I love The Economist, but sometimes they get it wrong.

Inflation is a very simple thing. You needn't make it more complicated than it already is, because it's not complicated at all, for all inflation is, is a function of two very simple things;

1. How much stuff an economy produces (GDP)

2. How much money its government prints (the Money Supply, or from hence on MS).

You see, the amount of money floating around in an economy REALLY technically doesn't matter. For what truly determines the wealth and standards of living of a nation is the amount of stuff it can produce. Print off all the money you want, so each American has a trillion dollars, that doesn't increase the amount of X-Box's, milk, cars, chocolate, food, jewelry, etc., that we produce. So while you may be excited once you get your trillion dollars, you'll soon realize that ultimately we're not a cent richer as a nation because no corresponding increase in the amount of stuff occured. Alas, we'd just have hyper inflation and the same standards of living.

Now, you'd think this simple truth would have been learned long ago. Ahhh, but never underestimate the power of what I call "The Essence of Socialism;"

You can get something for nothing.

For history is just full of idiots thinking you can get something for nothing, especially by just boosting the money supply. All the way from the ancient Roman Empire in 218AD to just a decade ago in Yugoslavia did idiots who believed in the essence of socialism think their problems would be solved by boosting the money supply.

But please don't think former communist countries and empires long ago are the only ones guilty of such stupidity. Look at America's most stupid decade, the 1970's.

With GDP and MS growth like this;

(Note- "Average MS growth is the average annualized growth rate of the M1, M2 and M3 money supply measures)

(Note- "Average MS growth is the average annualized growth rate of the M1, M2 and M3 money supply measures)How couldn't inflation occur?

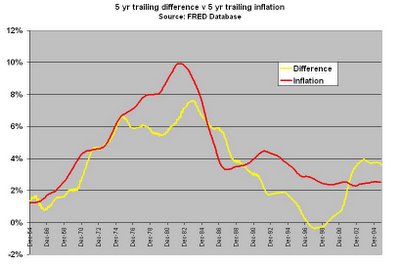

Well, OK, to the untrained eye this tells you nothing because GDP growth and inflation are volatile and erratic. So let's "simplify it up a notch" (got your spice weasel?) and take a 5 year rolling average;

Ahhh, the picture becomes much more apparent. For how couldn't there be inflation in the 70's? You had a money supply growing at an average rate of roughly 9% a year while the economy was only able to produce more stuff at 3% a year.

You may want to chalk up the heady inflationary days to "oil shocks" and "oil embargoes." I chalk it up to stupid politicians, stupid monetary policy and the Baby Boomers who were finally being shepherded out of their parents basement and into the working world to start their job protesting the Vietnam war (surprisingly "protesting the Vietnam War" doesn't contribute to GDP).

Now, notice, rough logic would dictate that if we increase the money supply by 9%, but the economy only grows by 3%, then we should roughly have 6% inflation. ie- the difference between economic growth and money supply growth should give us our inflation rate.

Only one way to tell.

The yellow line is the difference between economic growth (5 yr trailing) and money supply growth (5 yr trailing)

When superimposed on the 5 yr trailing inflation rate;

Well, shucks howdy! Look at that! As far as economics go, that's a perfect fit!

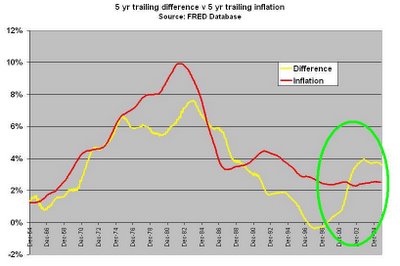

But notice the tail end there, where the difference between the money supply growth and GDP exceeds that of inflation. This is where it gets interesting.

Normally such a divergence would suggest higher prices and thus inflation, yet inflation has remained stubbornly low...or has it?

Normally such a divergence would suggest higher prices and thus inflation, yet inflation has remained stubbornly low...or has it?For you see, the CPI, which is represented by that red line, only includes the prices of consumables. It does NOT include two major asset categories;

Stocks

and

Housing

Notice the increase in the difference between MS and GDP occured in late 1999 and early 2000. Depsite the stock market crash, it was usurped by the housing market where prices have continued to skyrocket.

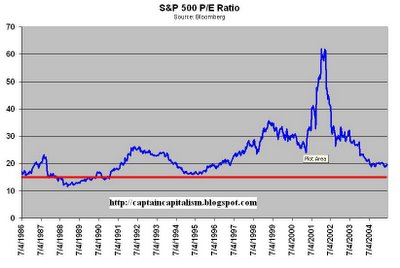

With everybody's money in housing and stocks, it doesn't show up in the CPI measure, but that doesn't mean there isn't inflation. So while the CPI and official inflation has remain relatively tame, stock prices

and property

and property hasn't.

hasn't.Alas, inflation has been with us this entire time, it's just we don't complain about it when the price of our stocks and homes go up.

Now enter in this most recent uptick in inflation.

Here, it is largely due to an increase in oil prices and people are now looking to their central bankers to slay inflation. A sort of "Leftist Syndrome" where people expect somebody else to solve their problems. But I'm not just talking sociology majors that want the government to create jobs so they can do something with their worthless degrees or spoiled brat trust fund babies who expect everything to be taken care of by daddy. We're talking the people at The Economist and the economics profession in general who are in knee-jerk reaction mode;

"Oh, there's inflation? Slay it Greenspan!"

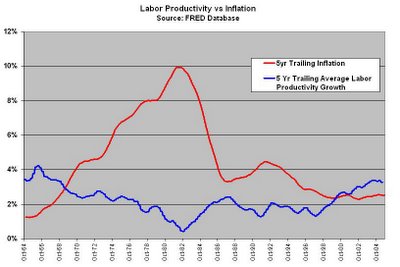

But as a capitalist and a despiser of all things lazy and leftist, need I remind you of the very important lesson we learned above? That inflation is a two-sided equation. It's not just how much money is slushing around in the economy, but how many goods and services we as a nation produce. Notice the relationship between labor productivity and inflation.

A nearly perfect negative relationship, showing that as productivity goes down, inflation goes up (note the chronic deterioration from the mid 60's to the early 80's. Yes, pot, supplanted by cocaine while listening to Jim Moronson may not be good for labor productivity.)

A nearly perfect negative relationship, showing that as productivity goes down, inflation goes up (note the chronic deterioration from the mid 60's to the early 80's. Yes, pot, supplanted by cocaine while listening to Jim Moronson may not be good for labor productivity.)Alas, the fighting of inflation is not solely the responsibility of central banks and central bankers, but by the workers of a country. The central bankers will control the money supply, you the worker, must produce a corresponding amount of goods and services that give reason for such a money supply to exist in the first place.

Thus, fellow countrymen, I say ask not what your central banker can do for you, but what you can do for your central banker.

Now get off your lazy asses and start contributing to GDP!

8 comments:

Well hello young Buckeye Fan. Thanks for the compliments. I'll keep trying to throw some good econ stuff up there.

My background is that I only have a BS in Finance with a minor in economics. During interning and working after college, more and more of my work was based in economics. That being said, it's almost better because I've seen some of these people who get their doctorates (and have attended more economics semianrs than I cared to) and they take it to such an extreme, the study is no longer practical.

Anyway, best words of advice I can give you is to always argue the truth and you will never lose an argument. I didn't become a capitalist because I thought making money was cool, it's just how the data's come out.

When you're taking classes, realize the majority of your professors are not working and have little to no experience in the real world. Very few of them approach economics from a purely scientific way - ie, letting the data form their opinions, not letting their opinions for their data. And while I'd like you to subscribe to my theories and ideologies it is best that you go and find your own way. Not that I'd be worried you'd come to a different conclusion, but if you find your own way you will be immensely better prepared to argue against those who disagree with you.

Besides, it's a great way to make money winning bets at college parties.

It seems like you're using the terms "productivity" and "GDP growth" interchaneably in your argument.

Wasn't Greenspan's take on the "miracle" of the 90's economic boom that it was driven by "productivity," meaning the amount of inputs it takes to create an output? This is what he said kept inflation low, not high GDP. (I'm just trying to figure out the semantics here, based on your last chart).

This was his definition of "productivity," where from your last chart it seems you mean high output keeps inflation low...

to clarify my jumbled thoughts:

Greenspan said that workers were more "productive" (because of technology, methods, etc.) and could produce more in less time and for less $. That's what he said kept inflation low.

Yes, you are correct. Productivity is akin to GDP, but it is measured in output per hour. Naturally if this goes up, so too does GDP.

That being said, yes, if you can produce more stuff with less resources, this will also have a dampening effect on prices, and this is what Alan Greenspan didn't so much believe as he KNEW.

Also what's keeping inflation down is cheap Chinese imports.

And guess what would happen if the protectionists insisted China float it's currency freely against ours and we slap a bunch of tariffs on China.

I like your blog very much. Your posts and charts are very enlightening. What surprised me about this post was the suggestion that reduced productivity produces inflation. That does makes sense, but wouldn't the converse also be true: that inflation would have a negative effect on productivity?

Ok I get the production of goods part of the equation having an effect on inflation, but there seems to be one problem...produce what, with what?

If I spend all day polishing turds, then have I really contributed to GDP because I made a bunch of shiny crap? And does anyone really want my shiny crap, no matter how low I price it on ebay?

If we moved our manufacturing base overseas, because nobody in america will build for a dollar what a chinaman will build for a penny; and if we have no capital with which to produce because we've taken out consumer debt to the hilt, destroyed our credit, and cant afford to work at mcdonalds because the cost of gas to get to work don't make it economically viable, how then can the people produce? If they can't produce because they lack the resources, market, skills, and capital, then what? Lack of production makes inflation go up. So the Fed increases the money supply to push capital into the market so people will produce more...but wait! more money is not the same thing as more capital in a fiat currency...it's just more paper...because all the real resources owned and consolidated. Sure you can trade this paper for those resources but your not producing more capital, your just shuffling paper. So as you try to stimulate the economy in the face of slowed GDP your only compounding the problem more. The whole thing becomes a giant Ponzi Scheme.

Think of it this way, wealth (real wealth) IMO is produced when a man takes a resource from a state of nature and, through labor and ingenuity, refines it into something of greater value for his fellow man. Then he charges him a buck to get it. But today we have millions of people who can not do that, Because they do not own the resources. When they borrow fiat currency with a promise to repay with interest, they didn't get new resources, they just got an obligation to somehow go and get a hold of some one elses wealth to stave off default, and then give it all back to the bank plus extra. But if they are successful in using this fiat paper to shift existing (not new) resources in thier favor, there is by definition a loser on the other side of that equation. So did they really contribute to GDP? After all, the other guy lost out in return, and his debts just became more tenuous. Was new wealth created or did they simply shuffle existing stuff around, in their favor-but at anothers expense?

The American people have a serious problem, and telling them to get off thier butts and work harder is not the solution: It is only the cracking of a whip that replaces real economic incentive. Regulations tax their ingenuity, Systems of control taxes their entrepenurial spirit, and Debt and interest on credit cards and loans are like swimming with an anchor tied to your ankle. Eventually GDP has to slow. And thats the kind of growth problem that can't be solved with a printing press at the fed or an economic stimulus package.

So is it any wonder that when people get a little money they use it to self medicate their economic woes away? We're returning to a new age of feudalism...but instead of castles we have corperations. Instead of slave masters we have banks, credit cards, and tax collectors.

This isn't a "trust fund kid problem" either. The impoverished innercity communities have every incentive to pull themselves out of despair that the x-box playing rich kids do and yet poverty is often generational there. The problem is theres only so much that can be produced before infusions of dollars stop acting like booster shots.

So...When does Rome finally fall? When theres a correction in the distribution and ownership of real capital, not fiat currency...redistribution that comes with no strings attached, no interests to be paid, no regulations to chain down the former serfs. In the mean time, as production slows, the cattle will need to be prodded.

No wonder the cops are stocking up on tazors.

My biggest beef with using GDP as a function of productivity is that government spending contributes to GDP. So does money spent complying with meaningless government regulations. Likewise breaking windows and replacing them.

Actually, here's a great list of ways to boost GDP. Almost all of them are easier than actually working, too!

http://www.mises.org/freemarket_detail.aspx?control=118

"If we moved our manufacturing base overseas, because nobody in america will build for a dollar what a chinaman will build for a penny;"

Here's a crash course in the state of manufacturing in the US as of 2006, when the study was completed. Feel free to counter this with newer statistics if you can bother yourself to find them. The situation hasn't changed much.

http://freetrade.org/node/612

High points are that the US has never manufactured as much stuff as it is now. We do about 20% of the global total of manufacturing in the US. The US manufacturing sector is still more than twice the size of China's manufacturing sector.

"and if we have no capital with which to produce because we've taken out consumer debt to the hilt, destroyed our credit, and cant afford to work at mcdonalds because the cost of gas to get to work don't make it economically viable, how then can the people produce?"

Well gee, I wonder how we have an unemployment rate under 5% if none of us can afford the cost of gas to get to McDonalds to work?

"So is it any wonder that when people get a little money they use it to self medicate their economic woes away? We're returning to a new age of feudalism...but instead of castles we have corperations. Instead of slave masters we have banks, credit cards, and tax collectors."

That's the part where you depart from baseless claims contradicted by the actual statistics into the territory of hyperbole and stupidity.

"So...When does Rome finally fall? When theres a correction in the distribution and ownership of real capital, not fiat currency...redistribution that comes with no strings attached, no interests to be paid, no regulations to chain down the former serfs."

As I thought. You're just another scavenger looking for something for nothing.

Post a Comment