purchase of carbon credits, originally called "Curb Mobility Abuse", targeted air travel by business, and by Congress at first. The irony of this was not lost on Global Warming advocates of the day, who thought carbon credits to be a good idea.

Today, the last Walmart is demolished as all business goes completely on-line. Corporate headquarters, in the Cayman Islands, could not be reached for comment. In a related story, this is the ten year anniversary of the cashless economy, a cash museum is planned in Reno Nevada, next to the casino museum.

The number of large, vacant buildings continues to rise as middle-age McMansions are condemned for being hopelessly energy inefficient, whole neighborhoods must be raised, and no future development is planned where transit is not already available. The Post Office, K-12 schools, and most college courses have been made obsolete by on-line services. On-line shopping has left empty the old movie theaters and retail by 70 % nationwide. Local bars, shoe stores, and spas continue to increase.

Light rail, which has not had a new line added in nearly 30 years, is running reduced service in many cities. High speed automated rail has supplanted light rail, passing subway and commuter rail ridership combined for the past 5 years.

Today, while the number of cars on the road is the same as 1961, the odds of a car, not clearly marked as delivery, car pool, or handicapped, to be vandalized is quite high.

The use of recycled building materials, and reduction in air travel has reduced global warming, icing over several new shipping lanes.

The high price of health care remains a top campaign issue as the glut of medical specialists continues. At the turn of the century, roughly 14 out of 15 of the top wage jobs for an employee were medical specialists. The remaining job was a CEO, this was before the executive compensation crisis of 2015 brought that back in line with consumer expectations. Today, 90 of the top 100 employee compensation packages are for medical specialists, and the ratio of specialists continues to soar. The time to act would have been at the turn of the century, again, when government and employers were involved, and when most of the country had health insurance.

"The regulators better be getting off their asses pretty soon."

How about we let the market kick their ass and leave the regulators out of it? I'm really disappointed in you Captain, that you think some sort of government regulation can overcome human stupidity.

More likely they'll just bail out the idiots and shake their shame-fingers at the banking industry for "exploiting" those stupid loan-seekers in the first place.

Your cynicism is harsh, but sadly, it is true.

I salute you and stand corrected!

;)

Post a Comment