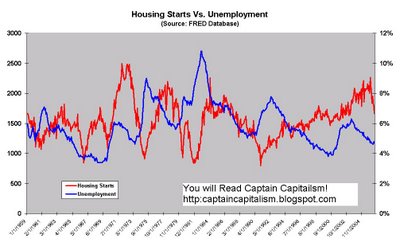

However, it wasn't necessarily the contraction of GDP that tipped me off to the correlation as much as it was how housing starts and unemployment act like a double helix;

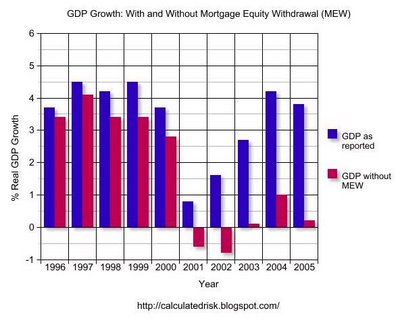

Now there are many things that would suggest to me that we're in for a recession. The obvious correlations above. The fact that consumer spending financed by fat-debt-bloated Americans with their addicted home-equity-loan spending has been having an artifical effect on the growth of the economy (and without perpetually increasing property prices this binge will end).

The utter patheticness of Gen X and future generations insisting on majoring in crap. And let's not forget all of this under the umbrella of constant threats from Muslim nutjobs, with a whimper weak retort from American's "leaders," and the impending social security and medicare crisis.

But it just ain't in my blood. I don't "feel" a recession coming on. It's odd, but contrary to all the mathematical evidence I have, I just got this gut feeling that the economy will be doing just fine for the next 12-16 months.

Alas, perhaps I'm one of the few economists that hasn't had the soul of economics kicked out of me and instead of replacing it with advanced econometrics, statistics, mathematics and models that no matter how complex are still finite, I still have a little faith in chaos, gambling and gut reactions.

5 comments:

Would any economist attribute any of the prior recessions as shown on the first chart to a decline in housing starts? I kind of doubt that any would seriously pin any of those recessions on a lack of housing starts. Also, in the 80s, when both housing starts and unemployment were declining, isn't that similar to the current situation(what would the housing start data look like adjusted for population growth, being that the unemployment rate is a ratio?). Both declining unemployment and housing starts in the 80s didn't stop the stock market from going up and the economy from doing well. In my opinion, attributing a recession to housing is misguided and mistaking correlation with causation. I agree that I don't feel that we're headed for a recession, and if it does happen, it certainly won't happen on account of the housing market.

Yes, it is more just a correlation I noticed, there may not be causality, but I will say that I can see some causality in that housing starts are predicators of the future in that it's indicative of 2-3 months of construction spending (to build the house) then 1-3 years of consumer spending as the Mrs. blows her husband's wallet on drapery, furniture and other crap.

I don't even see the correlation in that first chart. There were major declines in the 60s and 80s without a recession. It appears that every time there was a recession, there was a reduction in housing starts. But not the reverse. Which makes sense. Builders feel the recession coming on and start pulling back. But sometimes they are wrong.

I agree the causality you cited, it will be interesting to see it play out... Curious to know whether the calculatedrisk guy's calculation seems accurate to you - "to calculate MEW, I simply subtracted new single family construction spending from the increase in household mortgages. This is close to other methods." I couldn't find the numbers he looked at to create his chart, but that seems a little simplistic. By the way, great job with the site, I enjoy it thoroughly.

The asset run is over and the economy will likely slow down. I expect that by the end of 2007 the economy will be sluggish at best. I do not expect a severe decline but probably a mild recession. Not so mild for real estate though.

Post a Comment