Parading children around as an excuse to allocate resources to a whole bevy of programs. Demanding more money be spent on the children. Because we care for the children. And if you don't transfer wealth to the poor for the sake of the children, then you're a very very BAD PERSON!

Well, my question to you is, yeah, why won't somebody think of the children? It's one thing to say it, it's another thing to mean it.

Never has such a generation failed in their stewardship of future generations.

So you can only imagine my blood pressure when Ben Bernanke, who you know, is kind of a smart guy. Might know what he's talking about, being the head of the Federal Reserve and all gave a speech about the black and white realities of social security and medicare.

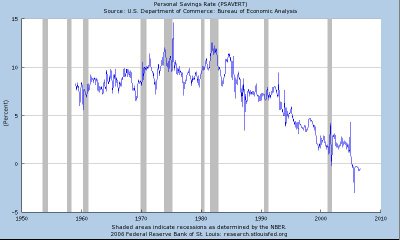

Juxtapose this speech with the latest in savings rates which would be a barometer of just how much people care about the children in that they'd be saving for their retirement so that future generations don't have to pay for their retirement;

Enough to drive a man to drink.

3 comments:

It is just symtomatic of the gradual slide of this country towards socialism. "I don't have to take care of myself or plan for the future because the government will just steal the money from my children and grandchildren to take care of me."

I have no saving account...but I do have a brokerage account and two rental properties. In the brokerage account I have ~75% cash and 7.625% interest, so THAT was my "saving acount". But, the gov't would not include in the personal saving...right?

stop it!! We sheeple have all been told that we're supposed to *invest* (not save) for retirement in our 401(k) accounts.

"Never attempt to time the market", they say, although strangely these same entities engage in continuous buy-sell program trading/hedging/CDS manipulation with synthetic money...

The previous fed chair saw to it that our savings were devalued by dropping the short term rate (which savings institutions quickly followed) to a negative real rate. What did you expect to happen?

Post a Comment