For example to accurately gauge economic growth in China and not the dubious "official GDP" statistics the Chinese government publishes, some economists look at electrical consumption. Alan Greenspan liked to look at railroad tie replacement rates. And there are others that escape my mind. But two come to mind here in the good ole USA that I've kind of unofficially kept track of;

Dance class enrollments and Harley ridership in the Black Hills.

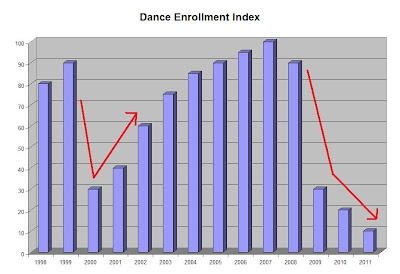

I have been teaching ballroom dance for the past 14 years. This includes the booming 90's, the subsequent stock market crash, the booming housing bubble and the subsequent great recession. Enrollments followed correspondingly. I had standing room only (which all dance classes are HAR!!!!) at the peak of the Dotcom bubble. The 2000 recession hit, BLAMO! Enrollments dropped about 60%. The recovered and exceeded previously levels as attendees used home equity lines to finance SUV's, trips to Europe and ballroom dance classes. The housing market collapsed and BLAMO! Enrollments dropped 90% from their highs.

Of course with the economy in full recovery according to the left, you would think enrollments would have recovered. However, a full 3 years after the housing crisis, they keep going down. Below is a guestimate chart.

Then there is the ridership in the Black Hills. Sturgis is coming up and this is the third year I've placed myself in the Black Hills for the better part of 2 months in my effort to enjoy the decline. My hotel is in a small mountain town and there are three statistics I've anecdotally noticed.

1. The number of motorcycles on the road are about 1/2 of what they were last year around this time. I noticed this because I can actually drive the speed limit and not be burdened by some slow driving Harley noob who carted his motorcycle, let alone a traffic jam of them. YOu can actually make it through the "Needles" highway in under 1/2 hour. Usually takes an hour.

2. The caliber of clientele at the hotel I'm staying at is no longer out of state, middle to upper middle class folk. It's locals who are using the hotel as temporary living quarters as they've been kicked out of their homes or are returning from jail. I am now officially in the minority of boarders in that I have NEVER been to jail. The majority of boarders have. Drugs have been found on the premises. Deals are now made in the parking lot. And I find it a beneficial practice to clean my guns in front of my hotel room on the patio so everybody sees them.

3. Talking with the various proprietors of the three bars in town (which I have now established rapports with), I find out sales and foot traffic are down about 40%.

The whole point of this potpourri of economic statistics you'll not find in college textbooks?

The economy isn't recovering, and not only is it not recovering, I believe it's high time for a double dip.

Whatever the headline figures may read, other "down to Earth" measures of commerce and economic activity are down. Sure, ballroom dance classes are a luxury good which has a high elasticity with disposable income. And of course you could claim gas prices are hurting tourism, but if the economy was recovering, even stagnant, these statistics would remain consistent from 2010. For 2011, they're continuing their decline.

Naturally I would like to see a booming economy, alas my economic spidey senses and plain common sense know that just is not going to happen any time soon.

In the meantime, you all may as well enjoy the decline until 2012, at which point there MAY be a reason to work hard and try once again. But we shall see.

9 comments:

Hey Cappy, north of 49th in oilsandy Alberta, the scuttlebutt is the opposite. Booming, but everyone says it under their breath so as to not jinx it.

Hey, Anon @ 3PM! You guys up there probably are MUCH better off than us in the US. You have an administration that actually wants to bring oil production up (unlike the one we have) and your business tax rates are less than half ours, because your leaders have a better knowledge of economics. Good for you.

Now this is a bit east of you.

I'm being tempted by my broker to take a small position in a small stock fund (ICPAX) which targets the oil-rich Williston basin. The fund has 51 stocks, most are large multinationals in various oil industry categories, some are large fertilizer companies and there is a part of the in mining precious metals. As of 3/31, there were only 242 inventors in the fund and the fund has been around since 2003.

I view this fund as more speculation than investing, but it might be interesting.

Cap - I think there is another factor at play here. It's that the kids these days just aren't interested in most of the activities that us older folks think are interesting. This includes flying airplanes and sailing boats and all kinds of other activities that take effort and money. I'm guessing dancing is up there too. Why bother when you have free video games and porn available in your parents' basement?

4.9% nominal GDP growth minus 3.1% inflation equals 1.8% real growth. 1.8% is a positive number, therefore we are in recovery, not recession QED.

The flaw in this logic is that "nominal GDP" includes food and fuel, while "inflation" does not. In real life, Americans are spending more money to buy less food, less fuel, and less of everything else.

Even worse, we vastly increased government spending to prevent a much bigger drop in GDP. This diverts real capital from producing what people want to producing what the government thinks they ought to have.

I came to Canada to work in mining, not doing badly, as long as one is willing to work hard (sometimes cold) and travel, sometimes abroad (how about getting paid to work in Mexico or Argentina!). There are some really good employment deals to be had with the big mining guys... the oil and gas guys pay even more, from what I hear...

The big mining companies are bringing undereducated and underexperienced engineers and geologists from Asia and Africa due to the skills shortage in North America... while the white kids keep on studying English and Contemporary Dance, I guess... then working at Starbucks and rural Tim Horton's...

Just avoid the tax money sucking Maritimes (for work, they are beautiful to visit).

There are just as many mining resources in the US, but I guess left handed lesbian turtles in California and NGOs human rights/animals rights/PETA are more important than people working real jobs that produce something (notice how NGO crusaders usually have a trust fund that frees them from working in the real world, unlike everyone else).

Minnesota used to be a big mining place, what happened?!?

There are statistics and then there is real life.

Cappy your on the front lines assessment reminds me of what my father used to observe as a tradesman: "A pound of putty now costs me twice as much as it did five years ago. And they say there is no inflation!"

Ahh. I use the Hamburger index. A couple years ago, a pound of 88% hamburger, not on sale, was around $3.00. It's now selling for around $5.00. Good luck on finding a sale on it. Beer has gone up a buck a six pack. Nevermind gas, which we treat as a real deal at $3.50.

Yet we're told we have no inflation.

Hey, you know what we need to get the economy going again? Another couple trillion in wealth transfer to unions and corporate cronies of the Democrats. We'll call it Stimulus 3: The Embiggening. It's a sure thing. All the rubes will buy it.

repertoires

I think you meant: rapport's

Unless you and they are actually putting on a show at the bar at 11:30pm.

In which case, unless the show is the "Captain's Economics Lectures", or the bartenders are female and you are demo-ing ballroom dancing, the less said the better.

Snap-on tools guy said last year was bad and he's down about 10% from that.

Post a Comment